Negative Interest Rates Could Spur Risky Lending

In its most recent monetary policy move, the European Central Bank lowered interest rates further, taking one of its main policy interest rates – the rates the central bank has the authority to set – deeper into negative territory. As my colleague, Jia Liu, explained earlier, the Federal Reserve is not likely to introduce negative interest rates in the U.S. unless this economy takes a substantial turn for the worse.

But even if the U.S. economy worsens and the Fed considers negative interest rates, it is not clear how helpful negative rates could be in stimulating the economy.

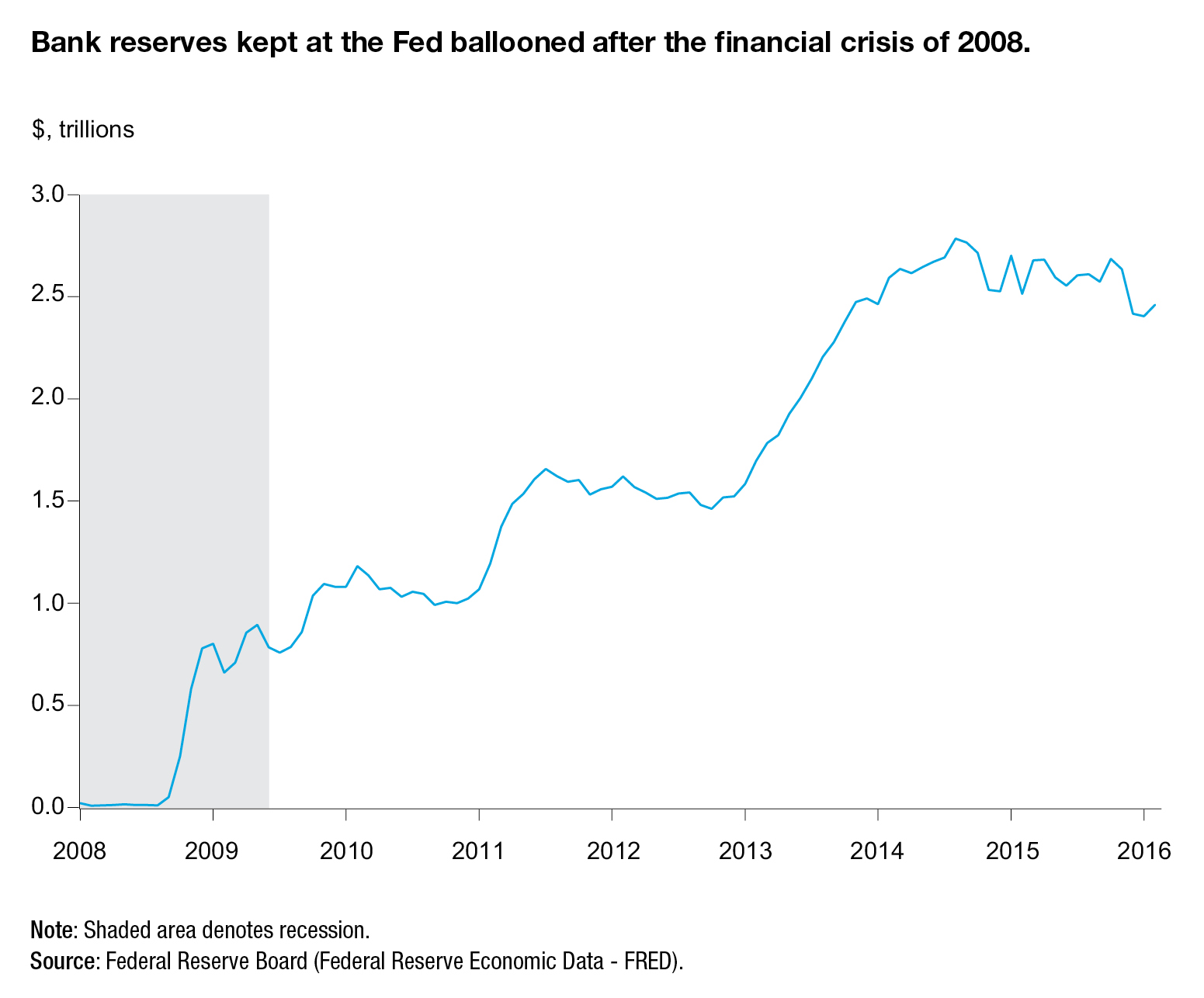

The idea behind reducing interest rates to negative is to stimulate lending and borrowing, which should, in turn, stimulate economic activity. The potential for increased bank lending appears to be substantial, because large bank reserves have been accumulating since the financial crisis in 2008, and are currently over $2.4 trillion (see Chart 1).

However, it is not clear that lowering the interest rates further would necessarily help. Lending happens when there is both a willingness to lend on the part of banks, as well as a willingness to borrow on the part of their customers. Negative interest rates would increase banks’ willingness to lend. But it is not clear that they can increase willingness to borrow, at least not for all borrowers.

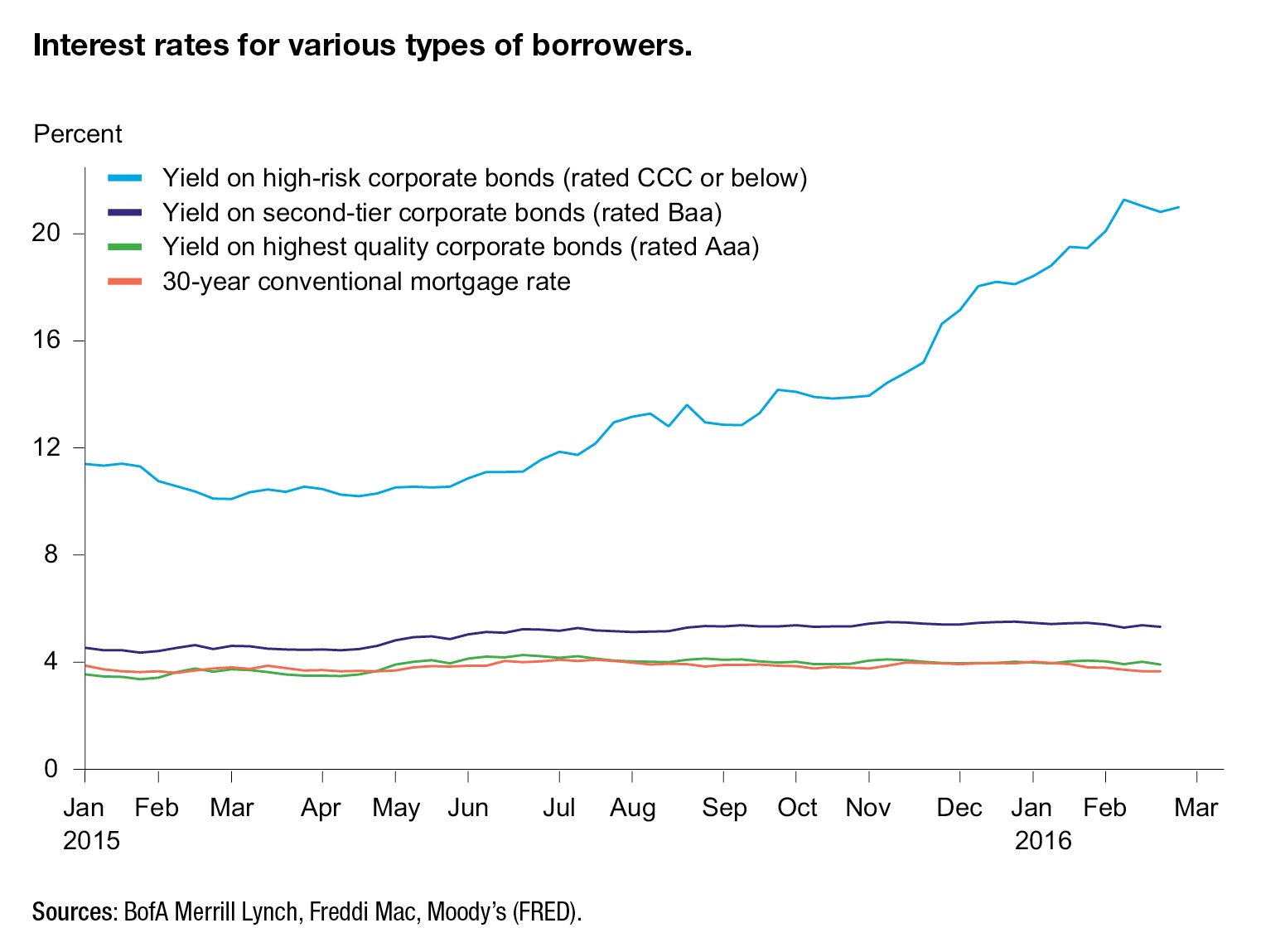

Interest rates for high-quality borrowers are already extremely low – both high-quality corporate bonds and 30-year mortgages carry interest rates that are close to historic lows (see Chart 2). It is not clear that interest rates limit how much businesses and individuals are willing and able to borrow. Lowering these interest rates further is unlikely to increase the willingness to borrow by much. And without the increased willingness to borrow, no amount of increased willingness to lend will affect the volume of lending.

Where the negative interest rates might make a difference is in higher-risk lending. Interest rates on riskier forms of lending, such as high-yield bonds, have been rising since late 2015 (see Chart 2).

If negative interest rates give banks an incentive to increase their lending significantly, they may venture into riskier territory by lending to lower-quality borrowers. The willingness to borrow is there, but so far the lending has been constrained by banks’ (un)willingness to lend to risker borrowers. Negative interest rates may make banks more willing to do it.

If banks do go for risker lending, it might boost economic activity for a time. But it also brings potential dangers. Taking on higher risks may not be a good idea for banks, as the last financial crisis showed.