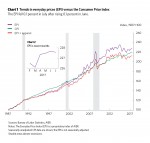

Everyday Prices Drop in July, Trail the CPI

AIER’s Everyday Price Index fell 0.1 percent in July, confirming the message from the Consumer Price Index and Producer Price Index reports: price increases overall remain very modest in the U.S. economy. Over the past 12 months, the EPI has risen just 1.3 percent. The EPI measures price changes people see in everyday purchases such as groceries, restaurant meals, gasoline, and utilities. The EPI including apparel, a broader measure, dropped 0.2 percent in July and is up just 1.1 percent over the past year. Both measures exclude prices of infrequently purchased, big-ticket items (such as cars, appliances, and furniture) and prices contractually fixed for prolonged periods (such as housing).

The more widely known price gauge, the Consumer Price Index, reported by the U.S. Bureau of Labor Statistics, includes less-frequently purchased items and matched the 0.1 percent decline of the EPI on a seasonally unadjusted basis in July but is up 1.7 percent over the past 12 months. The EPI is not seasonally adjusted, so we compare it with the unadjusted CPI. Over the last five years, the EPI has had an average 12-month rise of 0.1 percent compared to an average rise of 1.3 percent for the CPI.

Among the components of the EPI, major declines were reported for telephone services (down 8.9 percent from a year ago), media-rental services (−6.3 percent), internet services (−1.3 percent), and personal-care products (−0.8 percent). Those declines were offset by increases in the prices for audio discs, tapes, and other media products (up 7.7 percent from a year ago), tobacco and smoking products (7.1 percent), cable and satellite services (5.2 percent), prescription drugs (4.2 percent), and fees for lessons and instruction (4.0 percent).

The components with the largest weights in the EPI are food at home (21.2 percent), food away from home (15.6 percent), household fuels and utilities (13.9 percent), motor fuel (9.1 percent), and non-prescription drugs (6.4 percent). Together, they account for 66.4 percent of the EPI. Among these important components, food at home is up just 0.3 percent from a year ago, food away from home is up 2.1 percent, household fuels and utilities are up 3.6 percent, motor fuel is 3.1 percent higher, and non-prescription drugs are 2.3 percent higher than a year ago. Among the 25 categories of items in the EPI, 12 have 12-month changes under 2 percent while 13 are above 2 percent. Seven of the categories have 12-month changes below zero.

Most consumers watch prices, but certain ones, even among everyday purchases, tend to stand out. Food and gasoline prices tend to be volatile and get attention, particularly when prices rise quickly.

Thus many areas of the economy are seeing very modest price increases, and some are experiencing price declines. The key takeaways are that broad-based increases are still not present in everyday prices, and everyday prices are trailing the CPI.