Swan Song for the Elites: Taleb on Government Failure and the Libertarian Dream

“Black Swan” author Nassim Nicholas Taleb is forecasting a coming “libertarian’s dream” as the grip of the ruling classes weakens.

In a May 19 interview on the podcast Ron Paul Liberty Report, Taleb said he is pessimistic about financial markets but not pessimistic about the overall state of world affairs, envisioning a future of greatly diminished establishment pillars including the Federal Reserve and the New York Times.

That vision includes increasing use of bitcoins and spontaneous currencies.

Elections in India, Britain, the United States, and France show that rank-and-file citizens want greater control over their own affairs, he said.

“We will destroy what needs to be destroyed and build what needs to be built,” said Taleb in forecasting libertarian reform efforts.

“Things will develop in an organic, Hayekian way, and I’m very optimistic in that sense,” Taleb said, referring to one of his major influences, Austrian school economist/philosopher F.A. Hayek.

Hayek’s ideas included competing currencies, which he detailed in “The Denationalization of Money,” published in 1976. “The fatal conceit,” detailed in a 1988 book of the same name, is one of Hayek’s most famous utterances. That describes the idea that “the state, composed of ambitious politicians and bright (but wrong) activist economists, that think they can engineer an economy to prosperity,” wrote Nick Sorrentino, co-founder and editor of AgainstCronyCapitalism.org, in a 2012 blog post.

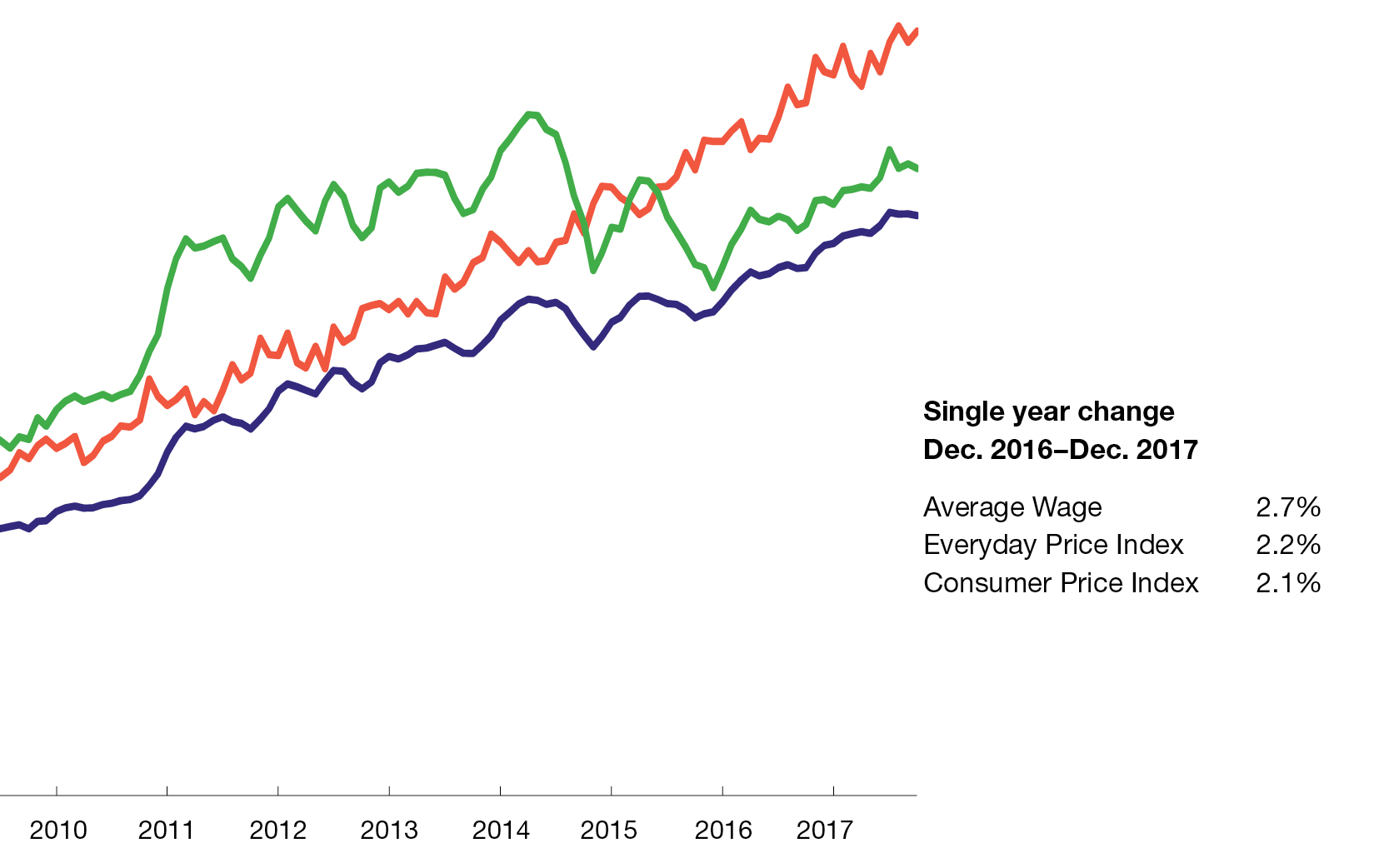

Taleb, who is also a hedge fund adviser, called the last 30 years of Federal Reserve policy “a story of incompetence” complete with distortions and asset-price inflation.

“You cannot have incompetence, serial incompetence, for such a long time without some kind of pushback,” he said.

Fed Chair Janet Yellen has said the central bank plans to shrink its $4.5 trillion balance sheet, which was built up during the Great Recession through accompanying quantitative easing. But some economists including Michael Gapen of Barclays see action as “far off,” according to a February research note.

Yellen’s predecessor, Ben Bernanke, said in September the balance sheet’s size is less important than the asset mix and that the size may not need to be reduced. But the Fed is in “unchartered waters,” with currency in circulation, or the total value of Federal Reserve notes outstanding, having risen to $1.4 trillion in April from $643 billion in August 2008, said Daniel Thornton of Missouri-based D.L. Thornton Economics. The money measure M1, currency in circulation plus checking deposits and other demand deposits, has climbed by more than $2 trillion since August 2008.

“There is no way to predict whether the continuous increase in the money supply will be benign or cause great havoc,” Thornton wrote in his latest newsletter. “We can only hope that the FOMC doesn’t get blindsided again.”

Elites in central banks and other government offices are pouring forth policies such as the expansionary monetary policies without having “skin in the game” and are creating calamities everywhere, Taleb said. Taleb labeled them “interventionistas” in a recent newsletter. At no point in history has so much risk been transferred to others, Taleb noted in reckoning actions by “interventionistas.”

Taleb likened the current system to airline pilots that are not harmed by crashes. Government people are rarely fired because of the difficulty of zeroing in on responsible parties, he said.

Harkening back to the concept explored in his book “Antifragile,” Taleb said systems are becoming increasingly fragile through centralizing government intervention.

“Put government in charge of nature and they’d eliminate the seasons,” he said. “They would see no need for them.”

“Antifragile” and “The Black Swan” are part of Taleb’s “Incerto” series. A fifth volume titled “Skin in the Game: The Logic of Risk Taking” is being written and is due out in six months.

A Lebanese-born former New York University engineering professor and derivatives trader, Taleb called trade “the best peacemaker.” By contrast, overseas interventions hurt business through the loss of markets and creation of enmity, he said.

Surveying Middle Eastern hot spots such as Iraq and Israel, Taleb said, “In an organic system you end up working things out. You don’t want to jeopardize your children’s lives by playing geopolitics.”

Instead of learning from mistakes associated with complex systems and interconnectedness, U.S. policy makers continue the same trajectory that brought on the 2008 financial crisis, Taleb said, adding that “too much Novocain” was injected into the system that is now staggering under as much as $25 trillion in debt.

“I had expected the system to fix itself through more bankruptcies,” he said in explaining his financial-market pessimism.