Two Factors That Could Tip the Economy

The U.S. economy remains in slow growth mode, with a reasonably low risk of recession in the next six to 12 months, but there are growing reasons for caution, according to the new February edition of Business Conditions Monthly, out today from the American Institute for Economic Research.

“While the risk of recession is still reasonably low, continued mixed performance by a wide range of economic data suggests a somewhat fragile future,” according to the report, which measures January data.

Those contradictions, the report notes, include a lackluster fourth quarter gross domestic product in the face of weak global growth and commodity-related industries, but a brightening labor picture.

Amid this backdrop, it is worth keeping an eye on two closely related measurements as possible harbingers of a recession, according to the report’s lead author, Bob Hughes.

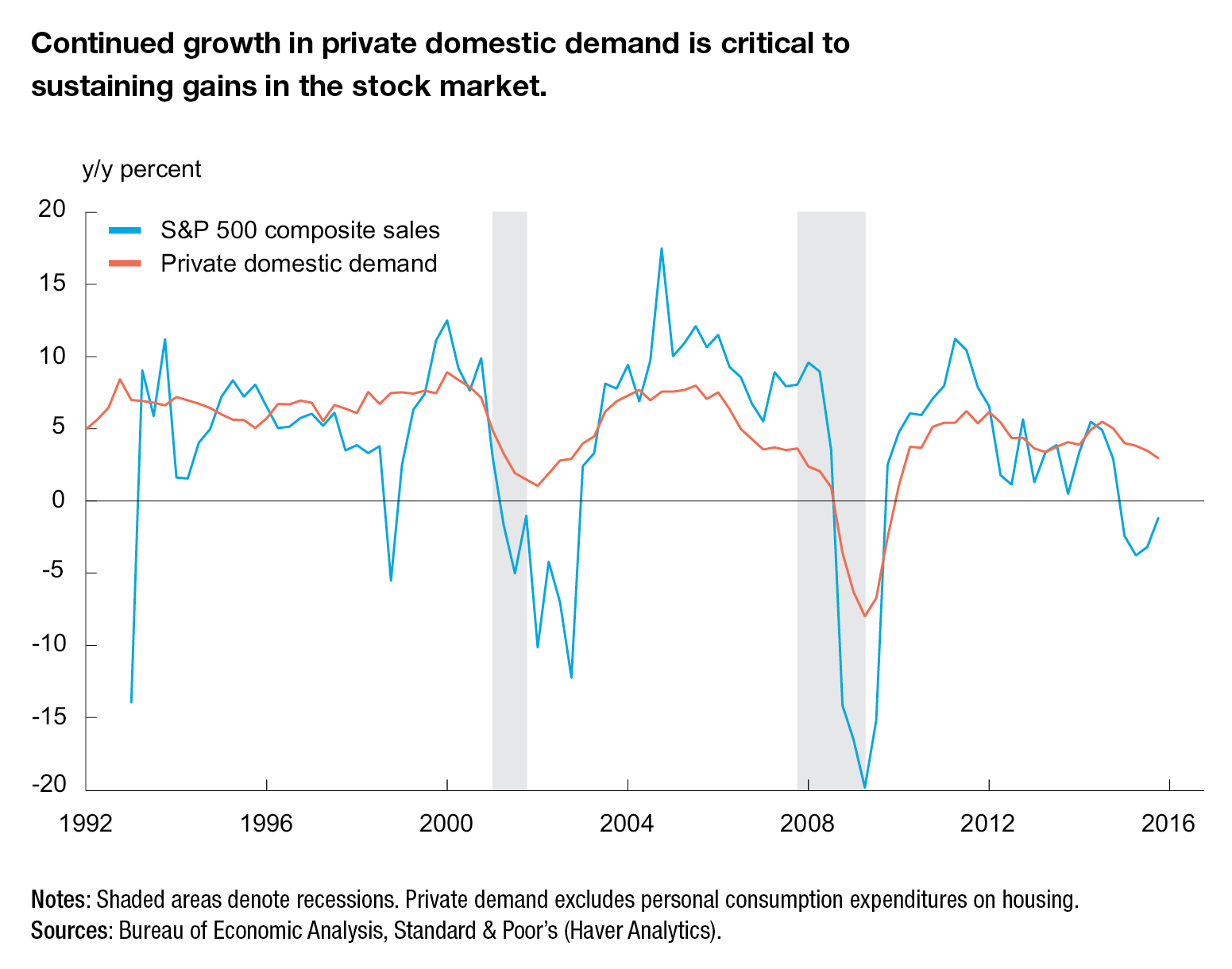

One of those areas is private domestic demand, which includes consumer spending and private investment. That will help inform the second factor we are watching: quarterly corporate earnings.

Among our leading indicators in January, the U.S. consumer continued to push the economy forward on the strength of favorable trends for real new orders for consumer goods, housing permits, retail sales, and the yield curve, Hughes said.

Those helped make January the 77th consecutive month in which AIER’s leading indicators indicate a low risk of recession. For this edition, 54 percent of our leading indicators were on an upward trend in January, unchanged from December. A reading of below 50 percent may indicate an increased chance of a future contraction in the economy.

But, “the outlook remains fragile given the strong crosscurrents affecting various parts of the economy,” according to the report.

Those crosscurrents include negative trends in areas like real new orders for core capital goods, and the ratio of manufacturers’ sales to inventories. The poor performance by core capital goods likely reflects the impact of energy and commodity price declines, Hughes said.

Continued growth in private domestic demand “will likely be critical to sustaining both broader economic activity and top-line sales gains for publicly traded U.S. companies,” according to the report.

So we are keeping a close eye on fourth quarter corporate earnings reports. Thus far, with about 40 percent of the S&P 500 reporting, earnings have been mixed, with big declines in energy and materials sectors offsetting solid gains in consumer discretionary, financials, health care, and telecommunication services. Most other sectors had small changes.

According to the report: “As companies experience strong, consistent profit growth, confidence in the outlook for future sales and earnings improves, supporting hiring increases. However, the reverse can also be true. Should sales and earnings growth slow or decline, companies can lose confidence in the outlook and often reduce hiring and increase job cuts.”

The entire report is available to the public. You can read the report here.