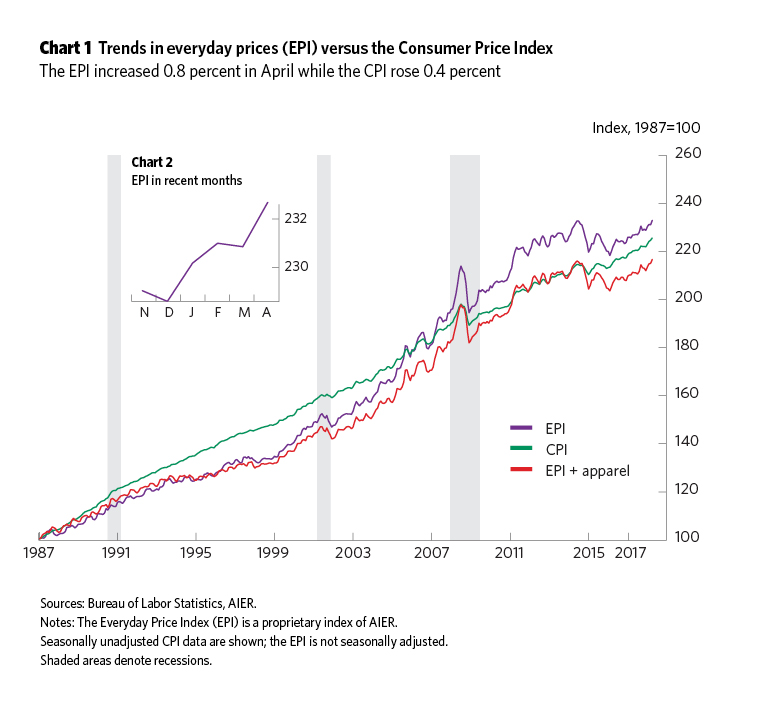

Gasoline Prices Fuel 0.8 Percent Surge in the AIER Everyday Price Index

AIER’s Everyday Price Index jumped 0.8 percent in April, ahead of the 0.4 percent gain in the Consumer Price Index. The EPI measures price changes people see in everyday purchases such as groceries, restaurant meals, gasoline, and utilities. The EPI is not seasonally adjusted, so we compare it with the unadjusted CPI. The EPI including apparel, a broader measure, also gained 0.8 percent in April. Both measures exclude prices of infrequently purchased, big-ticket items (such as cars, appliances, and furniture) and prices contractually fixed for prolonged periods (such as housing).

Over the past 12 months, the EPI has risen 2.7 percent, the fastest pace since September 2017, while the EPI including apparel is up 2.6 percent, its fastest pace since January 2017. The more widely known price gauge, the Consumer Price Index, reported by the Bureau of Labor Statistics, includes fewer frequently purchased items and everyday purchases. That measure is up 2.5 percent over the past 12 months, the fastest pace since February 2017. Over the last five years, the EPI is up at a 0.6 percent annualized rate compared to an average annual rise of 1.5 percent for the CPI.

Familiar themes are reappearing within the components of the EPI. Energy prices tend to be volatile and are a major component of the EPI. Therefore, energy-price moves often drive short-term movements in the overall EPI. Motor fuels jumped 6.1 percent in April on a not-seasonally-adjusted basis. That surge accounted for nearly the entire rise in the overall EPI. Excluding motor fuels, the EPI was up just 0.1 percent for the month. Among the components of the EPI, 12 of the 24 categories were up in April while 12 were down.

Over the past year, about three-quarters of the categories that make up the EPI have shown higher prices while one-quarter have shown price declines. Over the past five years, 9 of the 24 categories within the EPI have annualized price declines while 7 have annualized gains between 0 and 2 percent and 8 categories have gains above 2 percent. Among the categories with price declines are non-prescription drugs, telephone services, internet services, and pet supplies. The areas with the fastest price increases are prescription drugs, cable and satellite services, events admissions, restaurants, fees for lessons, household services, lawn and gardening services, and tobacco products.

Among the components with the largest weights in the EPI, food at home (20.8 percent weight) is up 0.5 percent from a year ago and up at a 0.5 percent annualized rate over the past five years; food away from home (17.0 percent) is up 2.5 percent over both the last 12 months and the last five years; household fuels and utilities (13.3 percent) are up 2.2 percent for the year and 1.5 percent over five years; and motor fuel (11.5 percent) is up 13.5 percent since last April but down 4.8 percent annually since 2012. Combined, they account for 62.5 percent of the EPI.

The key takeaways are that price increases have broadened among categories of the EPI though about one-third are still seeing outright declines; energy prices, especially motor fuels, tend to be the most volatile month to month; and the largest contributors outside of energy are generally labor-intensive or in highly regulated areas (prescription drugs and cable services).