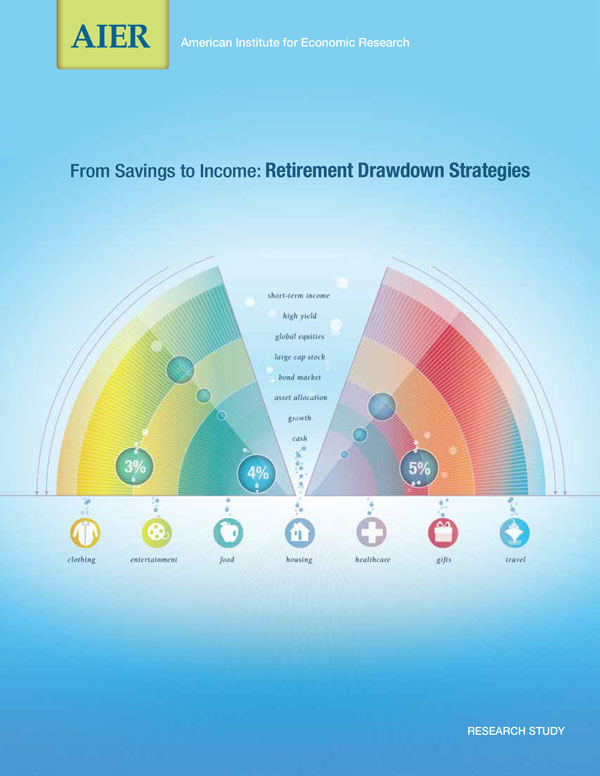

From Savings to Income: Retirement Drawdown Strategies

There is no magic bullet that foretells the ideal savings drawdown strategy. Our study, From Savings to Income: Retirement Drawdown Strategies, shows that retirees should develop a plan that considers good and bad markets and adjusts expectations and strategies over time. It equips people with the information needed to begin thinking about that process.

Did you know that more than one in three Americans is aged between 45 and 74? For most of these 100 million people, the days of pension plans are all but gone. Less than one in five workers is covered by a defined benefit retirement plan.

Meanwhile, the 401(k) experiment is well underway. These defined contribution plans make individuals responsible for financing and managing their own retirements. Given the massive cohort involved, informed decisions about retirement financing will be essential not only to retirees, but to the health of the U.S. economy. This Research Study is intended to determine whether there is a retirement drawdown strategy that strikes a balance between prematurely exhausting savings and under-spending during retirement. It is intended to help those nearing retirement consider how to effectively draw income from their savings after they have left the workforce.

/sites/default/files/Files/WYSIWYG/research/4213/RS20140717_Download.pdf