Pulling It All Together/Appendix

The Economy…

The latest readings from our new model are little changed from the prior readings and continue to suggest a moderate U.S. growth outlook. While the risk of recession is still reasonably low, continued mixed performance by a wide range of economic data suggests a somewhat fragile future. In this environment, corporate earnings results may help shed some extra light on economic conditions and highlight areas at risk.

…Inflation…

The AIER Inflationary Pressures Scorecard shows a weak outlook for inflation, with falling pressure for 15 out of 23 indicators tracked and eight showing rising pressure. Cheap oil and a strong dollar are depressing prices for food, energy, and imported goods.

…Policy…

Economic data have been mixed since the Fed in December raised its target range for the federal funds. Policy makers may be more cautious about raising rates in the face of mixed signals, making a March hike unlikely.

The AIER Inflationary Pressures Scorecard shows a weak outlook for inflation, with falling pressure for 15 out of 23 indicators tracked and eight showing rising pressure. Cheap oil and a strong dollar are depressing prices for food, energy, and imported goods.

…Policy…

Economic data have been mixed since the Fed in December raised its target range for the federal funds. Policy makers may be more cautious about raising rates in the face of mixed signals, making a March hike unlikely.

It’s too early to tell what ending the U.S. oil export ban will mean for domestic production, but it has already lifted domestic crude oil prices above the global benchmark.

…Investing

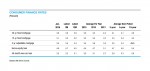

Economic trends are clearly visible in the capital markets. Junk bond spreads have widened, consistent with rising investor concerns over the economic outlook. The plunge in commodity prices is reflected in earnings for energy and materials companies and in hiring trends for those industries.

More broadly, economic trends are also seen in the sector breakdown of earnings for the S&P 500. Domestic demand remains the key driver for the U.S. economy and for corporate earnings. If earnings were to decline significantly, it could affect future hiring and put the current expansion at risk.

In China, the Shanghai composite stock index and the Chinese economy appear to be moving in different directions. Equity performance may still be at risk, but with government intervention far greater than in many other markets and economies, uncertainty abounds for investors.

Next/Previous Section:

1.Overview

2. Economy

3. Inflation

4. Policy

5. Investing

6. Pulling It All Together/Appendix

Click here to receive email notifications when the latest Business Conditions Monthly is available.