The Hidden Message in the Everyday Price Index

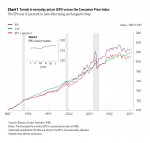

Aggregates can provide a reasonable summary but can also be deceiving. AIER’s monthly Everyday Price Index rose 0.1 percent in June after being unchanged in May. Over the past 12 months, the EPI has risen just 0.9 percent. In aggregate, the performance of the index suggests that price increases are tame, but under the surface lies a range of results. The EPI measures price changes that people see in everyday purchases such as groceries, restaurant meals, gasoline, and utilities.

The EPI including apparel, a broader measure, was unchanged in June after falling 0.1 percent in May. Over the past 12 months, the broader index has increased 0.8 percent. Both measures exclude prices of infrequently purchased, big-ticket items (such as cars, appliances, and furniture) and prices that are contractually fixed for prolonged periods (such as housing).

The more widely known price gauge, the Consumer Price Index reported by the U.S. Bureau of Labor Statistics, rose 0.1 percent on a seasonally unadjusted basis in June and is up 1.6 percent over the past 12 months. The EPI is not seasonally adjusted, so we compare it with the unadjusted CPI.

Within the components of the EPI, prices of household fuels and utilities were the biggest gainer, rising 0.32 percent for the month. That gain was offset by drops in the prices for motor fuel, groceries, and telephone services. All of those categories tend to be fairly volatile and often drive the monthly changes.

More interesting is the lack of significant price increases among the other categories. About one-third of the 26 categories of items in the EPI have had falling prices over the past 12 months and over the past five years, and about 60 percent of the categories have had 12-month and five-year annualized increases below 2 percent.

Components with the fastest price increases include prescription drugs, fees for lessons and instruction, gardening and lawn services, postage and delivery services, tobacco and smoking products, and household fuels and utilities.

Most consumers watch prices, but certain ones, even among everyday purchases, tend to stand out. Food and gasoline prices tend to be volatile and get attention, particularly when prices rise quickly. But many areas of the economy are seeing very modest price increases, and some are experiencing price declines. The key take-away is broad-based increases are not present in everyday prices.