How Government Stifles Choice and Competition at the Pump

Government subsidies and regulations are usually a mess. Each rule or payment might have its own laudable goal in a vacuum. But in many industries, aided by politics and corporate lobbying, the laws pile up on each other, twisting markets until economic logic seemingly doesn’t apply.

I was confused this week when I read that the White House announced plans to remove limits on selling gas containing 15 percent ethanol (E15). The government currently bans sales of E15 in summer months because of air pollution concerns; the move this week is to lift that ban and make E15 available year-round.

Has something changed since the mid-2000s, when the government notoriously mandated that all gasoline must contain at least 10 percent ethanol? Why would sellers who must be forced by law to keep ethanol content above 10 percent be itching to go up to 15 percent?

To understand what’s going on, we have to enter the regulatory black hole, where multiple rules collide and tear the very fabric of markets apart. Join me, if you’re brave enough.

From Farm to Fuel Tank

We have to start with corn, the key ingredient in ethanol. In addition to being a dietary staple and key feed crop for livestock, corn is the most heavily subsidized crop in the United States. Last year, the government handed over $5.2 billion in payments to corn growers, including subsidized crop insurance and payments to farmers if the national average price falls below a certain level.

While one hears lofty rhetoric about protecting small famers (though most payments go to agribusiness) and protecting the nation’s food supply, most observers see farm subsidies as pure political gamesmanship. Congresspersons in farm states, which are often also Midwestern swing states, fight hard for subsidies to keep their electorates happy. The result is that corn sells below its unregulated market price. The margin is likely significant, though estimating an exact amount is difficult.

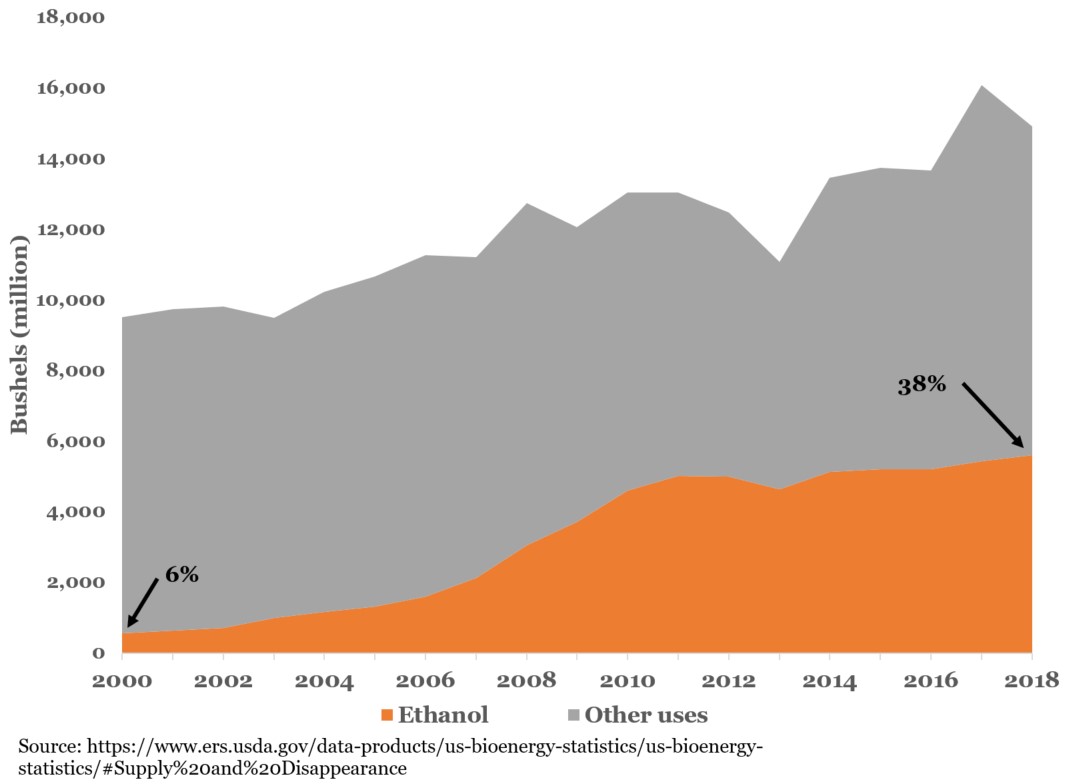

If government subsidies artificially increase the supply of corn, government regulations on ethanol artificially increase its demand. As chart 1 shows, 38 percent of American-grown corn will go to ethanol this year, up from 6 percent in 2000.

Chart 1 – Ethanol versus other uses for U.S. corn (2000–2018)

Ethanol-based fuel has been around almost as long as automobiles. In small amounts (well under 10 percent), it is an effective additive to make gasoline burn more efficiently. But as the concentration increases toward 10 percent, it becomes more environmentally harmful, by many measures, than petroleum-based gas.

Ethanol is almost entirely responsible for the increase in the U.S. corn crop over the last two decades. The big changes were laws in 2005 and 2007, among other regulations, that created the rule that all gasoline sold must contain at least 10 percent ethanol. The spike in demand created by those laws is easily visible. The catchphrase “breaking our addiction to foreign oil” was in full bloom around the time of those laws, but the real motivation goes right back to those corn growers in swing states.

To take stock, we have subsidies that increase the supply of corn and regulations that increase its demand for use as ethanol. But where does a rule change about what season you can sell E15 fit in to all of this?

Escaping the Maize

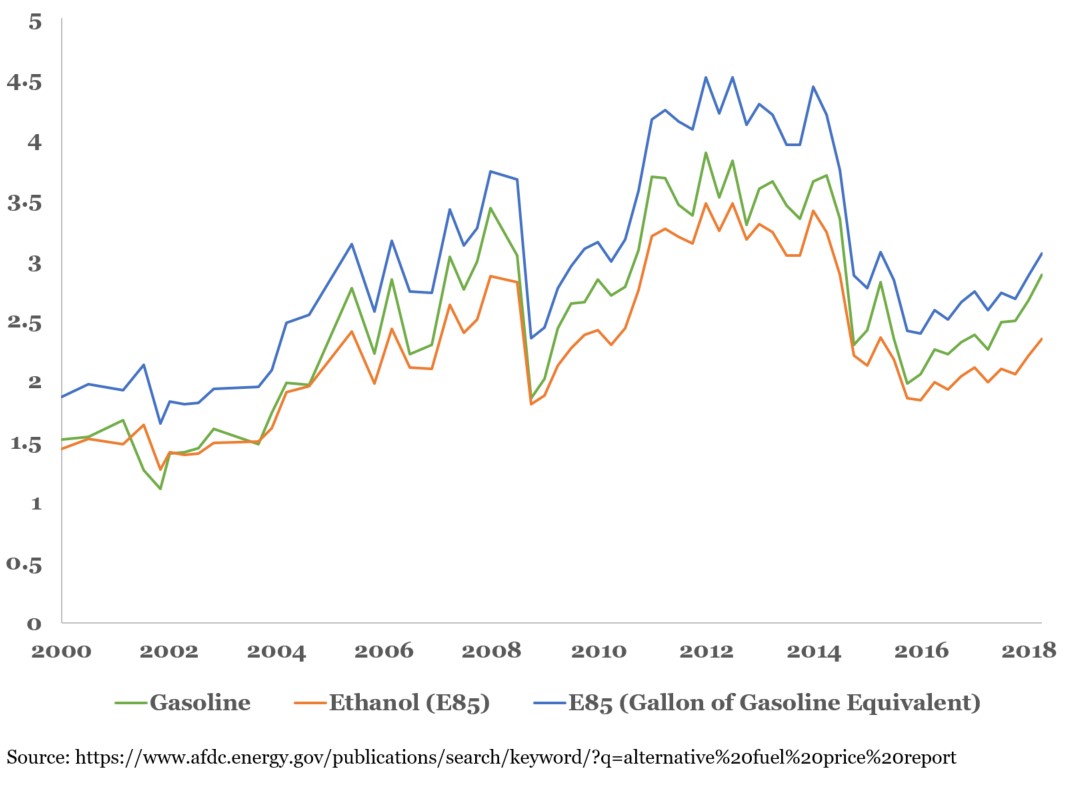

My first guess about the easing of E15 regulations was that the price of ethanol has dipped relative to traditional gasoline, and instead of worrying that there isn’t enough ethanol in our tanks, we’re now worried there’s too much. Chart 2 shows that I was wrong.

Chart 2 – U.S. average gasoline and ethanol (E85) prices per gallon (2000–2018)

For the moment, focus on the red and green lines. Since about 2005, E85 (85 percent ethanol) has consistently tracked the price of regular gasoline but sold at a discount. This discount does not appear to have grown larger in recent years, rejecting my simple price hypothesis.

Another story emerged when I considered the blue line tracking the price of E85 not in terms of its (liquid) volume but in terms of its energy. It turns out a gallon of E85 only gets you about two-thirds as many miles as a gallon of regular gas. When we make the comparison mile-for-mile, the ethanol discount becomes an ethanol premium.

If petroleum-based gas and ethanol had the same energy content, there would be a single optimal mix based on the relative prices of the two. But what the government’s maze of regulations is really stifling is competition, product differentiation, and consumer choice. There may be room in the market for fuel with ethanol content below 10 percent and above 15 percent.

Without the dueling E10 and E15 rules, sellers could offer a range of products to consumers with different mixes of fuels. Well-informed consumers could pay less for fuel with lower mileage per gallon and more for higher mileage; expected usage on the highway versus the city would likely impact that calculus. Sellers could furthermore alter mixtures as the relative prices of the two fuels changed. And without that first layer of corn subsidies, we could find a more optimal mix of uses for our scarce land and other resources.

Here in Great Barrington, I base my gas station decisions primarily on the availability of iced coffee and Monster energy drinks. That’s because at the pump, our web of government subsidies and rules force sellers to provide nearly identical products. That needn’t be the case: in our ordinary, market-based universe, there would be more competition and consumer choice. But once industries are sucked into the regulatory black hole, it’s hard to escape.