To Really Cut Taxes, We Must Cut Government Spending

Government consumes scarce resources both directly and, indirectly, by subsidizing other people’s consumption. Its annual budget is a measure of that consumption. Of course, every dollar the government’s decision makers spend is taken, one way or another, from someone in the industrious sector: through taxation, inflation, civil asset forfeiture, fines, and eminent domain. Those decision makers distribute the resources to fulfill objectives decreed by the legislature and bureaucracy. Obviously, what the government consumes cannot be consumed or invested by those who produced those resources.

The nature of government as a consumer was identified as early as 1817 (if not earlier) by the French liberal economist Antoine Destutt de Tracy, whose book A Treatise on Political Economy Thomas Jefferson so admired that he had it translated into English. “In every society,” Tracy wrote, “the government is the greatest of consumers.” He was not persuaded by the popular view that government spending creates wealth for society:

Those who persuade themselves that consumptions can be a cause of direct riches, maintain that the levies made by government, on the fortunes of individuals, powerfully stimulate industry; that its expenses are very useful, by augmenting consumption; that they animate circulation; and that all this is very favourable to the public prosperity. To see clearly the vice of these sophisms, we must always follow the same track, and commence by well establishing the facts.

Among those facts is this:

The expenditure [government] makes does not return into its hands with an increase of value. It does not support itself on the profits it makes. I conclude, then, that its consumption is very real and definitive; that nothing remains from the labour which it pays; and that the riches which it employs, and which were existing, are consumed and destroyed when it has availed itself of them.

In other words, government does not create value as entrepreneurs do; it takes value from others. It “does not live on profits, it lives on revenues,” Tracy wrote.

This disquisition on the nature of government as consumer is not just of theoretical interest, because it bears on the tax debate in Washington, D.C. While politicians talk about cutting tax rates, we hear almost nothing about cutting spending. (Sen. Rand Paul is an exception.) Spending may shift among budget categories (say, from domestic to military purposes), but an overall cut in spending is not in the cards. But revenues would fall, creating a larger shortfall than today’s. Former budget hawks have had their wings clipped.

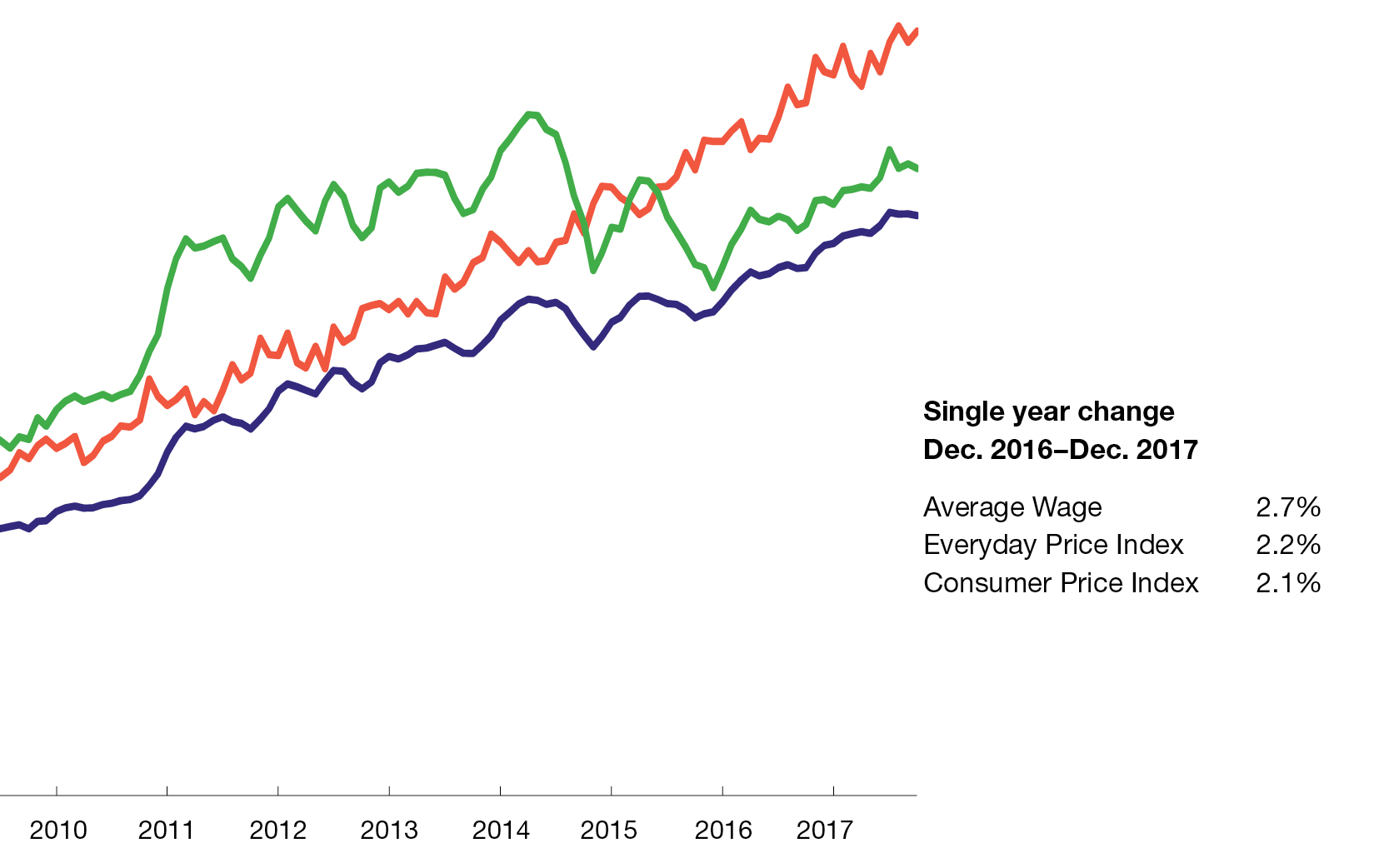

Here’s what is missed: if tax revenues drop while government spending remains constant or grows, real taxation — the extraction and consumption of resources from the industrious sector — will not have been reduced. If government does not take the resources openly, it will do so by stealth, disguising the extraction in arcane tax-code provisions that obscure who really pays the taxes; by acquiring purchasing power at the expense of the bulk of the people by printing money; or by borrowing, which pushes the burden onto future generations. Borrowing not only burdens our descendants, it also diverts resources from productive use today. That creditors choose to lend the government money should not blind us to the fact that they do so only because the government can tax someone to repay the loans.

The government’s budget is already in the red. So cutting taxes, which President Trump promises, without cutting spending would increase the budget deficit and therefore the national debt and interest payments. Eventually, the government will want more tax revenues to pay down the debt, but the taxpayers who will bear that burden either are too young to vote today or haven’t been born yet.

We are told we can have real tax cuts without spending cuts because tax cuts will “pay for themselves,” or, in other words, “we can grow out of the deficit.” But we have no reason to believe that any stimulus from a formal tax cut would bring in the same amount of revenue that would have been collected in the absence of the tax cut. And we have less reason to believe that any new revenues would be used to cut the deficit rather than finance new missions. Politicians just cannot be trusted in that way. Besides, why would we want the government to consume the same quantity of resources as before when the imperative always is to reduce how much the politicians consume? Every dollar the government spends is a dollar its producer cannot invest or spend.

The fiscal problem with democracy is that politicians have an incentive to promise benefits that can be made to appear to be free. The flip side of this perverse incentive is to promise to cut taxes without reducing the government’s consumption. Since this is clearly unsustainable, we should change things sooner rather than later.