Personal income rose 0.3 percent in July while total personal consumption expenditures (PCE) rose 0.4 percent. Gains in disposable income should provide support for future increases in spending and suggest a positive outlook for the economy.

READ MORE

A new recession would not only mean lower or even negative economic growth rates, it would also induce governments to increase public spending. Then, the public debt quotient (debt over gross domestic product) would rise because of a lower denominator and a higher numerator. With the interest rate at historical lows, and the debt ratios already at the point of fiscal unsustainability, there is no space for a new stimulus.

READ MORE

Revised estimates show the U.S. economy grew at a 4.2 percent annual rate in the second quarter while after-tax profits rose 3.7 percent to a record $1,968.5 billion at an annual rate.

READ MORE

Consumer Confidence rose for the second month in a row, to the highest level since October 2000. Overall, consumer attitudes remain at historically favorable levels, suggesting support for future gains in consumer spending and overall economic growth.

READ MORE

New orders for durable goods fell 0.2 percent in July, however, excluding aircraft, orders jumped 1.3 percent to a record high. The data suggest that demand remains strong and that the outlook for the economy remains positive.

READ MORE

Sales of new single-family homes fell 1.7 percent in July. Slowing sales are coinciding with slowing construction suggesting new-home building is unlikely to contribute significantly to growth in coming quarters.

READ MORE

Sales of existing homes fell in July, the fourth consecutive decline. Declining affordability due to rising home prices and rising interest rates is likely to continue weighing on housing activity in coming quarters.

READ MORE

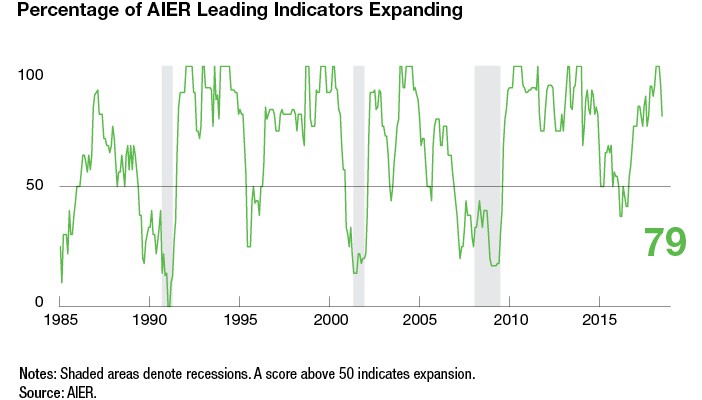

AIER’s Business Cycle Conditions Leading Indicators index eased back in July, registering a 79 following a 92. The Roughly Coincident Indicators index returned to a perfect 100 reading while the Lagging Indicators index fell to 83 (see chart below). De …

READ MORE

Retail sales for July rose 0.5 percent, marking the sixth consecutive month of gains. The report suggests that U.S. economic growth is maintaining strong momentum, supported by consumer spending.

READ MORE

The Small Business Optimism Index from the National Federation of Independent Business rose 0.7 points in July, coming in at 107.9, the second-highest in history, extending a run of 20 consecutive months above 100.

READ MORE

The latest Job Openings and Labor Turnover Survey from the Bureau of Labor Statistics shows the number of open positions in the private sector was essentially unchanged in June, holding at a very high level. Overall, the data relating to the labor market continue to show strength.

READ MORE

U.S. nonfarm payrolls added 157,000 jobs in July, below consensus expectations. However, job creation appears to have reaccelerated over the past ten months, supporting gains in hourly earnings. Overall, the report was upbeat.

READ MORE250 Division Street | PO Box 1000

Great Barrington, MA 01230-1000

Press and other media outlets contact

888-528-1216

press@aier.org

This work is licensed under a

Creative Commons Attribution 4.0 International License,

except where copyright is otherwise reserved.

© 2021 American Institute for Economic Research

Privacy Policy

AIER is a 501(c)(3) Nonprofit

registered in the US under EIN: 04-2121305