Should the U.S. Issue Supernotes?

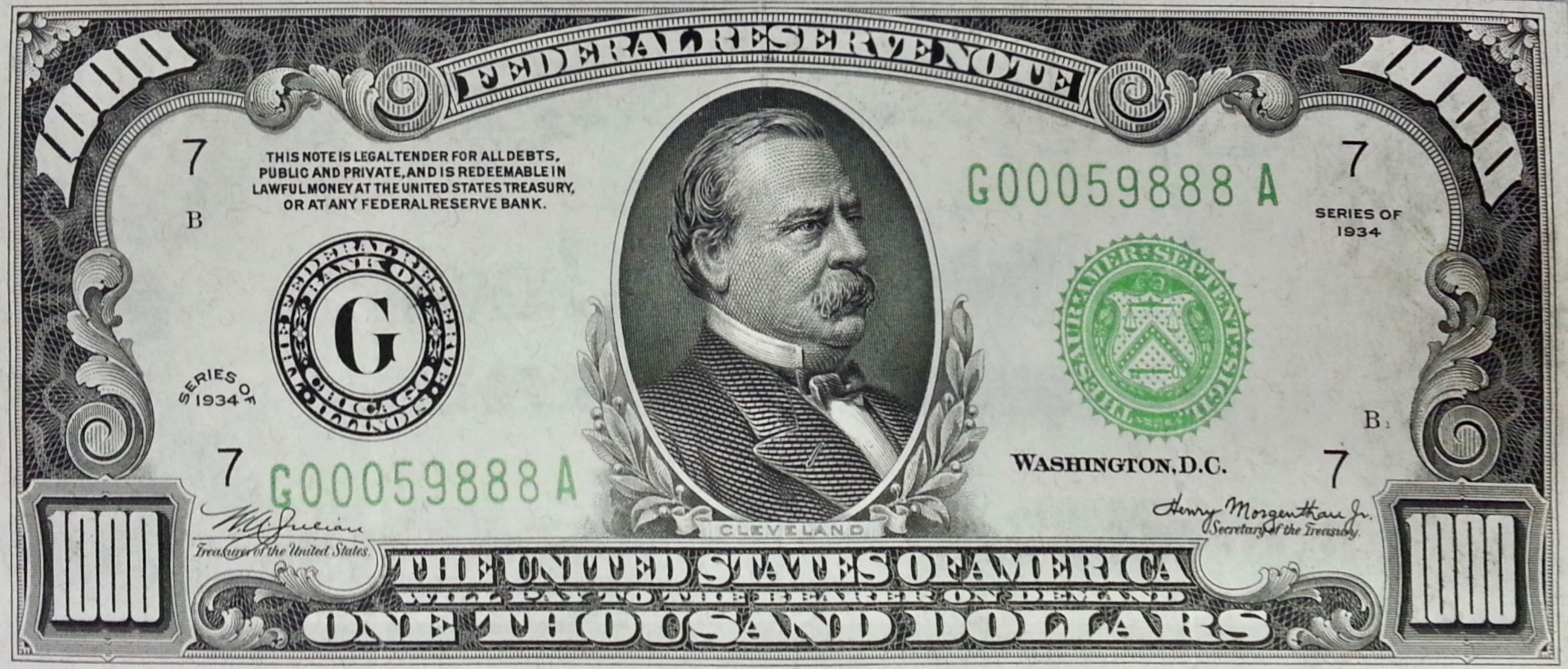

Cato Unbound hosted a discussion throughout the month of August on the theme of Cash, Crime, and Civil Liberties. In the lead essay, Sound Money Project contributor J.P. Koning argues that the U.S. should issue $500- and $1,000-denomination notes. Inflation, he points out, means that the denominations available at present just aren’t what they used to be.

The ability of U.S. paper money to provide censorship resistance, data protection, and to act as the globe’s back-up monetary system has steadily declined over the years. Low-denomination banknotes like the $1 and $5 are excellent for providing small amounts of the above services. But to enjoy larger flows of these services, $1s and $5s are too bulky—higher denomination must be brought into service. Here’s the catch. Inflation has been eating away at the purchasing power of the U.S.’s highest denomination banknote, the $100 bill. Back in 1969, one $100 could buy 700 dollars’ worth of 2018 goods. Put differently, in 2018 it takes seven bills to do the work of just one.

By issuing supernotes, the U.S. would undo some of the damage inflation has done to the denomination structure.

Koning acknowledges, however, that supernotes might facilitate crime and tax evasion. To reduce the downsides of his proposal, he suggests levying a tax on supernotes.

In reply, James McAndrews, who served as executive vice president and head of the Research and Statistics Group at the Federal Reserve Bank of New York from 2010 to 2016, notes some problems with the proposed tax:

It is important to state that a tax on high-denomination notes is not a Pigouvian tax, one that taxes a noxious activity, such as imposing an excise tax on the output of a factory that creates pollution. Instead, it is a tax on an input to activities, only some of which may be noxious. That is akin to taxing the labor that could be used in the polluting factory or in a nearby nonpolluting garden. Taxing inputs that can be used for good or bad purposes will regrettably impose taxes on some good uses of the input, in this case high-denomination notes.

He also remarks that the additions of $500- or $1,000-denomination note “would represent a relatively dramatic change in the current denomination structure and would require more convincing evidence than we have at present.” Instead, he recommends introducing a $200 note while increasing expenditures on law enforcement.

AIER Sound Money Project senior fellow Joshua Hendrickson also takes issue with Koning’s tax, questioning whether high denomination notes create the sort of externalities that might be addressed with a tax.

An externality is not simply any action that imposes a cost on others. If a new restaurant opens up across the street from an existing restaurant, the incumbent might incur a cost in the form of lower profits. However, this is not an externality that requires a public policy solution. Thus even if an activity is made illegal precisely because a vast majority of the population considers the transaction to be morally abhorrent, this does not necessarily imply that there is an externality. Pearl clutching, like foregone profits, are an external cost. Nonetheless we do not compensate firms for foregone profits, and therefore it is unclear whether mere distaste requires any sort of compensation. To the extent to which illegal trade is said to generate an externality, the external costs of such transactions are likely overstated.

Despite these reservations, however, Hendrickson concludes largely in favor of Koning’s proposal.

In the final response to Koning’s lead essay, I endorse his position to issue supernotes while rejecting the idea that a tax on such notes would be in order. Indeed, I claim it would be better to subsidize supernotes (and all of the other notes).

The case against taxing supernotes at a higher rate is even stronger when one realizes that the tax on existing notes is already too high. As Koning points out, inflation is a tax on cash. And, as with any other tax, it prompts users to switch to less desirable alternatives to avoid the tax. That is a problem. If we are holding too little cash, we are less well-equipped to make transactions. Some transactions—and the gains from those transactions—will go unrealized as a result.

In a much-cited article, Milton Friedman argued that setting the rate of return on cash equal to the rate of return on risk-free bonds would induce people to hold the optimal quantity of money. Today, the real rate of return on a 1-month Treasury bill is around 0.45 percent. Hence, Friedman’s analysis suggests that the optimal tax on currency is not 2 percent, the Fed’s current inflation target, but something in the neighborhood of negative 0.45 percent.

The subsidy I have in mind would not require cutting checks to users. Instead, the Federal Reserve could commit to a policy of mild, productivity-driven deflation by adhering to a strict nominal income target.

The conversation continues at Cato Unbound, with follow-up articles by Koning, Hendrickson, and me. As they say, read the whole thing.