Offsetting Factors Point to Modest Inflation

Going forward, sufficient supply will balance increased demand from an improving economy, while rising interest rates will have the two-fold effect of slowing the growth of the money supply and strengthening the U.S. dollar. The latter will result in cheaper imports that will put a downward pressure on domestic prices.

CONSUMER PRICES

The general level of consumer prices, measured by the Consumer Price Index for All Items (CPI), dropped 0.37 percent in December, after falling 0.26 percent in November. Despite these two consecutive monthly declines, over the 12-month period ending in December 2014, the CPI rose at a seasonally adjusted 0.66 percent, the smallest 12-month increase since October 2009. Undoubtedly, the recent decline was due in large part to the sharp decline in oil prices. This drop is reflected in the fall of the CPI Energy Index for six consecutive months, with a cumulative decrease of about 20 percent between June and December 2014, which is the latest month for which data are available.

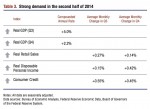

In fact, by looking at the non-energy-related prices we can see how declines in energy prices were greater than price increases in all other categories. See Table 1 for the CPI breakdown.

Overall, the CPI decreased along with CPI Energy, but CPI Core—a measure that excludes volatile food and energy prices—trended upward slightly in the last quarter of 2014. The CPI Food and Beverage Index also increased in the last three months by an average of 0.21 percent. As with the other non-energy related components, the components of the CPI that capture prices for rent and medical care commodities both advanced at rather fast paces. One might expect that lower gas prices at the pump might draw some new car buyers into the market and thus might push sticker prices up. However, recent evidence doesn’t support this expectation, as the CPI New Vehicles Index did rise 0.18 percent in October from the previous month, but declined slightly in November and December, resulting in basically no change for the fourth quarter of 2014.

Also included in Table 1 are other broad price measures. AIER’s Everyday Price Index (EPI), a measure of prices for goods and services that consumers buy frequently, shows a continuous decline since July 2014. This decline reflects falling oil prices and the importance of oil-related goods in consumers’ everyday purchases.

While most price indexes focus on selected goods and services, the Personal Consumption Expenditure Price Index measures the average price of all of the goods and services that consumers purchase in a period. It is the broadest possible measure. It is also the measure preferred by the Federal Reserve for tracking inflationary pressures in the economy. This index dropped on average over the last three months of 2014 due to cheaper oil, and advanced a modest 1.33 percent over the 12 months to December. This figure is well below the central bank’s inflation target of 2 percent, which explains why the Federal Reserve faces no pressure to conduct contractionary monetary policy to curb inflation.

To sum up, on the consumer front, the substantial decline in oil prices is the force behind the decrease in the overall price level. But that decline didn’t have much effect on consumer prices unrelated to oil and energy.

Prices tend to lag in reaction to economic events, a phenomenon that economists refer to as “sticky prices.” For example, high oil prices have created a demand for electric vehicles. But, the expansion of the electric vehicle industry takes years and decades, not months. Thus, in this analysis we only focus on the reactions of other prices to oil price decline through the chain of production, which happens over the span of months, not years. Since oil is an important input into production, the sharp decline in oil prices would lower production costs and thus reduce consumer prices.

A look at the producer prices below tells us that the influence of lower oil prices on the cost of production has already started.

PRODUCER PRICES

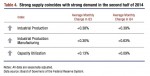

Producer prices reflect supplier costs and therefore the costs of production. Table 2 shows that the decline in oil prices has worked through the chain of production, resulting in decreases in producer prices at all stages of production—crude goods and materials for future processing, intermediate goods, and finished goods.

The Producer Price Index (PPI) Crude fell by 2.91 percent in the fourth quarter of 2014, followed by PPI Intermediate decreasing 1.21 percent, and then the PPI Finished Goods declining by 0.73 percent.

One would expect that lower production costs would reduce consumer prices. But it seems that the decline in producer prices has not transferred to consumer prices, at least not yet. The PPI Finished Consumer Foods (wholesale) was falling in November and December, while at the same time food prices at the consumer (retail) level rose. Similarly, producer prices for manufacturing have also continuously trended downward in recent months, while retail prices did not always follow.

Normally, consumers are more likely to see higher production costs show up in retail prices than to see the benefits of lower production costs. If lower production costs do show up in retail prices, this chain of events can take some time to play out. Economists characterize this condition as prices being “sticky downward,” but not upward. When production costs fall but consumer demand is high, producers may simply increase profit margins and keep prices unchanged or—if the demand is high enough—even raise them. The data indicate that this is the current situation.

DEMAND

Strong demand for goods or services tends to push up consumer prices, but it does so with a lag. We found a high positive correlation of 0.74 (out of 1) between the year-over-year change in consumer credit and four-month lagged CPI Core inflation in the past 15 years. This is to say that 74 percent of the current change in CPI Core can be explained by the change in consumer credit four months earlier. Hence, in order to investigate the effect of changes in demand on current prices, we need to look at demand not only in the most recent month or two, but also four months earlier, in the third quarter of 2014. Table 3 shows four important indicators of demand from consumers.

Real Gross Domestic Product (Real GDP), the broadest measure of the total demand in the economy, advanced at the compounded annual rate of 5 percent in the third quarter of 2014, the fastest growth in more than a decade. Real Retail Sales, more directly related to consumers’ expenditures than the GDP, trended up by an average of 0.27 percent on a monthly basis in the third quarter of last year. Sales grew for seven consecutive months in 2014 from February to August. Real Disposable Personal Income, which gives us a sense of consumers’ after-tax income, rose 0.15 percent month-to-month. In addition to real disposable personal income, Consumer Credit shows the consumers’ purchasing power fueled by borrowed funds. Consumer Credit in the third quarter increased by 0.55 percent on average month-to-month.

Overall, all indicators in Table 3 show a strong demand in the third quarter of last year, which could be an important contributor to the growth of non-oil-related prices in the fourth quarter.

Going forward, changes in demand in the fourth quarter of 2014 provide insight into the likely changes in consumer prices in the first or second quarter of 2015. Again, all indicators posted strong growth in the fourth quarter of 2014, suggesting inflationary pressures in the near future.

However, strong demand alone does not necessarily mean higher prices. If there is sufficient industrial capacity to expand supply to meet the growing demand, we may see stable prices. Thus, we turn to the role of supply forces on prices.

SUPPLY

Three important indicators of supply all suggest that supply is expanding (Table 4).

It appears that strong supply coincided with strong demand in the second half of 2014. Overall, industrial production experienced fast growth in the last two quarters. In particular, industrial production for manufacturing grew 0.63 percent on average in the fourth quarter, compared with 0.4 percent in the first half of the year. However, the capacity utilization rate, which measures the extent to which the nation’s capacity for production is used, grew at a slower pace in the fourth quarter to 79.6 (out of 100), indicating potential for future production growth. Usually, developed economies have capacity utilization rates between 80 and 85. The gap between the fourth quarter utilization rate and where we expect a well-functioning U.S. economy to be indicates that there is room for supply expansion in the U.S. to meet the growing demand from the improving economy.

Since the economy is currently in a business-cycle expansion phase, it is reasonable to expect rising demand going forward. Knowing this, producers will increase their production to meet the growing demand. Strong demand may put upward pressure on consumer prices, but the expanding supply should help constrain the price increases.

MONEY AND EXCHANGE RATES

In contrast to the effects of demand and supply in the short or medium term, in the longer term the trend in the money supply—a measure of the total amount of money available in circulation—is the primary determinant of the price level. Abundant money chasing an inadequate volume of goods and services causes the overall price level to rise. Recently the money supply, measured by M2 monetary aggregate, has been increasing at about 5 percent per year while GDP has been growing at about 2.4 percent per year.

But these trends may change in the near future. The growth in the money supply is likely to taper off as the Federal Reserve raises interest rates in the middle of the year—a policy intention given by the Federal Open Market Committee statements. All else being equal, this increase in interest rates will slow down inflation.

Rising interest rates have another effect on inflation, which works indirectly through the exchange rate between the U.S. dollar and other currencies. As the Federal Reserve raises the interest rate, dollar-denominated financial assets become more attractive to investors. This, in turn, pushes up demand for U.S. dollars, causing the U.S. dollar to appreciate against other currencies.

The attractiveness of the dollar is further strengthened by the fact that other major central banks have been lowering their interest rates recently, thus inducing investors to search for higher yields elsewhere. For instance, in September 2014, the European Central Bank (ECB) lowered all interest-rate targets to record lows and set its bank deposit rate at -0.20 percent. That is, banks are now paying to deposit with the ECB instead of earning interest. At the same time, the Bank of Japan shocked global financial markets in October 2014 by expanding its massive stimulus spending to keep interest rates low. More recently, Denmark’s central bank cut its deposit rate deeper into negative territory on January 29, 2015, and Australia cut its benchmark interest rate to a record low of 2.25 percent on February 3, 2015.

As the Federal Reserve continues to telegraph its intentions to raise interest rates in a global environment of low interest rates, the stronger U.S. dollar makes imported goods cheaper, putting downward pressure on U.S. domestic prices. At the same time, U.S. products become more expensive—and therefore less desirable—in foreign markets. This situation creates an incentive for U.S. producers to sell their products in the domestic market instead of exporting them, bringing potential supply to the U.S., and thus lowering domestic prices.

CONCLUSIONS

Over the period of plummeting oil prices, consumers have seen price increases elsewhere. Even though the cheaper oil has lowered costs at all stages of production, it hasn’t had much effect on final consumer prices. In the improving economy, strong demand is the force preventing prices from falling.

Going forward, growing demand is likely to be offset by strong supply, resulting in only modest price growth in the near term. In the longer term, rising interest rates in the U.S. will slow the growth of the money supply, putting downward pressure on inflation. In addition, higher interest rates will make the U.S. dollar stronger, resulting in cheaper imported goods that will also contribute to lower domestic prices.

[pdf-embedder url=”https://www.aier.org/wp-content/uploads/2015/03/March2015IssueBrief.pdf“]