Bicentennial of Ricardo’s “Principles” Relevant to NAFTA Debate

David Ricardo’s classic book extolling free trade turns 200 years old this year. Its rediscovery could do much to improve current trends.

The Trump administration is looking for a new and improved NAFTA 23 years after the agreement went into effect. The negotiations spring from a mindset that free trade is an economic loser for the United States. Ricardo knew better. His “On the Principles of Political Economy and Taxation,” published in 1817, presented ideas that over time enabled England to grow “rich from its liberal policies,” in the words of another famed economist, Ludwig von Mises.

Besides being a successful London stock broker, Ricardo was a member of the British Parliament. Congress could use someone like him today because neither major party has such a vocal free trade advocate. President Trump calls NAFTA a jobs killer and threatens to pull the United States out of the agreement, but that stance elicits no pushback from anyone on Capitol Hill.

The United States has a $60 billion annual trade deficit with Mexico that Trump would like to see lessen or disappear. Likely Ricardo would have focused on the annual $1 trillion in trade among the United States, Canada, and Mexico.

“Under a system of perfectly free commerce, each country naturally devotes its capital and labour to such employments as are most beneficial to each,” Ricardo wrote in his “Principles.” “This pursuit of individual advantage is admirably connected with the universal good of the whole.” Further, “by stimulating industry, by regarding ingenuity, and by using most efficaciously the peculiar powers bestowed by nature, it [free commerce] distributes labour most effectively, and most economically: while, by increasing the general mass of productions, it diffuses general benefit, and binds together by one common tie of interest and intercourse, the universal society of nations throughout the civilized world.”

When’s the last time you heard something like that from the floor of Congress? Our representatives could certainly match Ricardo in verbosity but not in vision.

In the public life of his time, Ricardo was most famous for his opposition to British agricultural protection measures known as the Corn Laws. The laws would cause stagnation of the economy in channeling resources to less productive uses, he argued. Parliament repealed the Corn Laws in 1846, 23 years after Ricardo’s death, with British agriculture becoming more efficient after that, although not without some dislocations.

Today Ricardo is regarded as one of the founding fathers of classical economics, alongside fellow Britons Adam Smith, Thomas Robert Malthus, and John Stuart Mill.

Ricardo’s ideas are present in today’s economics textbooks, although they are often overlooked or little appreciated. His theory of comparative advantage suggests countries mutually benefit from trade by specializing in export goods they can produce at a lower opportunity cost than another country. An example he used was trade in cloth between England and Portugal. This is different than absolute advantage, in which one country can produce more goods than another country.

Economist Eric Chiang explains the idea using a hypothetical, simplified example with an economy consisting of just two commodities, crude oil and silicon chips, produced by the United States and Mexico. “At first glance you might wonder why the United States would even consider trading with Mexico,” Chiang writes in his textbook “CoreMicroeconomics.” “The United States has so much more production capacity than Mexico, so why wouldn’t it just produce all of its own crude oil and silicon chips? The answer lies in comparative advantage.”

Through some simple mathematics that identify opportunity costs, it becomes apparent that Mexico has a comparative advantage in oil production and the United States has a comparative advantage in making silicon chips. His example demonstrates that the United States can produce not just more silicon chips but more oil than Mexico.

“The two countries can engage in trade to their mutual benefit,” Chiang writes. “As long as relative production costs differ between countries, specialization and trade can be mutually beneficial, allowing all countries to consume more.” As the economies of trading partners become more equalized in size, the benefits of their comparative advantages grow, most economists say.

Some economists point to one of the conditions posited by Ricardo: that capital must be immobile for comparative advantage to work as theorized. Increased mobility of capital in today’s world can lead to offshoring and job losses. Thus some economists say comparative advantage does not necessarily apply to the contemporary economy. But global trade continues to expand. If comparative advantage is no longer operative it’s hard to imagine how this expansion would be taking place.

NAFTA hasn’t been without a downside. Some U.S. jobs have gone to Mexico because of lower production costs. Industries suffering comparative disadvantage often have to limit production and/or cut workers.

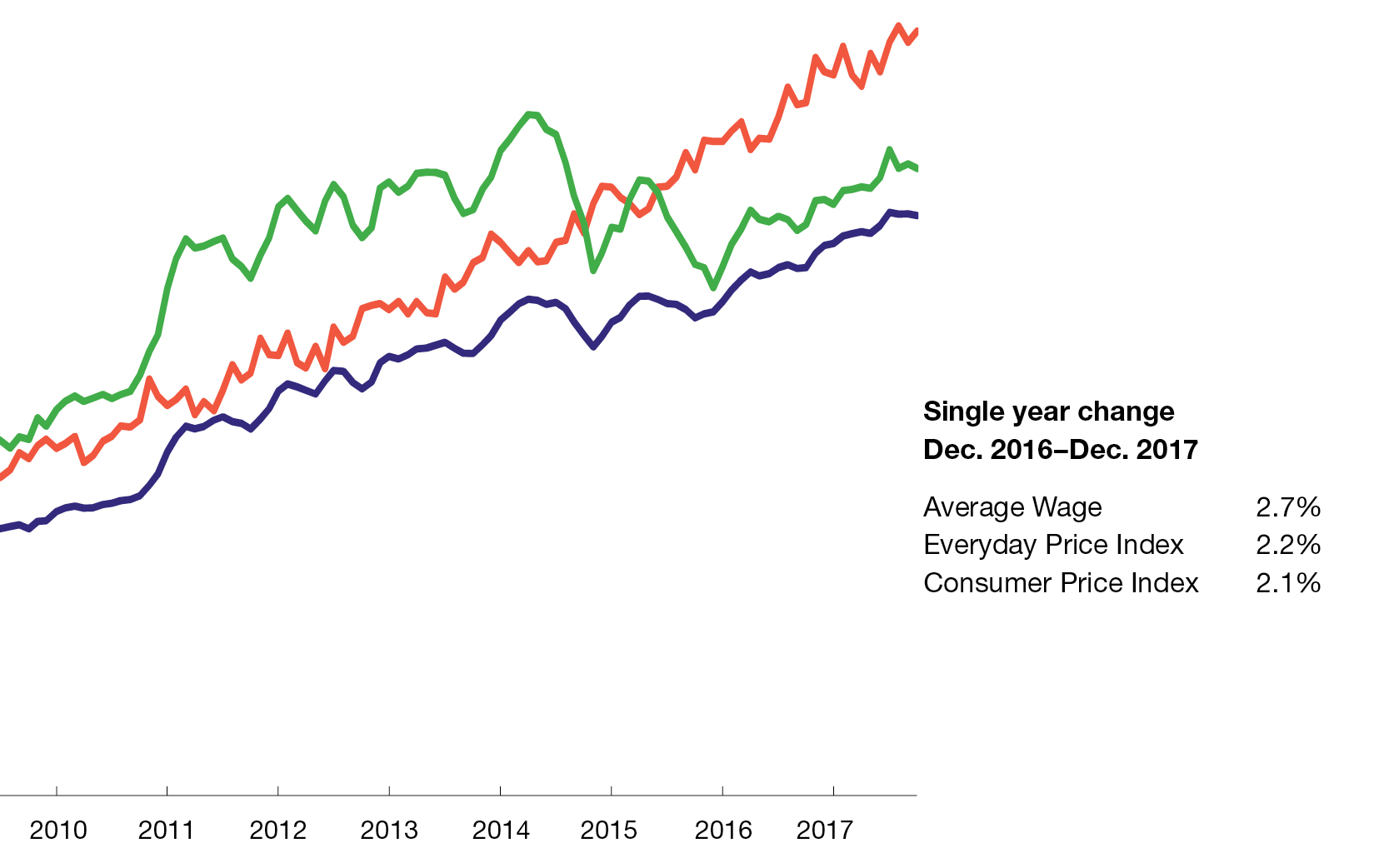

But NAFTA has worked to the overall betterment of the U.S. economy, with the low unemployment rate helping make the case. Writes Chiang: “By opening up more markets for U.S. products … NAFTA did stimulate economic growth, such that retrained workers may end up with new and better jobs.”