Auspicious Start to 2014

Our research, led by our Business-Cycle Conditions (BCC) indicators, suggests that the current economic expansion is likely to continue through early 2014. But vigilance is warranted: Changing economic conditions might be signaled in advance by activity in several areas. AIER researchers have identified six in particular that are well worth watching.

Strong Finish to 2013

Last year saw both many positive developments for the U.S. economy and a number of setbacks. On the positive side, GDP grew at an annual rate of 2.6 percent over the first three quarters of the year, including a strong 4.1percent reading for the third quarter.

More than 2 million new jobs were created, helping to lower the unemployment rate to 7%, the lowest since 2008.

Finally, rising home and equity prices helped push household net worth back up to a record high.

On the negative side, Americans remain disappointed in the political system, according to recent polls by The Wall Street Journal/NBC News. Washington policymakers have lost public esteem following the mid-year budget and debt-ceiling debacle, the temporary government shutdown, and the flawed rollout of the Affordable Care Act (ACA, or “Obamacare”) health care insurance exchanges.

Monetary policymakers have drawn their share of criticism as well. The Fed’s initial discussions about QE (quantitative easing) tapering over the summer provoked a harsh response from bond markets. Then failure to follow through with expected tapering action in September was perceived as a communications gaffe.

Government foibles notwithstanding, the private economy appears to have gained momentum in late 2013, with constructive progress made on several fronts.

Economic data on employment, consumer spending, industrial production, and inflation all beat expectations. The positive economic data was reflected in AIER’s Business-Cycle Conditions indicators, which registered strong readings for the fifth month in a row.

Congress managed to put together a budget deal (though a battle over raising the federal debt ceiling remains to be settled), the Fed began the QE tapering process without precipitating a market crisis, and equity markets closed the year with the S&P 500 at 1848.36 – an all-time high.

In aggregate, these develop-ments indicate that 2014 is starting off with positive momentum. They lend solid support to our expectations for improving economic conditions and continued expansion in 2014.

BCC Indicators Look Promising

December is the third consecutive month of across-the-board 100 percent readings for the primary leading, coincident, and lagging indicators in our Business-Cycle Conditions index.

The cyclical score for the leading indicators, derived from a separate mathematical analysis, came in at a strong 86-out-of-100 reading in the latest month—though that is down slightly from 91 in the prior month (Chart 1).

Key takeaways from the latest readings of AIER’s BCC indicators include:

Leading: Among the leading indicators, ten out of ten with discernible trends were positive in December. An impressive four of those ten hit new highs in December: the index of common stock prices, the yield curve index, the average workweek in manufacturing, and new orders for consumer goods.

Coincident: All six of our coincident indicators show positive trends, resulting in a perfect 100 reading for the 24th month in a row. Four of the six registered new highs in December: nonagricultural employment, the index of industrial production, manufacturing and trade sales, and gross domestic product.

Lagging: AIER’s index of lagging indicators posted its 20th straight month of perfect 100 readings. Among the individual indicators, December marked new highs for both manufacturing and trade inventories and ratio of consumer debt to income.

In aggregate: Ten of our 24 indicators hit new highs last month. Taken together, the AIER cyclical indicators point to strong economic momentum and suggest continued economic expansion in early 2014.

Consensus Outlook Considerably Improved

On December 17 and 18, the Federal Reserve’s FOMC (Federal Open Market Committee) met for the final time in 2013. The big surprise of the meeting was the implementation of QE tapering, the process of winding down the Fed’s $85 billion per-month purchase of Treasury bonds and mortgage-backed securities.

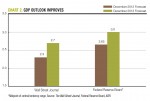

In addition, the FOMC provided updated economic projections from the Board members and twelve Federal Reserve bank presidents. While the projections given at the December meeting were little changed from those released in September, they are significantly higher than the projections of the previous December—a sign of the progress made during 2013. In December 2012, the current-year projections called for 1.7 percent to 1.8 percent GDP growth, with one-year-ahead estimates of 2.3 percent to 3.0 percent. On December 18, 2013, FOMC members projected current-year GDP growth of 2.2 percent to 2.3 percent and one-year-ahead growth of 2.8 percent to 3.2 percent, all well ahead of last year’s estimates.

Private-sector forecasters also have boosted their projected GDP growth rates. According to The Wall Street Journal, in December 2012, private forecasters were expecting current-year GDP growth of 1.9 and one-year-ahead growth of 2.3 percent. The December 2013 survey showed that private-sector forecasters had revised their GDP outlook to 2.1percent for the current year and 2.7 percent for

the following year (Chart 2 above).

Both Fed and private-sector forecasts are consistent with AIER’s expectations for continued economic growth and generally improving economic conditions—expectations based in part on our well-established BCC indicators.

Six Areas We’ll Be Watching in 2014

While our positive outlook for the U.S. economy in 2014 is supported by our BCC indicators, risks to the outlook remain. Though it’s impossible to know where the next surprise will come from, we have identified six key areas that we believe may be particularly important to the outlook.

1. Fed tapering, interest rates, and credit markets. Now that the Fed has begun tapering its securities purchases, there is somewhat less uncertainty surrounding monetary policy. However, questions remain. How will new leadership at the Fed impact policy? How will the pace of tapering progress, especially with the Fed emphasizing that continued tapering will be data-dependent and not tied to a set schedule? Market reaction to the start of tapering was muted, partially due to the events of last summer and partially due to Fed indications that they intend to keep interest rates low for a longer time than previously indicated. However, if over the coming months, bond markets react more harshly to additional tapering moves, there’s risk that the resultant higher interest rates could slow housing, capital investment, and durable-goods spending – and put downward pressure on equity markets as well.

2. Housing. Housing activity has been trending higher since the recession ended. Home sales are near the 5 million annual rate level. That’s consistent with levels seen in prior expansions, though well below those seen during the housing bubble years (2003-2006). New-home construction is picking up, and more optimism can be seen in surveys of homebuilders. Finally, home prices are rising, helping boost household net worth. Additional gains in household net worth would help sustain consumer spending and housing activity, both of which may be important contributors to stronger economic growth.

3. Energy. Energy may play a crucial role in the U.S. economy in two ways during 2014:

As a major consumer of energy products, the U.S. economy is susceptible to energy price swings. Energy prices can have a significant role in directing purchasing power. Higher energy prices necessarily divert resources from other spending and can impact both consumer confidence and business investment plans, while lower energy prices can boost spending and saving. Though a late-1970s-style energy crisis seems unlikely at this stage, the impact of energy price swings can range from significant to catastrophic.

America’s role as an energy producer is gaining in importance. Combined, the U.S. energy exploration, extraction, transportation, and refining industries are a growing source of jobs, revenue, profit, and taxes. Additionally, the benefits to U.S. companies of low-cost energy, particularly natural gas, can be a significant source of global competitive advantage for a range of industries from petrochemicals to smelting to manufacturing. That advantage can lead to higher profits and accelerating job growth.

4. Capital spending. Accelerating economic growth, rising utilization rates, intense competition, a low cost of capital, and improving business confidence are typically the necessary ingredients for a new capital investment cycle. After contributing significantly to GDP growth in 2010, 2011, and the first half of 2012, capital investment in equipment has been weak or negative in four of the last five quarters. A new investment cycle could be one of the supports for accelerating growth in 2014. On the other hand, continued weakness could indicate a slowing economy.

5. Profit margins. Whether measured from the National Income and Product Accounts (NIPA) that produce the GDP estimates or from the income statements of publicly traded companies, profit margins in the U.S. are near record-high levels. Despite the worst recession in decades, global economic weakness, persistently high energy prices, weak pricing power, policy uncertainty, and regulatory scrutiny, U.S. business have maintained exceptionally high profit margins. With labor markets tightening and labor costs almost certain to rise, it will likely become more difficult to maintain such high margins. Improved productivity may be one offset, particularly if capital investment picks up; but pressure on profit margins seems inevitable. The questions are: How much pressure will there be, and what are the implications?

Among the possible implications: Equity market prices could fall, causing a drop in household wealth and a slowdown in consumer spending; companies may slow hiring; and/or companies may try to force through price increases, boosting inflationary pressures. How companies respond to shrinking profit margins could be critical to the outlook for growth and inflation in 2014. We will cover our outlook for inflation in our next Inflation Report.

6. Debt demand and credit growth. “Money printing” by the Fed can neither boost the economy nor create inflation unless that money finds its way into the economy. Right now, most of the money created by the Fed remains out of circulation in the form of reserves on the balance sheets of banks. Credit growth has been extremely weak despite the Fed’s efforts, for a number of possible reasons: a lack of desire by banks to lend, the persistence of overly restrictive lending standards, a dearth of credit-worthy borrowers, a lack of demand for credit by qualified borrowers, or some combination of those factors. The severity of the last recession was due in part to the excessive debt built up by consumers and some parts of the financial system. Deleveraging—paying down debt—by both has progressed significantly, and may be coming to an end; but until there is some acceleration in consumer and business borrowing, U.S. economy growth is likely to be restrained.

Wind in the Economy’s Sails For Now

The new year is starting with solid positive momentum behind the U.S. economy. Our BCC indicators are strong; consensus expectations have improved; and some policy risks have diminished. Nevertheless, key areas deserve special attention. Our focus will be on monitoring developments for signs of accelerating or decelerating growth in 2014 and sharing our findings with our readers.

[pdf-embedder url=”https://www.aier.org/wp-content/uploads/2014/01/BCC20140106.pdf“]