One Chart’s Foreboding Message About the Economy

In a Wall Street Journal survey this month, economists estimated a 21 percent probability that a recession will start within the next year, up from just 10 percent a year ago. The Journal reports some economists think the risk is even higher.

A number of economic indicators, from soft business investment to weak auto sales, suggest possible weakness in the economy. However, the sharp slowdown in hiring in May, when the U.S. economy added only 38,000 jobs compared to over 100,000 in earlier months, is widely considered by economists to be a one-month outlier, or a temporary drop . Federal Reserve Chair Janet Yellen said in her press conference last week that the May jobs report only provided one month of data, and we should wait to see more data in coming months.

The hiring slowdown indeed only occurred in May so far. But a broader indicator—the Labor Market Conditions Index—has fallen into negative territory, and continued to fall since January this year. This indicates that the labor market may be worse as a whole than the individual measures show. The disappointing May jobs report may be not an outlier, but may instead be starting to capture a worsening labor market.

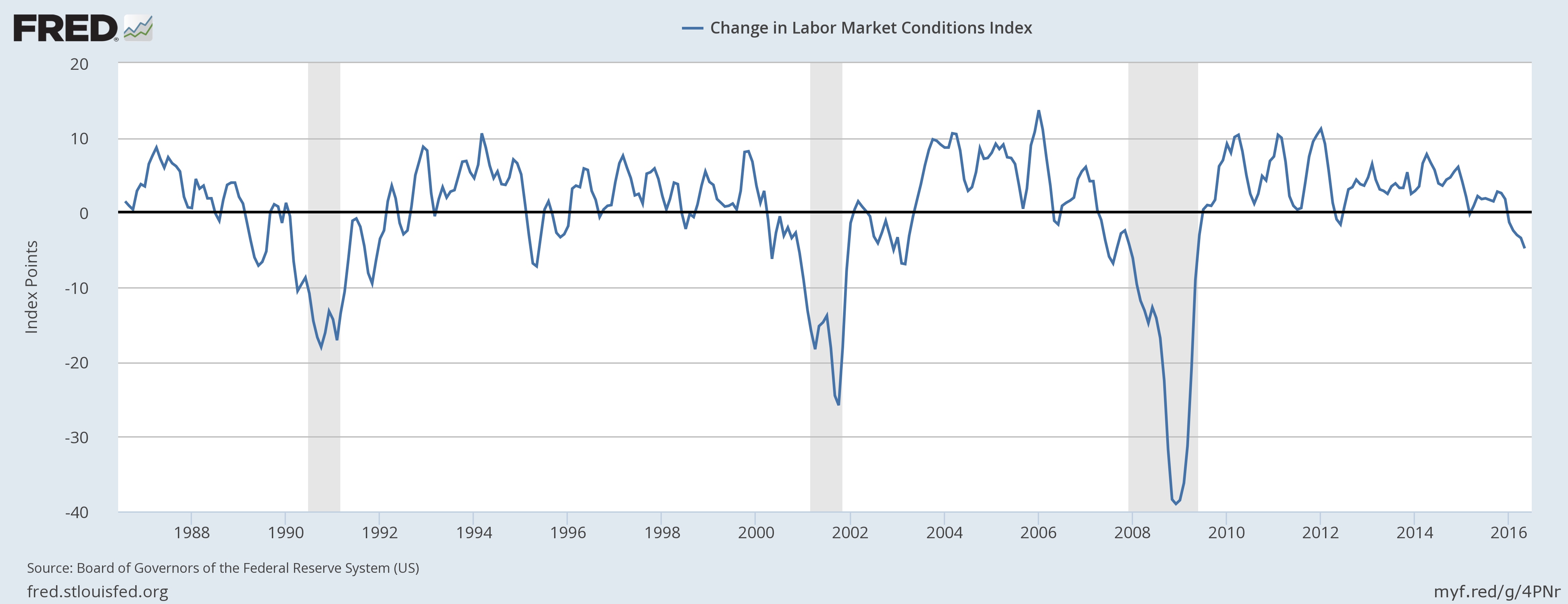

The Labor Market Conditions Index is derived from 19 labor market indicators, including measures like the unemployment rate, labor force participation rate, and average hourly earnings. It is constructed and released by the Board of Governors of the Federal Reserve System. The chart below shows the monthly changes in the Labor Market Conditions Index over the past three decades.

For the last three recessions, the Index was a fairly reliable leading indicator. The Index dropped into negative territory seven months before the recession that started in December 2007. For the preceding recession, which began in March 2001, the Index fell to a negative reading in April 2000—11 months ahead. In the early 1990s, the Index declined for five consecutive months before the recession occurred in July 1990.

But it’s worth noting that the Index sent a false signal in 1995, when the Index showed negative readings for five straight months, and no recession happened.

Now the Index has been in negative territory and continuing to fall for the first five months of 2016. This is a reason to take notice.

Labor market conditions are only one part of the picture of the entire economy, but with this index’s track record in predicting recessions, it is concerning.

Click here to sign up for the Daily Economy weekly digest!