What’s Up With the $1 Coin?

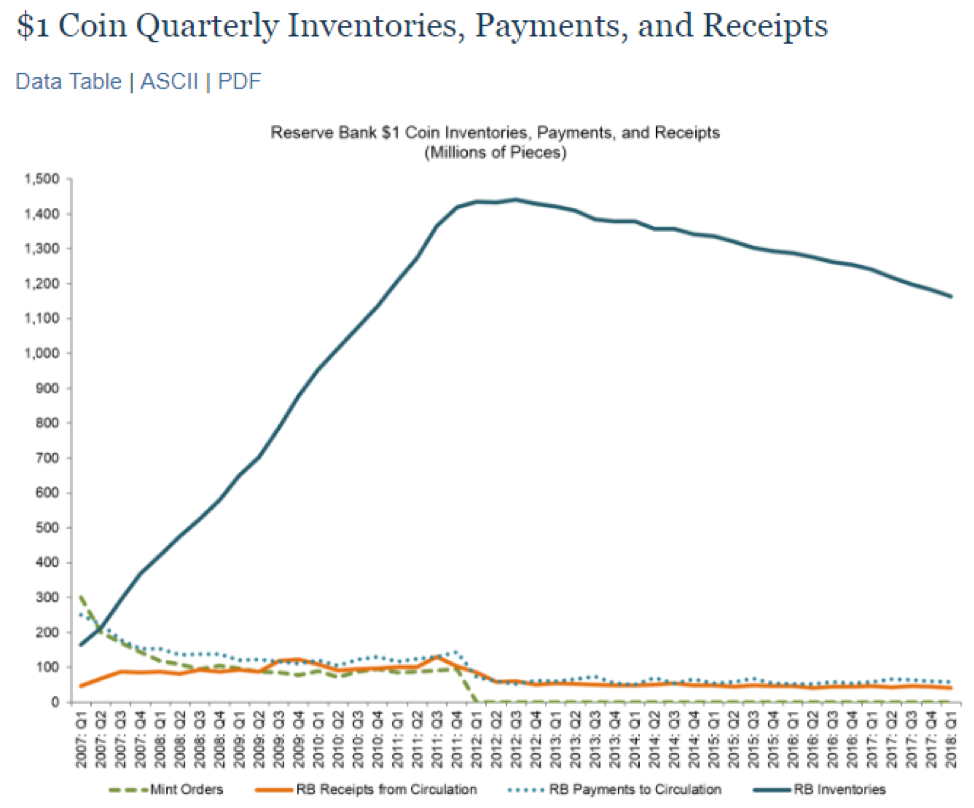

A few days ago, I stumbled upon the following chart. It shows inventories of $1 coins held at the Federal Reserve, which currently clock in at a ridiculously high 1.16 billion coins.

Source: Federal Reserve

The attempted introduction of $1 coins into circulation probably stands out as one of the United States’ greatest monetary failures of the last few decades. The Eisenhower dollar (produced 1971–78), the Susan B. Anthony dollar (1979–1981; 1999), the Sacagawea dollar (2000–1; 2009–11), and the Presidential dollar (2007–11) have all failed to gain wide circulation.

Whereas other countries have successfully introduced $1 coins by simultaneously removing the paper version of the denomination, thus forcing adoption, each $1 coin issue has always faced the unpleasant prospect of competing directly with the incumbent $1 banknote. The political will to issue a $1 coin while removing the $1 bill just hasn’t been there. It is a general rule that Americans prefer paper notes to coins of the same denomination.

Paper is lighter and more convenient. The result has been that any $1 coin that gets put into circulation tends to be quickly rejected. Individuals who receive it as change quickly bring the coin back to their banks, the banks in turn trucking these coins back to the Federal Reserve. Huge amounts of $1 coins have accumulated in Fed vaults, as described by NPR here.

As the chart above shows, the Fed is currently stuck with 1.16 billion of these coins, most of this amount having been built up between 2007 and 2011 as it mass-produced the Presidential series of coins to meet a demand that never emerged. This hoard is being withdrawn at a glacial rate of about $40–$60 million per year. At that rate, inventories won’t be exhausted for another 23 years, sometime in the early 2040s. Although Americans don’t much like the $1 coin, dollarized nations like Ecuador, which has adopted Sacagawea dollars, do and are probably responsible for a significant part of this drawdown in inventories.

The co-circulation of $1 coins and banknotes is a waste to society. Two items needlessly fulfill the same function with one doing a very poor job of it, necessitating a doubling up of fixed costs to support both. Many people think the $1 bill should be the unlucky one to be canceled, as has been the case in places like Australia, Canada, and New Zealand. But this may not be a good idea. Because the two instruments have circulated in competition with each other for decades, Americans have had a sufficiently long time to sample both, and they have consistently chosen the bill over the coin. Overriding the customers’ choice by forcing the $1 coin on them seems presumptuous.

Coins have typically been advertised as the cheaper of the two instruments because their longevity means they needn’t be replaced as often as notes. A lower resource cost would mean the taxpayer is made better off. A 2013 Federal Reserve study puts this claim to rest. The Fed found that if the life of the $1 bill is greater than 4.75 years, then it is the more efficient instrument to produce. Any lifespan less than 4.75 years and coins are optimal. At the time of the study, the $1 bill had a life of 5.9 years (it has probably lengthened since then), giving it the win.

Since Americans prefer $1 notes, and the $1 note is more efficient, it only seems logical that monetary authorities should consider scrapping the $1 coin program altogether. The cherry on top is that all the metal locked away in Fed vaults could be put to better use. Each $1 coin contains 7.2 grams of copper, 0.5 grams of zinc, and some manganese and nickel. At today’s prices, this amounts to around five cents’ worth of metal in each coin. Put differently, the Fed’s hoard of 1.16 billion $1 coins embodies around $55 million worth of metal. (I used this resource for my calculations.)

Rather than keeping that metal inert in the Fed’s vaults for the next few decades, why not just melt it down now and sell it, the proceeds to be invested in something useful? Coins are bulky, so along with the benefits of investing the $55 million, the taxpayer would enjoy ongoing savings on storage and security costs. As far as monetary reforms go, the $1 coin’s removal may not be very flashy, but it seems like a no-brainer.