September Business Conditions Monthly

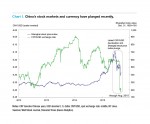

China’s economy is decelerating, its equity markets are plunging, and the nation’s tightly controlled currency, the yuan, has been losing value since last year (see Chart 1). Consequently, volatility spread throughout global markets in August, including a rout in U.S. equities from Aug. 17 to Aug. 25 when the S&P 500 dropped 11.2 percent, the tech-heavy Nasdaq slid 11.5 percent, the mid-cap S&P 400 fell 10.8 percent, and the small-cap S&P 600 sank 9.5 percent.

The normally more-volatile index of companies with smaller market values performed better than its larger-cap peer, suggesting that investors see the more domestically oriented small-cap stocks as better insulated from lower global growth. Our analysis generally supports that notion. While the U.S. economy is susceptible to external disruptions, it is much less sensitive than some export-focused economies.

This month we look at potential effects of China’s slowdown. We conclude that while there may be some increased headwind, recent events are unlikely to significantly disrupt U.S. growth.