Bitcoin’s system of radically decentralized governance is facing perhaps the biggest test in the digital currency’s history. As my colleague Patrick Coate described, the code used to run Bitcoin’s blockchain database needs to be updated to transmit mor …

READ MOREAIER’s monthly Everyday Price Index rose 0.6 percent in April led by price increases at grocery stores and gas stations. The EPI measures price changes that people see in everyday purchases such as groceries, gasoline, utilities, and personal-care prod …

READ MOREIt’s not systemic reform, but the Federal Reserve’s recent indication of climbing down from its $4.5 trillion balance sheet is being met with at least half smiles by free market economists. Release of the March minutes from the Federal Open Market Comm …

READ MOREMove over, Al Gore. Joseph Schumpeter is the real inventor of the internet. Harvard University Professor Shane Greenstein has put Schumpeter’s “creative destruction” concept at the center of his book “How the Internet Became Commercial: Innovation, Pri …

READ MOREThe career of Carl Schurz (1829–1906) illustrates the transformation of American liberalism from a philosophy of limited government to one that provided the beginnings of a welfare/warfare state. It was a model that Americans now take for granted. Schu …

READ MOREGlass-Steagall’s separation of commercial and investment banking was a solution in search of a problem.

READ MORESince taking office in January, President Trump has cancelled 13 regulations issued by Obama administration agencies thanks to a hitherto rarely used law Congress passed over 20 years ago. Congress and the president could potentially cancel thousands of other rules the same way.

READ MOREAmericans spend $400 billion dollars per year to comply with the tax code. Americans also dedicate 9 billion hours of labor to comply with the current tax code. Beyond costly compliance, the current tax code distorts investment and work decisions in the economy. Something needs to be done to simplify the tax code and make it pro-growth.

READ MOREWhen people refer to the national debt, they almost always mean the debt owed by our government. But there are actually two important types of debt in the American economy: government debt, and private debt owed by households and businesses.

READ MORE

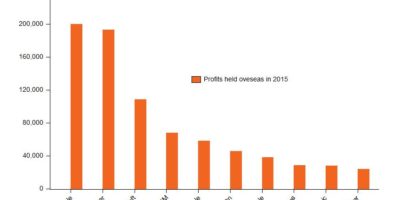

House Speaker Paul Ryan recently proposed a tax plan called A Better Way: A Vision for a Confident America. Ryan’s plan to make the United States more competitive includes a tax cut for businesses, a switch to a territorial tax system, and a border-adjustment tax. A tax cut and a switch to a territorial system would be positive for the economy. On the other hand, the border-adjustment tax would work like a tariff. It would encourage inefficient domestic production, which would raise prices and reduce real output. Over the long run the BAT would not even reduce the trade deficit.

READ MORE“Nothing is so permanent,” said Milton Friedman, “as a temporary government program.”

READ MORE

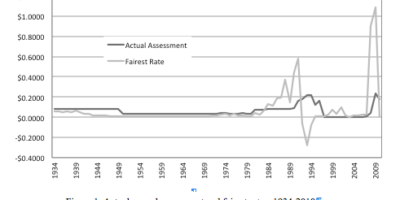

Many economists have argued that government mortgage programs and low interest rates policies caused the 2008 financial crisis. We maintain that government deposits insurance, provided in the United States by the Federal Deposit Insurance Corporation (or FDIC), may have also been a contributing factor. By failing to price risk fairly, the FDIC encourages banks to increase their risk-taking activities.

READ MORE250 Division Street | PO Box 1000

Great Barrington, MA 01230-1000

Press and other media outlets contact

888-528-1216

press@aier.org

This work is licensed under a

Creative Commons Attribution 4.0 International License,

except where copyright is otherwise reserved.

© 2021 American Institute for Economic Research

Privacy Policy

AIER is a 501(c)(3) Nonprofit

registered in the US under EIN: 04-2121305