New York Fed Manufacturing Survey Plunges in March

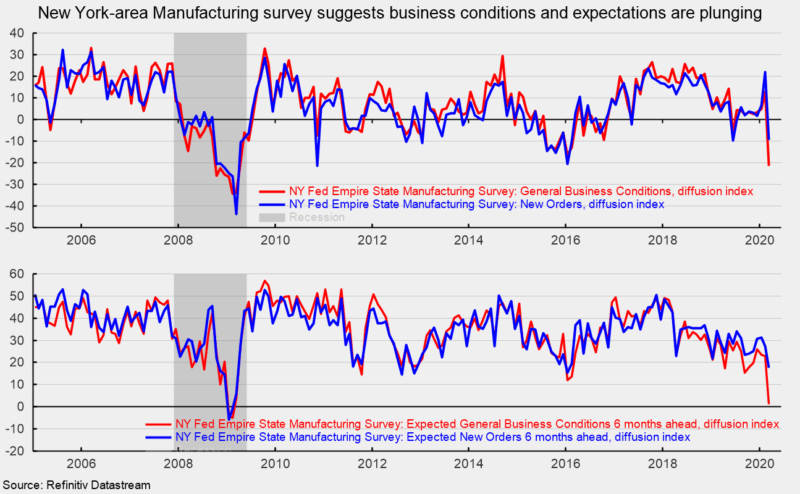

The Empire State Manufacturing Survey from the New York Federal Reserve shows general business conditions deteriorated sharply in March with the index posting a record 34.4-point drop to a -21.5 percent reading versus 12.9 in February. That is the lowest result since 2009 (see top chart).

Among the key components, the New Orders Index sank 31.4 points to -9.3, the largest drop since a 31.8-point fall in November 2010 (see top chart). The shipments index was -1.7 percent in March, down from 18.9 in February and the lowest level since 2016.

The number of employees index fell to -1.5 percent in March, down from 6.6 in February while the average workweek index fell to -10.6 from -1.0. The delivery time index came in at 2.2, down from 8.3 in February and the unfilled orders index fell to 1.4 from 4.5 in the prior month.

The prices paid index was roughly unchanged, coming in at 24.5 versus 25.0 in the prior month but the prices received index dropped to 10.1 from 16.7 in February.

Among the forward-looking indexes (questions asking about expectations six months ahead), the general business conditions index fell to 1.2 from 22.9, hitting the lowest level since February 2009 during the last recession (see bottom chart). Expectations for new orders also fell, with the index losing 9.9 points to 17.6 from 27.5 in February. The March result is the lowest since January 2016 (see bottom chart).

The indexes for future shipments, delivery times, prices paid, prices received, number of employees, average employee workweek, capital expenditures, and technology spending all had declines in March. The indexes for future unfilled orders was roughly unchanged while the index for future inventories rose 14.1 points to 5.8.

Today’s report from the New York Fed suggests New York-area manufacturers have turned sharply less optimistic. The survey was conducted between March 2 and March 10 and likely reflects the impact of the COVID-19.