Fighting Protectionism Once Again

“When adversely affected minorities are politically powerful, governments often intervene with special-privilege legislation to insulate the “injured” parties from the effects of international cooperation or to give them special advantages in the international arena. As the chronic worldwide inflating of the past few decades has left its usual legacy of faltering economic performance in virtually all countries, protectionist sentiment and practice again has risen to a high pitch, threatening to impede international flows that foster economic advancement and thus to set back even further the chances of reviving sustainable economic growth. In view of the propensity of politicians in the free-world nations to pander to domestically powerful special-interest groups, we fear that protectionism will increase dramatically in the coming years, compounding the economic difficulties already so evident.”

This paragraph, which nearly perfectly summarizes the current climate of protectionism under the new administration, was published in a 1982 AIER Research Report, ”Protectionism: Prescription for Stagnation.” Unfortunately, the biggest differences between the situation then and now are a more severe post-inflationary economic downturn, more blatant pandering to special-interest groups, and even greater fears of a dramatic increase in protectionism. It appears that when it comes to protectionism, history not only repeats itself but gets worse.

AIER has consistently advocated free trade throughout its 84-year history, and it is time to do so again. After explaining why new protectionist plans are a step backward in America’s already problematic trade policy, we will review the case for free trade that is widely accepted by economists across the political spectrum. We will then examine why protectionism remains such a potent political force despite near-universal agreement that it is bad economics.

Another step backward

It is clear both from campaign promises and early executive orders that President Donald Trump intends to radically reduce the free flow of trade of the U.S. with other nations. One component of his strategy that at the very least is symbolic is withdrawing from or renegotiating trade deals. On Jan. 23, President Trump officially withdrew the nation as a signatory to the Trans-Pacific Partnership (TPP) and vowed to end the era of multinational trade agreements in favor of bilateral agreements to “promote American industry and protect American workers.” The TPP was signed in February 2016 but it had not yet been ratified by the U.S. Congress or legislative bodies of other signatories at the time of withdrawal. The president also pledged to renegotiate the North American Free Trade Agreement.

To be clear, the policies and deals negotiated by previous administrations were not truly free trade. There is considerable debate among advocates of free trade about the merits of deals like NAFTA. For example, while the Cato Institute, in “NAFTA at 10: An Economic and Foreign Policy Success,” argues that free trade agreements are a step in the right direction, the Mises Institute writes in “The NAFTA Myth” that they are nothing more than thinly veiled mechanisms for government and special-interest control of trade. But it is clear that by ending or altering these agreements, the president plans to further restrict the free flow of American goods.

The White House website says, “By fighting for fair but tough trade deals, we can bring jobs back to America’s shores, increase wages, and support U.S. manufacturing.” While the term “fair” is meant to sound innocuous, it has long been code for protectionist policies. Our 1977 Research Report, “What Does Protectionism Protect?” said, “No longer is ‘free trade’ a popular phrase to some U.S. businessmen and labor union leaders; it has been replaced with the call for ‘fair trade.’ Of course, what one person might deem ‘fair’ may be considered quite the opposite by others, and likewise among countries. Therefore, concern about trade imbalances has increased, and along with it a fear of the imposition of protectionist policies.” President Trump also has personally spoken out about outsourcing by U.S.-based manufacturers such as Carrier Corp. and Ford Motor Co., and he has floated plans to impose a 20 percent border tax on imports from Mexico.

A truly free flow of goods and services across borders, while feasible, has at best been a talking point in previous administrations, but the new president has taken steps toward protectionism in both rhetoric and action. When it comes to trade policy, we have traded in a sputtering sedan for a rickety tricycle.

Why free trade works

Free trade, like other transactions in a market system, derives its benefits from the power of specialization. No one argues against individuals specializing in a career that fits their skills. A worker who is skilled with woodworking becomes a carpenter while another worker is a voracious reader and becomes a lawyer. The carpenter and the lawyer then trade services, making both better off. In the absence of mutually beneficial transactions, the carpenter and the lawyer would consume much less. If each person was left to their own skills and abilities to provide for their needs, society would be worse off (imagine if the lawyer had to fix his own roof). Not all people are able to produce goods and services as efficiently as others. People should be free to pursue an industry that fits their skills and abilities. The same is true for a country.

Specialization works even when one party is more efficient at producing multiple goods in an absolute sense, but each party produces the goods with different relative efficiency, a concept called comparative advantage. For the interested reader, “What Does Protectionism Protect?” provides a numerical example of comparative advantage in action.

Countries should be free to pursue industries in which they have a comparative advantage. A country’s comparative advantage stems from its special mix of labor and capital. Take the U.S. and China, for example. China has a large work force willing to work for relatively low wages in factories, whereas the U.S. has a highly educated workforce. Different countries can produce different goods and services relatively cheaply. China provides the U.S. with inexpensive consumer electronics, while the U.S. provides China with a range of capital goods such as jet engines. By allowing free trade, both countries receive goods and services at a higher quality and lower price. Free trade lets countries put their resources to the most productive use, raising incomes and living standards.

Henry George wrote “Protection or Free Trade” in the 19th century when the U.S. had many trade restrictions in the form of tariffs. George wrote, “Trade is not an invasion. It does not involve aggression on one side and resistance on the other, but mutual consent and gratification.” Trade restrictions prevent mutually beneficial transactions, limiting freedom of choice. U.S. consumers prefer to purchase imported goods if the products are superior to domestic goods.

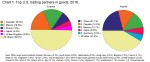

The U.S. auto industry is a good example. In the 1970s, American auto companies went to Congress and demanded a tariff on Japanese autos. The effects were to reduce the quantity of Japanese cars that would have otherwise been sold and to raise their price. Americans could drive less fuel-efficient, domestically produced cars or pay a higher price for a Japanese car. Chart 1 shows the relative size and rankings of America’s largest import and export partners. It shows that Japan accounts for 4.3 percent of our exports and 6 percent of our imports.

As we wrote in our 1977 Research Report, “Cake for a Few, Costs for You,” “Any time that trade with other nations is restricted, whether through import quotas, tariffs, or ‘voluntary’ agreements, the result is higher prices for the consumer.” If the U.S. protects one industry, consumers pay a higher price for the goods produced by that industry. In effect, the protected industry is asking its fellow citizens for a subsidy or a handout.

Some argue that other countries protect their industries, so we should, too. Retaliatory trade restrictions do no good. When other countries subsidize their own industries, they lower the price of our imports. Let them subsidize our consumption. Protection also fosters bad management and poor products that would otherwise be eliminated under free trade. By letting bad management persist, trade restrictions prevent labor and capital from finding their most productive use. This stifles innovation and the creation of new industries and occupations.

Bad economics, dangerous politics?

If the overall benefits of free trade to each country involved are so clear, why does the debate once again appear to be swinging toward protectionism? First, those individuals in the U.S. who have been harmed by free trade have formed a powerful voting bloc. Second, due to the nature of the benefits and costs of free trade, it is easy for other voters to develop false perceptions.

Those who work in less relatively efficient industries whose operations are moved abroad may be harmed by free trade, despite its benefits to society. Economists have often responded that such harm is temporary, as overall growth from free trade will allow workers to find new jobs or retrain. They also often suggest that since free trade enlarges the overall economic pie, these workers could theoretically be compensated.

These arguments, while true, caused some economists to dismiss the concerns of those who have lost jobs until they elected Donald Trump. Promises from politicians such as, “you’ll find a new job,” or “you can go back to school,” will likely not sit well with a 50-year-old, laid-off assembly-line worker, and economists rarely define the specifics behind the theory of compensating them. U.S. manufacturing employment has declined by almost 5 million jobs since 2000, likely increasing the number of people viewing free trade as harmful.

Another reason free trade remains a topic of debate is that while the benefits diffuse widely through society in the form of lower prices and overall economic growth, the harm is sometimes more directly visible. Voters who benefit from trade therefore may perceive only the harm, especially when this false idea is fed by politicians.

Ironically, manufacturing workers who support protectionist policies out of fear of losing their jobs may be among the biggest current beneficiaries of free trade. A recent report in the Wall Street Journal shows that areas in the U.S. with the highest share of exports contributing to local gross domestic product are in Trump-voting states. AIER has also recently shown in our blog and Business Conditions Monthly that domestic manufacturing now uses a substantial fraction of imported intermediate inputs, meaning that even producers who could be protected at the expense of American consumers are likely to face higher business costs if barriers to free trade are enacted.

Finally, many of the manufacturing jobs lost since 2000 that politicians lead American voters to believe were lost to outsourcing actually were eliminated by technological change such as automation. Several recent papers provide evidence for this idea and argue that jobless recoveries in manufacturing stem from technology enabling firms to not replace workers laid off in recessions. Historically low interest rates since the Great Recession, which lower the price of capital relative to labor, have likely also contributed to this trend.

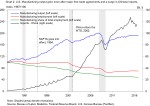

As Chart 2 shows, U.S. manufacturing output has grown since the Great Recession, and it grew in the two previous expansion periods, but manufacturing employment did not rise along with output. Rather, it dips in recessions and remains flat in expansions. The percentage of the labor force employed in manufacturing has been in decline for even longer, well before NAFTA or the significant rise in Chinese imports.

More fodder for protectionist politicians is the large U.S. trade deficit with other countries. However, our ability to trade across borders is not to blame for this deficit, which is exacerbated by both the dollar’s role as the world’s reserve currency and our government’s propensity to continually increase the money supply. The former widens the trade deficit by increasing the relative value of the dollar, making imports to America cheaper and exports more expensive. The latter helps finance the trade deficit and allows it to persist. Truly free trade, along with a sound currency, would address this issue far more effectively than more trade restrictions.

Freedom to cooperate

It is not surprising that free trade remains a political punching bag, as we have described both the actual and perceived harms associated with it. However, the case in favor of free trade, as we have laid out, is too important to be ceded to the current whims of politicians and must be made time and time again.

We would all do well to pay heed to AIER founder Edward C. Harwood, who wrote in “Useful Economics,” “The economic behavior we label ‘free competition’ or ‘voluntary cooperation’ results in the greatest possible total of benefits for all who participate. Unlike the competition in games where some lose what the victors win, and unlike war where even the winner may lose more than he gains, freely competitive economic behavior enables each participant to gain the greatest possible reward by voluntarily cooperating in a procedure whereby all concerned benefit.”