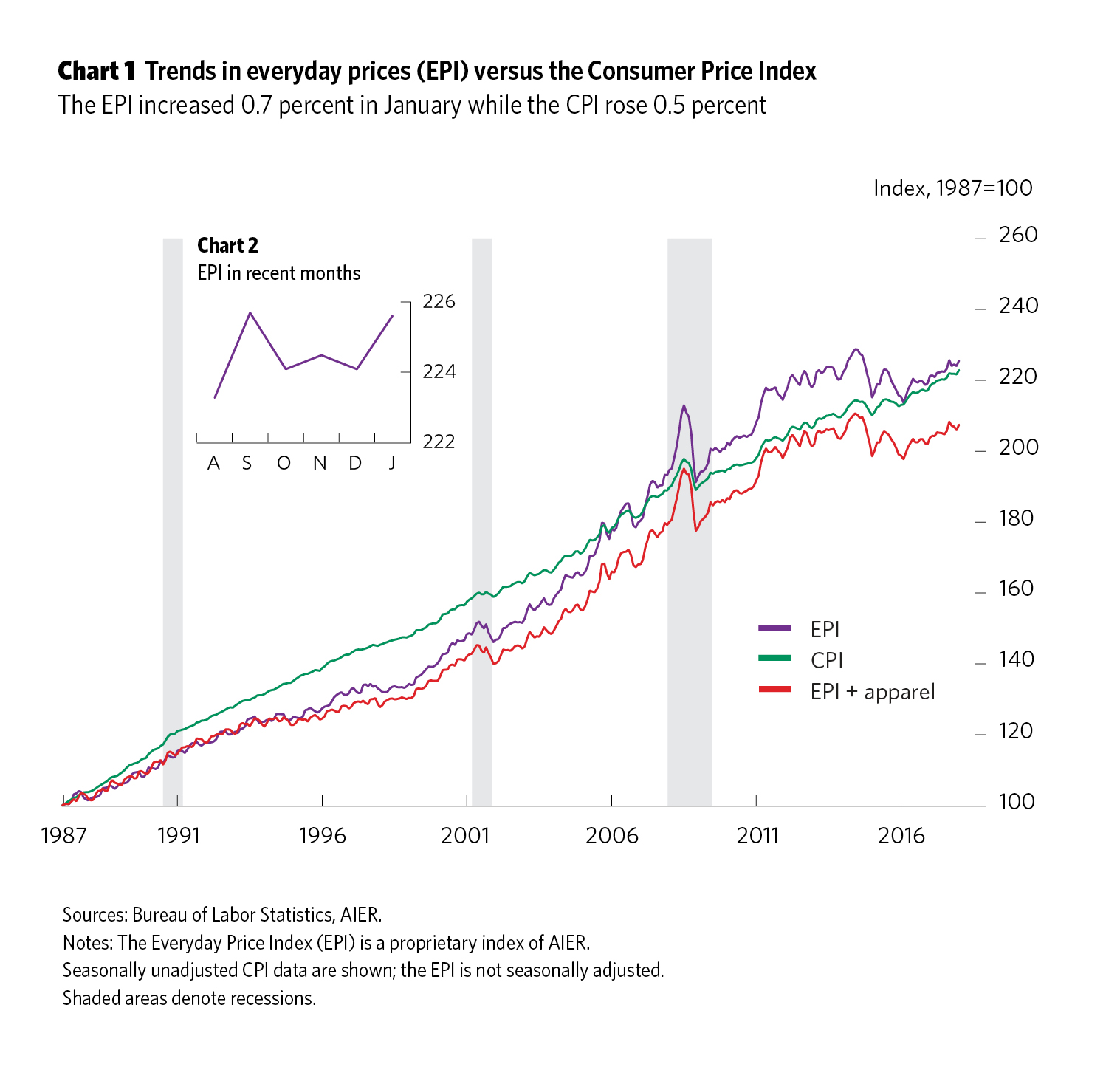

Everyday Prices Start 2018 With a 0.7 Percent Surge

AIER’s Everyday Price Index (EPI) jumped 0.7 percent in January following a 0.2 percent decline in December. The EPI measures price changes people see in everyday purchases such as groceries, restaurant meals, gasoline, and utilities. As a comparison, the more widely known price gauge, the Consumer Price Index, which is reported by the Bureau of Labor Statistics and includes less frequently purchased items, was up 0.5 percent in January. The EPI is not seasonally adjusted, so we compare it with the unadjusted CPI.

The EPI including apparel, a broader measure, also gained 0.7 percent in January as apparel prices rose 1.4 percent for the month. The EPI and the EPI including apparel exclude prices of infrequently purchased, big-ticket items (such as cars, appliances, and furniture) and prices contractually fixed for prolonged periods (such as housing).

Over the past 12 months, the EPI has risen 2.0 percent while the EPI including apparel is up 1.8 percent. For the same period, the CPI is up 2.1 percent. Over the last five years, the EPI is up at an annualized rate of just 0.6 percent, the EPI including apparel is up at an annualized rate of 0.5 percent, and the CPI is up 1.5 percent.

The largest contributors to the January surge were motor fuel and food at home. Motor fuel prices rose 3.2 percent for the month, contributing 0.34 percentage points to the 0.7 percent rise, while prices for food at home rose 0.5 percent and added 0.11 percentage points. Together, these two categories accounted for about two-thirds of the total increase in everyday prices in January.

Energy prices, and prices of motor fuel in particular, are extremely volatile and often drive the month-to-month changes in the EPI and sometimes the CPI. Over the past 20 years, energy prices surged along with the price of crude oil. Crude oil went from $20 per barrel in 2002 to $140 in 2008. Prices briefly plunged during the global recession, falling to $40 per barrel in March 2009. Prices returned to around $100 per barrel by 2014 before collapsing again, retreating to $31 per barrel in early 2016. With crude trading at around $60 a barrel currently, it is well above the $20 territory for much of the 1990s but substantially below the $100 area of the mid-2010s. Significant developments both in energy technology (fracking, horizontal drilling, and alternative energy) and energy policy are likely to drive major shifts in the longer-term trends in crude oil prices while short-term shifts in economic conditions drive short-term volatility.

Increases in prices for food at home (groceries) have been quite tame in recent years, rising 1.0 percent over the past 12 months and just 0.5 percent at an annual rate over the past five years. Big increases in cereals and bakery products as well as fruits and vegetables were the main drivers of the January gain.

The key take-away is that food and energy were the main contributors to increases in everyday prices in January. Outside of food and energy, price increases in the EPI remain extremely modest.