Charitable Remainder Unitrusts (CRUs)

The donor may also stipulate that distributions are to be up to “income only,” with or without a further stipulation that any shortfall of actual income received by the funds from the fixed percentage be “carried forward,” and be available for distribution in subsequent years in which the actual income is in excess of the fixed percentage.

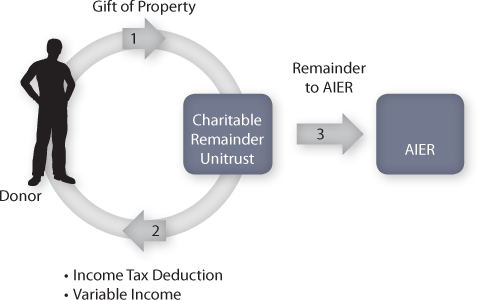

How CRUs work:

- You transfer cash, securities, or other property to a Charitable Remainder Unitrust.

- You receive an income tax deduction and pay no capital gains tax. During its term, the trust pays a percentage of its value each quarter to you or to anyone you name.

- When the trust ends, its remaining principal passes to benefit AIER.

The trustee of a CRU need not be AIER itself (although most of our donors have requested AIER to serve as trustee).

Call the Planned Giving Office at 413-528-1216 x3153

or email pgo@aier.org for more information.