Cost-of-Living Adjustment Likely to Be Small

Retirees are likely to see a positive but very small cost-of-living adjustment in their Social Security benefits next year. When the 2017 adjustment is announced on Oct. 18, we forecast with 90 percent confidence that it will increase between 0.2 percent and 0.5 percent. While Social Security benefits will increase, since there was no cost-of-living jump in 2016, the amount will be the smallest since the Social Security Administration began automatic annual adjustments in the mid-1970s.

Our forecasted increase for the cost-of-living adjustment would add between $2 and $6 to the average Social Security beneficiary’s monthly check, less than the increases they saw in most recent years. The average adjustment since 2000 has been 2.3 percent, which would have added $28 a month at current average benefit levels. Overall, however, this year’s small increase is not necessarily bad news for beneficiaries, as it reflects extremely low inflation over the past year. Whether a beneficiary comes out ahead or behind depends on individual spending patterns, as we will show.

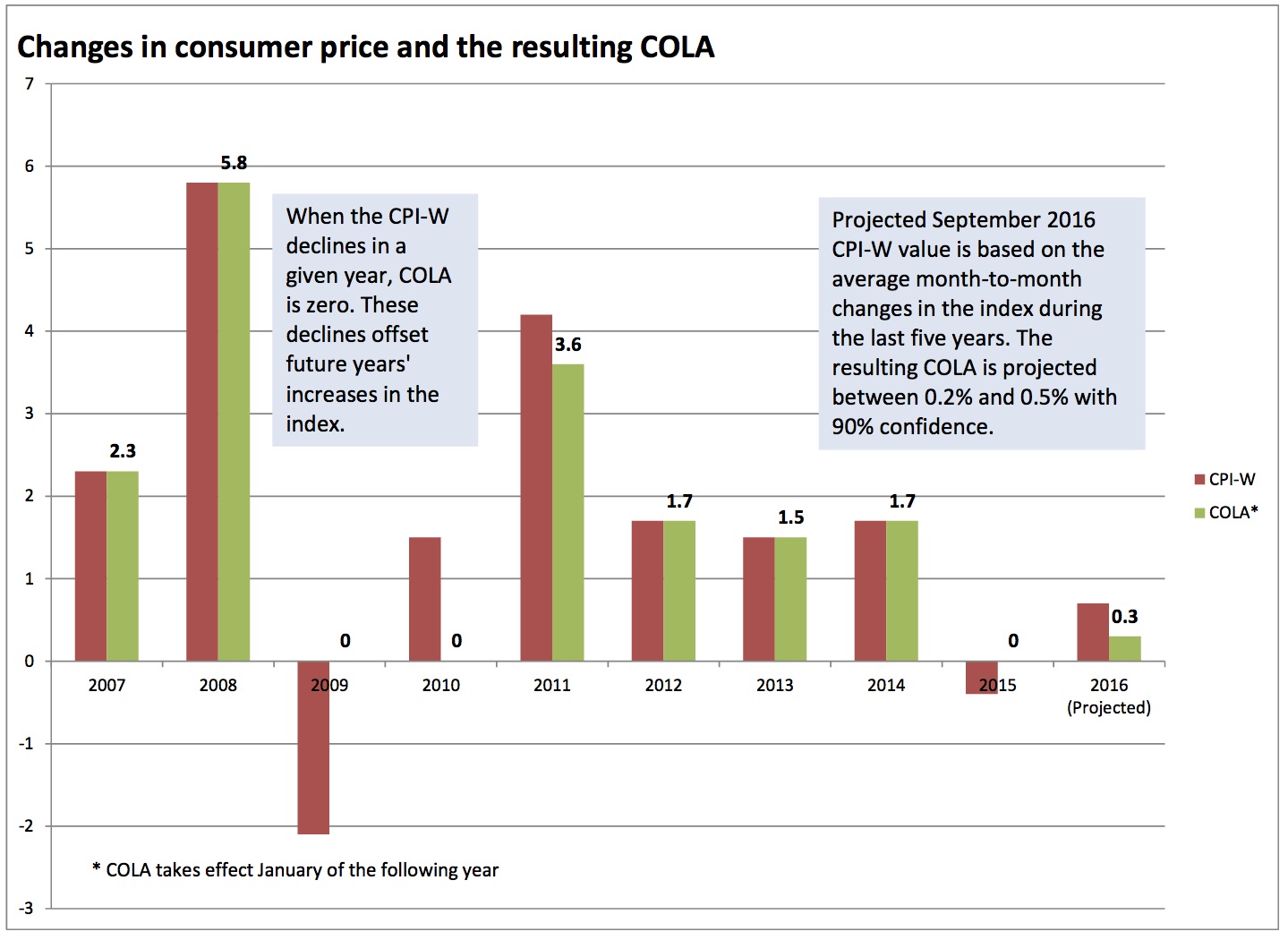

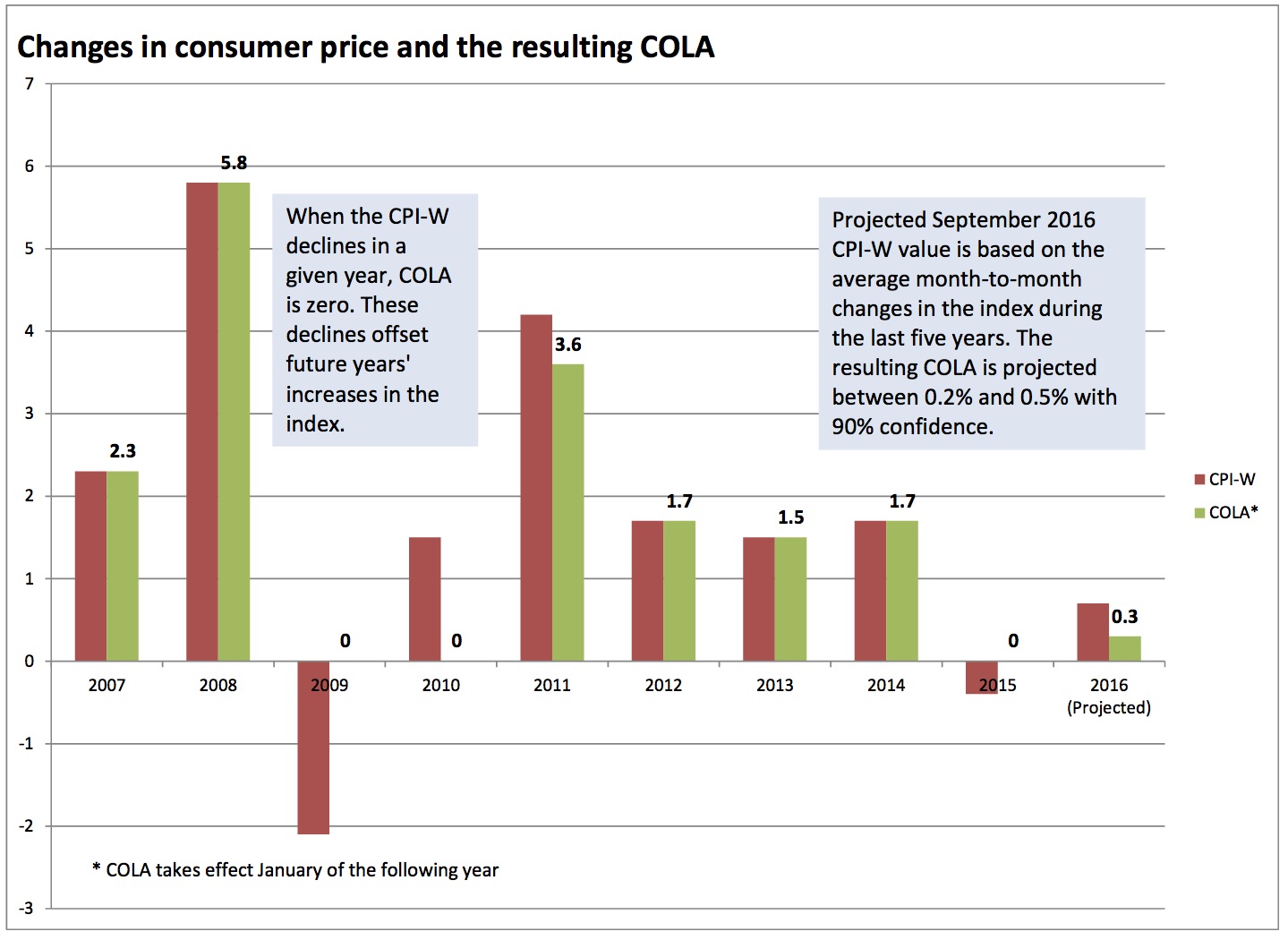

The Social Security Administration calculates the cost-of-living adjustment using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The COLA equals the percentage change in the monthly average of the index for the third quarter of the current year compared with the third quarter of the previous year. The cost-of-living adjustment is announced when the CPI-W for September, the final data point, becomes available.

When the CPI falls, as it did from 2014 to 2015, the cost-of-living adjustment is set to zero. However, such decreases offset the increases in the index in following years. Because the third quarter average CPI-W fell by 0.4% from 2014 to 2015, that amount will be subtracted from this year’s increase when the cost-of-living adjustment is calculated.

We forecast the final September data point by calculating the range of likely changes in the CPI-W from its value in August. Using the history of month-to-month changes in the index over the past five years, we have determined that with 90 percent likelihood, the September CPI-W will increase 0.6 percent and 0.9 percent over the third quarter of 2015 (potential values outside this range in recent history would not vary enough to significantly change the conclusions of this analysis). After applying the 0.4 percent offset from the previous year, we arrived at our projected range for the COLA of 0.2 percent to 0.5 percent. Chart 1 shows the CPI-W and resulting cost-of-living adjustments for the past ten years.

No index perfectly captures changes in the cost of living, especially as peoples’ habits vary. Other common price indices have changed this year in a manner broadly consistent with the CPI-W. As of August, both the CPI-U, typically used as the baseline index for inflation, and the CPI-E, an experimental index intended to reflected spending habits of Americans ages 62 and older, had 12-month increases of 1 percent. While these were slightly higher than the CPI-W, the difference is not great enough in the current year to question whether the CPI-W understates changes to Social Security beneficiaries’ costs of living.

Whether individual beneficiaries win or lose this year depends on their household spending patterns. The Bureau of Labor Statistics reports that the cost of health-care services has increased 5.1 percent since August 2015. To the extent that many Social Security beneficiaries spend more of their money on health care than the average American, this year’s COLA may not keep pace with actual living costs. However, energy prices decreased 9.2 percent during the same period, so beneficiaries who drive more than average may come out ahead.

The cost-of-living adjustment also plays a role in determining premiums for Medicare Part B, which covers services such as doctor visits, preventative care, and lab tests. The hold-harmless provision, which applies to about 70 percent of beneficiaries (excluding high-income individuals,those who continue to work and delay social security benefits beyond retirement age, those qualifying for Medicaid), caps annual increases in premiums, so Social Security checks cannot decrease year-to-year. (Medicare fees are deducted directly from Social Security checks for most beneficiaries.) The provision effectively limits premium increases to the dollar amount of the COLA, meaning that for most beneficiaries, this year’s Medicare premium increase can only be very small. However, wealthier beneficiaries and those working past retirement age are likely to take a hit due the very small cost-of-living adjustment. The hold-harmless provision means that any increases in Medicare premiums must be concentrated in these two groups. In June, the Wall Street Journal predicted a 22% rise for those not covered by the hold-harmless provision, although in previous years Congress has stepped in to prevent the largest increases in premiums. We provide a more detailed explanation of the role of the COLA in Medicare in our 2015 report.