Commodity and commodity-backed currencies

A commodity money is an item that individuals consume (or otherwise make use of) that also functions as a commonly accepted medium of exchange. Commodity monies can be contrasted with fiat monies like the modern dollar, euro, yen, etc., which function as commonly accepted media of exchange but are not used for any non-monetary purpose. In other words, commodity monies are goods that function as money.

Commodities that have served as money include gold, silver, copper, and salt, among others. In an oft-cited case study, it is reported that cigarettes were used as money in a POW camp. Cigarettes are also believed to have circulated in Germany following WWII and in prisons today.

Since commodity monies are privately provided goods, their supplies are governed by ordinary market mechanisms. They do not need to be maintained by central banks like fiat monies. Lawrence H. White offers an excellent account of the underlying mechanism in his book, The Theory of Monetary Institutions. As I explain in brief below, this mechanism functions to stabilize the purchasing power of the commodity money.

Following White’s lead, I will consider the mechanism when gold is employed as money. The analysis is much the same for other commodity monies. As anyone who has watched the hit Discovery Channel TV show Gold Rush: Alaska knows, gold is produced by digging it up and separating it from the dirt. Gold might also be destroyed or fixed in ways that are not recoverable. The production and destruction of the underlying commodity is known as the flow market. When the amount of gold produced equals the amount destroyed over a given period of time, the net flow is zero. As a commodity money, gold is used for monetary and non-monetary purposes.

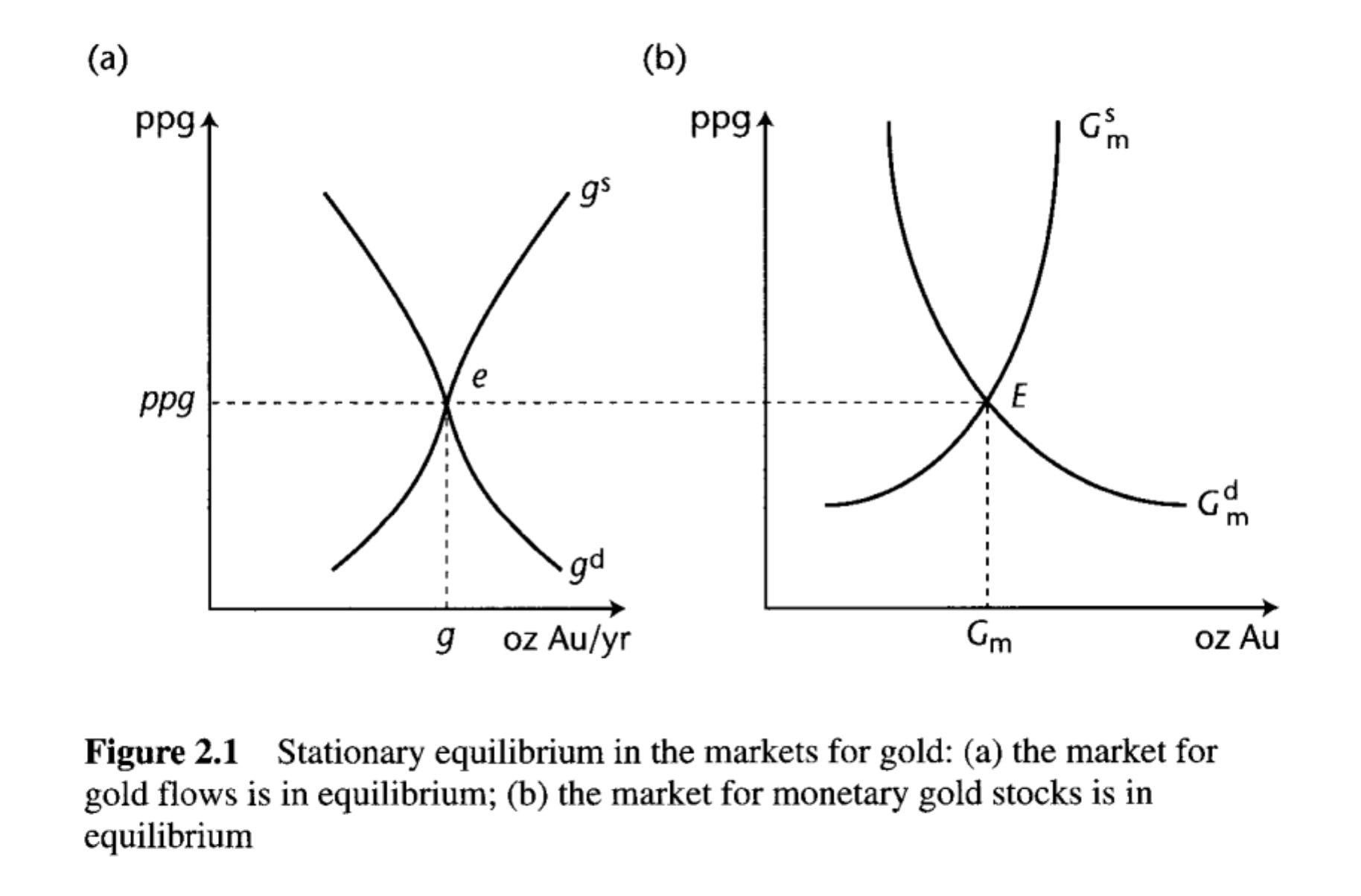

We will focus on the market for gold coined as money. In this stock market, the purchasing power of gold adjusts to clear the supply of gold coined as money and the demand for gold coins. (I use the term “coin” here loosely to denote any quantity of gold, including bullion bars, that might readily be spent as money.) The following graph from White’s book depicts flow (left) and stock (right) markets for gold in a stationary equilibrium. With both stock and flow markets in mind, we can consider the underlying mechanism by starting in a stationary equilibrium and tracing the effects of various shocks. A stationary equilibrium results when the supply and demand for gold coins intersect at a purchasing power of gold that corresponds to zero net gold flows. If it isn’t immediately clear why this is an equilibrium, don’t worry. It should be clear after considering the shocks.

Shock 1: An exogenous increase in the demand for gold coins.

Suppose individuals suddenly wish to hold more gold coins. The increase in demand pushes the purchasing power of gold up in the stock market. Two things happen. First, the movement along the supply curve shows that, as the purchasing power rises, people will convert non-monetary gold into monetary gold. As they melt their candelabras and other gold items to mint gold coins, the quantity of gold coins supplied increases. Second, the higher purchasing power of gold means that miners will increase production on intensive and extensive margins. They will hire more people and rent more machines to exploit existing gold reserves. They will dig deeper or attempt to recover gold from material that wasn’t profitable before the increase in purchasing power. As such, more gold will be produced than is destroyed. There will be a net inflow of gold. Some of this gold will be coined as money and, as it is, the stock supply of gold coins shifts right. Indeed, inflows will continue to increase the stock supply until the initial purchasing power is restored. At that point, the economy has returned to a stationary equilibrium.

Shock 2: A exogenous decrease in the demand for gold coins.

Suppose individuals suddenly wish to hold fewer gold coins. The decrease in demand pushes the purchasing power of gold down in the stock market. As before, two things happen. First, the falling purchasing power leads people to convert monetary gold into non-monetary gold. That is, they melt coins to fashion candelabras and other gold items. Second, the lower purchasing power of gold means that miners will decrease production. They will hire fewer people and rent fewer machines. It will no longer pay to dig so deep to recover gold. As such, less gold will be produced than is destroyed. There will be a net outflow of gold. The stock supply of gold coins shifts in. Indeed, outflows will continue to decrease the stock supply until the initial purchasing power is restored. At that point, the economy has returned to a stationary equilibrium.

Shock 3: An exogenous increase in the supply of gold coins

Suppose there is a sudden discovery of gold coins. The increase in supply pushes the purchasing power of gold down. What happens? Look at the flow market. At the lower purchasing power, it no longer pays to hire so much labor and rent so much capital. It no longer pays to dig so deep. Therefore, the amount of gold produced each year falls below the amount destroyed. The outflow of gold in general means the supply of gold coins will fall. When will it stop? When the original purchasing power is restored, the economy returns to a stationary equilibrium.

Shock 4: An exogenous decrease in the supply of gold coins Suppose some gold coins are permanently lost, destroyed, or otherwise fixed in ways that are not recoverable. The decrease in supply pushes the purchasing power of gold up. In this case, the higher purchasing power leads miners to hire more labor, rent more capital, dig deeper, etc. The amount of gold produced each year will exceed the amount destroyed, causing the supply of gold coins to increase. Only when the original purchasing power is restored will the economy returns to a stationary equilibrium.

Having considered the four exogenous shocks above, it should be clear that the money supply is endogenous under a commodity money standard. Any exogenous shock to the supply or demand of gold coins will bring about an offsetting monetary supply response. Unlike fiat money standards, where a central bank must manage the supply of money, the money supply response under a commodity money standard is automatic. Moreover, this mechanism does not rely on the (1) good will of key players or (2) their sophisticated knowledge of the macroeconomy. Decentralized actors pursuing their own interests and relying on their own local knowledge of the purchasing power of gold, wage of mining employees, rental price of mining equipment, etc. is sufficient. Perhaps this is why money growth and inflation have been lower, on average, under commodity standards.

Having explained the advantage of a commodity money standard, let’s turn to two potential disadvantages.

Disadvantage 1: The Resource Cost

Recall that fiat monies are only useful as a medium of exchange. The upside of that is that we do not have to forego alternative uses to employ such items as money. That is not the case with commodity monies. When gold, silver, or salt is used as money, it is not employed in its alternative use.

Disadvantage 2: Slow Adjustment

While the money supply is endogenous under a commodity money standard, it might not adjust very quickly. It takes time to hire more workers, rent more capital, etc. Adjusting the supply of fiat money, in contrast, takes very little time. So, while a commodity standard anchors purchasing power in the long run, the economy could be subject to large swings in the short run.

Assessing the Disadvantages

There is no denying the resource cost of a commodity money. However, it can be reduced by employing a commodity-backed currency. Rather than using the commodity–gold, silver, salt, etc.—to make transactions, one might trade claims to these assets. Banks might issue notes redeemable for gold and/or allow transfers of gold balances by physical or electronic check. If the underlying commodity does not circulate, we would not need to keep so much of it in vaults to support the monetary system. Hence, the resource cost would be much lower. Such a system, known as free banking, performed quite well historically. Still, as Milton Friedman famously argued, it is costly to dig up gold only to bury it again in vaults so that we can ultimately trade pieces of paper or make balance transfers.

Friedman changed his tune in the 1980s, as experience with full-blown fiat standards made it clear that the resource cost of an irredeemable paper money was not, in fact, zero. Since long run purchasing power is unanchored in a fiat standard, many will spend valuable resources trying to figure out what purchasing power will be in the future. Today, for example, there is large Fed watching industry, with market participants pouring over data releases and the words of FOMC members to get some sense of what the Fed will do next. All that Fed watching is very costly. More broadly, as Roger Garrison remarks, “Any discussion of the costs of a gold [or other commodity] standard and of the controversy that surrounds this issue is, by its very nature, a one-sided discussion. The comparison of alternative standards on the basis of costs will not be meaningful unless the corresponding benefits are brought into view.” In other words, even if a commodity standard is more costly, the costs might be justified if the commodity standard outperforms the alternatives.

What about the slow adjustment period? Although some advocate a fixed money supply or a fixed money growth rate, they are mistaken. Monetary neutrality requires that changes in money demand be offset by changes in money supply. So the money supply should be flexible to accommodate such changes. In terms of providing sufficient flexibility, some commodity monies might do a better job than others. James Buchanan argued for a brick standard. The ink-and-paper standard of Somalia seems to have worked pretty quickly as well. A better solution would be to allow banks to issue redeemable inside money (i.e. free banking,) which could be increased or decreased as necessary to accommodate changes in demand.

Finally, one must ask: what good is flexibility if it is not employed appropriately? The argument that a fiat money standard is superior because its supply can be adjusted more quickly presupposes that its supply will be adjusted appropriately. If the supply is adjusted when it should not be or over-adjusted when it should be, the fiat money standard might perform even worse than the admittedly slow-to-adjust commodity standard. The available evidence suggests that even our best performing managed monetary systems have faired poorly. At a minimum, this should prompt a reconsideration of alternative monetary systems like the commodity and commodity-backed standards of the past.