Money Management Skills Empower Abuse Survivors

To address this, AIER developed Money School, a pilot program for women who have survived domestic and sexual violence in our area, Berkshire County, Massachusetts. Partnering with Elizabeth Freeman Center (EFC), a county-wide service center for survivors, we ran a series of workshops teaching women how to establish credit, open a bank account, plan and budget, and learn to be financially independent.

Most important, we taught the women how to work toward a big financial goal, such as going back to school or saving for future needs. We encouraged them to develop a, “My money, my choice” attitude toward finance and to use local resources – bankers, credit counselors, and other women who have gone through a similar experience – for support.

Our work was funded in part by a grant from Rosie’s Place, Boston, the first women’s shelter in the United States.

Focus groups built the foundation

Before conducting any workshops, AIER built its curriculum from the ground up by running a focus group with women to determine what topics were most important to them. The women revealed that they wanted to learn about financial planning, basic budgeting, and credit repair, as well as gain access to local resources and information on transportation, job searching, and investing.

One woman in the group, for instance, reflected a common theme of needing help with basic financial planning when she said she wanted to learn “basic habits, organization, saving, investing, and budgeting” because she didn’t know where to find this information. Another woman said that many people don’t know where to go for help like that, and others who do know “don’t feel comfortable coming in.” In addition to not knowing where to turn for informational support or resources, the women said that it’s hard for survivors to reach out for help even when they know such support exists. One woman told the group, “It is difficult to talk or turn to people for help,” and another agreed: “When you are in the middle of crisis, it is hard to reach out even when you know that the support is out there. In that situation, it is hard just to pull your vision together and figure out the next step.”

Based on this focus group, in addition to a review of the literature on social networks, domestic violence, existing financial education programs, and best practices, we decided that the Money School workshops ought to teach financial skills as well as connect women to local organizations. Using the existing literature on domestic violence and social networks, we understood that many women struggle financially after leaving abusive relationships because, among other reasons, they have been economically dependent on their partners and socially isolated from people, friends, family, and organizations. Furthermore, a lack of financial independence can contribute to remaining in an unsafe domestic abuse situation.

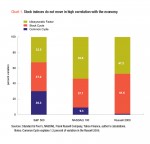

Money School is based on the idea that financial knowledge and more extensive networks of community resources contribute to the self-confidence needed to make better financial decisions for women who are leaving abusive relationships. This “theory of change” is illustrated in Chart 1.

To address the women’s needs, AIER and Elizabeth Freeman Center ran a series of five-week workshops in three locations: Great Barrington, Mass.; North Adams, Mass.; and Pittsfield, Mass. A total of 40 women completed the workshops. At each of the three, we taught the following topics: setting financial goals, saving for the future, confronting credit and debt, juggling finances, and making money count.

Women learned from each other and from resources provided by local experts. In two of the weeks, for example, one-on-one financial coaches from local banks, including Berkshire Bank, TD Bank, NBT Bank, Greylock Federal Credit Union, and Lee Bank, provided individualized support in credit repair, banking and budgeting, and savings. We also had guest speakers discuss education, savings, and goal setting. They came from local schools, such as the Massachusetts College of Liberal Arts, Berkshire Community College, and Williams College, and local community service organizations.

Active learning and coaching taught the fundamentals

Women in the classroom learned the material in different ways – from lectures, group activities, role playing, and one-on-one coaching. Our most successful lessons were those that combined active learning techniques to teach fundamental concepts followed by one-on-one coaching sessions with local experts. The group work and role playing were active, facilitating the participants’ learning of fundamental financial concepts. Matching participants with the coaches ensured that women had opportunities to meet experts in the field who would help them with support in the future. This also introduced them to resources they might not have known about otherwise, such as social services, educational and job development opportunities, and financial tools. In one of the weeklong sessions, women learned about the difference between credit and debt and how to find and interpret their credit reports. Instead of lecturing, the facilitator led a group role-play on credit.

Following the instruction, women met individually with their financial coaches to clarify the information. They learned how to interpret credit reports, how to improve their credit scores, and what to do to prioritize their debt payments. One participant wrote in an end-of-workshop survey that she thought the one-on-one coaching was particularly helpful in clarifying concepts. “The co-teachers were able to clarify the confusion about the difference between credit and debt,” she said.

This combination of active learning techniques, role-playing, and one-on-one work helped to facilitate learning. In the North Adams series, 8 out of 11 women correctly identified the difference between credit and debt in the post-lesson quiz. In Pittsfield, 11 out of 13 women correctly identified the difference after the lesson.

The lecturing, role-playing, and group activities gave women an introduction to fundamental financial concepts; the small size of the workshops and the one-on-one coaching sessions gave participants a chance to clarify the concepts. The partner work also allowed coaches to encourage their participants. Many coach-participant pairs began to build trusting working relationships that, we hope, will endure as women work toward their goals. At the end of one of the Pittsfield sessions, for instance, one participant wrote, in response to a question asking her reaction to her financial coach, “It was great to meet with a financial adviser because she was able to give me information on how to pay off current loans.” One participant thought her coach was “amazing, knowledgeable, supportive, and encouraging.” Another wrote regarding her coach, “It is very helpful to review different resources to consolidate debt and begin plans for financial success.” Finally, one wrote in the final workshop survey, “I don’t feel defeated or ashamed anymore, and I’m motivated to do better.”

Confidence was built by gaining skills

AIER was interested in seeing improvements in three areas: competence, confidence, and connections. Competence was measured by comparing scores on pre- and post-tests. The specific competence objectives are shown here. Before the workshops, participants in North Adams scored an average of 60 percent. Afterward, they scored an average of 71 percent.

Money School objectives for five workshops.

Set Financial Goals

➀ become aware of the effects of economic abuse

➁ learn the value of competence, confidence, and connections

➂ set at least one long-term financial goal

➃ identify fixed and variable expenses and income

Confront Credit and Debt

➀ dentify a personal asset

➁ find sources of support

➂ learn the difference between credit and debt

➃ access and interpret a credit score and report

Save for the Future

➀ prioritize debt and learn how to reduce it

➁ identify ways to increase income, save, and invest

➂ recognize the benefits of savings and interest

➃ understand the risks and rewards of investments

Juggle Finances

➀ translate financial goal into a plan

➁ learn to balance income and expenses

➂ build a budget around current spending

➃ find ways to cut expenses and increase income

Make Money Count

➀ monitor and adjust budget each month

➁ set realistic goals for paying debt and saving

➂ recognize when a budget is meeting financial goals

➃ know who to call for budget help

Qualitatively, women reported in the end-of-workshop questionnaire that the workshops helped them learn the skills to analyze their finances. Participants reported that the simple practice of monitoring income and expenses, for example, helped them to become more aware of their spending habits and to learn how to begin to change them. As one participant said in a post-workshop interview:

“The school gave me a willingness to scrutinize my finances… I was literally shocked at how much I spent money on stuff I don’t really need. And here I am scrambling, but when I take a good hard look at my finances, I wouldn’t need to scramble. And that was a huge thing at a personal level… Before, talking about money brought tears to my eyes and now, you know, I am much more comfortable talking about it.”

Money School also sought to increase women’s confidence to make financial decisions, as measured by pre- and post-workshop questionnaires and interviews conducted immediately prior to and following the cycle. One woman from the Pittsfield series related that before Money School, she would look at something that cost $20 (something she could not afford) and become depressed. But now, she said that she looked at that item, and instead of being disappointed that she shouldn’t spend the money, she felt empowered. As she said, “Hey! I just saved $20!” She said that making the decision to not spend the money also meant she was actively choosing to save it. In this sense, the workshops helped women see smaller opportunities to save money, empowering them to take pride in these short-term financial decisions that would help them in the long run.

We also observed informal and formal connections forged throughout the workshops—our final outcome. Another young woman expressed in an interview that the program made her feel like she wasn’t alone and that she could get support from other people who were “in the same place as [she] was.” She liked that she could talk about her trauma and her experience with money to people whom she felt understood her. The women themselves served as a source of powerful emotional support for one another.

Women who leave abusive relationships also need more formal social support from places like social services agencies, financial institutions, and housing assistance programs. After all, many women stay in abusive relationships because they do not have the money or resources necessary to leave and establish another home. Leaving is even more challenging in rural areas like Berkshire County, where there are limited labor market opportunities for people with less formal education and experience. Money School helped the women who attended our workshops find people and resources to support them in taking charge of their own lives. Every guest who participated in the program, whether they were coaches or speakers, had information to share on local job opportunities, education, credit repair, banking fees, and financial services.

Following the workshops, some women met individually with their financial coaches to get more support, information, or tools. For example, one woman had an overdraft fee and no money to pay for it. Her coach, who was a bank branch manager, helped her address the fee issue. This was the first help the woman had received from someone in a financial services position. Not only did Money School help her with this problem, but she learned that she had the skills to improve her own situation. After the workshops, she described herself in an interview as more “resourceful, motivated, [and] laser-focused” toward her goal of going back to nursing school, and she knew now whom she could turn to for help. More than that, she no longer felt shame in asking for help or talking to people about her plans. Similarly, another woman said that after meeting with two of the local experts individually, she felt like she had a place to start with her financial planning. She related feeling more confident in her ability to start saving, and now she has even made plans to begin investing. Money School helped women in the program not only meet different experts and service providers; it helped women see that they have the skills and resources to build toward the future they want.

Money School expands

Using the results and lessons learned from the first year of workshops, AIER developed a workbook that facilitators across the region can use to run their own sessions of Money School. Each Facilitator Guide also comes with a set of Participant Workbooks and corresponding testing tools. This summer, AIER distributed these materials to 30 representatives of over 15 organizations interested in holding Money Schools in Massachusetts.

It is our hope that these organizations will use our materials in their communities. As Becca Bradburd, director of operations at Elizabeth Freeman Center said:

Most of our clients have been systematically torn down by their abusers, who strive to make them believe they are worthless, that no one else loves or cares about them, and that they can’t make anything of their lives. Money School is a powerful antidote to this kind of messaging, one that provides survivors with the tools to generate economic recovery and independence.

Money School is one small part of AIER’s educational programming. The Teach-the-Teachers Initiative has aimed to raise economic literacy in America by providing customized training for high school teachers. Its internship and fellowship programs recruit talented undergraduate, graduate, and post-graduate students across the country to engage in economic research. And AIER frequently gives talks to students locally to deliver information on financial literacy.