Fed’s Balance Sheet, IOR, and Uncertainty

It seems likely that in the coming months monetary policy discussion will start focusing on the problem of shrinking the Fed’s balance sheet. A particular challenge of shrinking the Fed’s balance sheet is that of discontinuing the policy of paying interest on reserves (IOR). While at first sight it might seem that the IOR is too low to have any significance, it indeed has an effect on the demand for reserves by the banks (for an interesting discussion see here.) The policy of IOR increases the demand for reserves, while shrinking the balance sheet would reduce the supply of reserves.

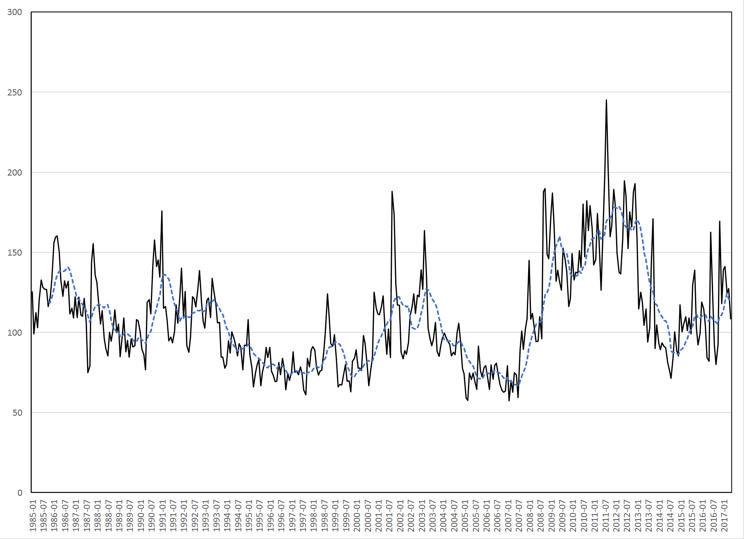

Monetary policy, however, does not happen in a vacuum. Other branches of government or policy makers can make things easier or harder for monetary policy makers. For instance, the arrival of a new administration has considerably increased the uncertainty of what the economic environment (regulations, institutions, taxes, etc.) will be. Spikes in uncertainty are not new. The figure below shows the Economic Policy Uncertainty Index for the United States between January 1985 and May 2017. It shows a sudden increase of economic policy uncertainty starting with the 2008 crisis. And even though the spike of uncertainty eventually falls to levels similar to that of 2003, it does not star to go down until mid-2012. This means that economic policy maintained a high level of uncertainty for around four years since the beginning of the crisis. Uncertainty is a “tricky” concept. It cannot be directly observed, it cannot be measured (or is it very hard to do so). But it does have a real impact on the economy. The higher the uncertainty level, the less likely business will invest or expand their business. It seems that the role of uncertainty has been overlooked by policy makers during the 2008 crisis and therefore the economy did not rebound as expected. With high uncertainty, money demand remains high and expenditures (consumption and investment) low.

This high uncertainty helps to understand why the low IOR that the Fed pays is actually not that low and banks prefer to receive the risk free payment of parking reserves at the Fed instead of lending to business in a high uncertainty economy. Additionally, since business are not inclined to invest and expand business during high periods of uncertainty, banks do not face a large amount of credit applications.

The figure also shows that the uncertainty index starts to increase in 2015 and has a spike in late 2016 with Trump’s nomination as the new U.S. President. In fact, the mixed signals coming out of the Trump’s administration are a good example of how to increase economic uncertainty.

As the Fed moves to discuss whether or not shrinking its balance sheet, the level of economic uncertainty should be taken into consideration. It seems, however, that if uncertainty goes down and money demand falls, then money velocity would increase. This should be taken into account when trying to achieve a more stable money policy. As the Fed reduces the IOR and banks start looking for opportunities to lend the excess of reserves it will need to take into consideration changes in the demand for cash balances and in uncertainty. Otherwise, the Fed may miss its balance sheet target. Whether or not uncertainty will fall is of course yet to be seen.