Data released last Friday show new housing starts fell 18.7 percent in November from October as single-family home starts fell 4.1 percent and multifamily home starts fell almost 44 percent.

READ MORE

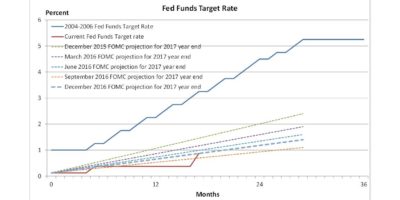

The Fed’s decision yesterday to raise the federal funds target rate by ¼ point, from a range of 0.25 – 0.50 to 0.50 – 0.75 sent shockwaves through markets. But it should be interpreted with a healthy dose of calm and perspective.

READ MOREBusiness conditions continue to improve. Our index of Primary Leading Indicators rose for the third straight month, reaching its highest level since September 2015. Contributing to the increase were improvements in consumer expectations and real new orders for core capital goods.

READ MORE

The Federal Reserve yesterday afternoon released data on household balance sheets and income for the third quarter of 2016, and the results look favorable. Household net worth rose to a record $90.2 trillion on gains in assets, amid modest increases in liabilities.

READ MORE

A mixed November jobs report suggests the economic expansion continues to grind ahead and the labor market continues to tighten, but wage growth faltered.

READ MORE

The Thanksgiving holiday is over and the final month of 2016 is approaching. The coming week brings a crowded list of important economic events, and beyond it, some big economic news to watch in December.

READ MORE

We received more data this morning that show the housing market with continued upward momentum.

READ MOREConsumer spending slowed to a 2.1 percent annual rate in the third quarter from a strong 4.3 percent pace in the second quarter, according to the latest data on real gross domestic product from the Bureau of Economic Analysis. On a year-over-year basis, personal consumption expenditures, a measure of real consumer spending, grew at a 2.6 percent rate, down slightly from a 2.7 percent pace in the second quarter (Chart 1).

READ MOREExcessive debt played a major role in the Great Recession, from December 2007 to June 2009. In the seven years since the recession ended, home prices have rebounded, and households have significantly reduced their debt load. Only recently have households begun to increase their overall debt, which has inched up just 2 percent from when the recession began. Debt growth for corporate and small businesses has been more significant, rising 36.5 percent and 29 percent, respectively.

READ MORE

A moderately upbeat October jobs report suggests the economic expansion continues to grind ahead and the labor market continues to tighten. The October gains in jobs and wages suggest the economy is maintaining positive momentum in the early part of the fourth quarter.

READ MORE

The preliminary estimate for personal income for the third quarter shows a 3.9 percent increase, the same pace as in the second quarter, according to new data released by the Bureau of Economic Analysis this morning. These are solid though not spectacular gains.

READ MORE

Today’s report from the Department of Commerce on new orders and shipments of durable goods sent mixed signals on the state of the economy and outlook for third quarter GDP.

READ MORE250 Division Street | PO Box 1000

Great Barrington, MA 01230-1000

Press and other media outlets contact

888-528-1216

press@aier.org

This work is licensed under a

Creative Commons Attribution 4.0 International License,

except where copyright is otherwise reserved.

© 2021 American Institute for Economic Research

Privacy Policy

AIER is a 501(c)(3) Nonprofit

registered in the US under EIN: 04-2121305