GOP Chooses Progressive Taxation over Sustainable Growth

As I explained on Friday, the Republican tax plan, as introduced by the House leadership, is nowhere near the slam-dunk growth generator our economy needs. The good and the bad features seem to balance each other out.

However, there is a bigger problem with the reform, a structural design that, over time, could actually turn out to be negative for our economy. This design resembles a football team that has benched its wide receivers: it is all about playing defense. There are more features in the reform to further a short-term political victory than to boost long-term economic growth.

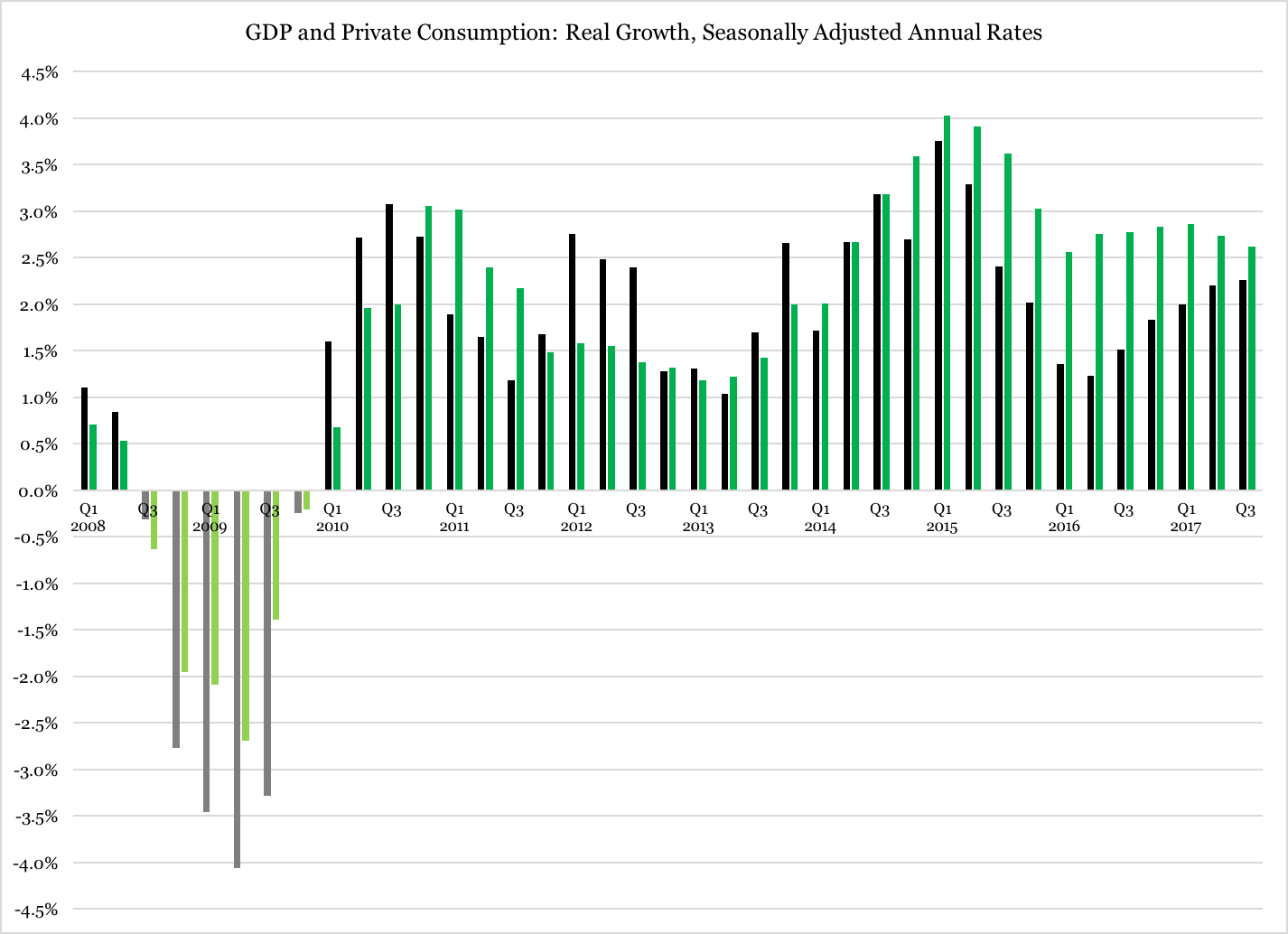

This is a relatively big problem. As Figure 1 shows, our GDP growth record in the past 10 years is less than impressive (black columns):

Figure 1

Source: Bureau of Economic Analysis.

As the green columns report, consumer spending — the largest item in GDP — has had a somewhat better growth record recently. However, it is not strong, stuck in the 2.5-3 percent neighborhood over the past two years.

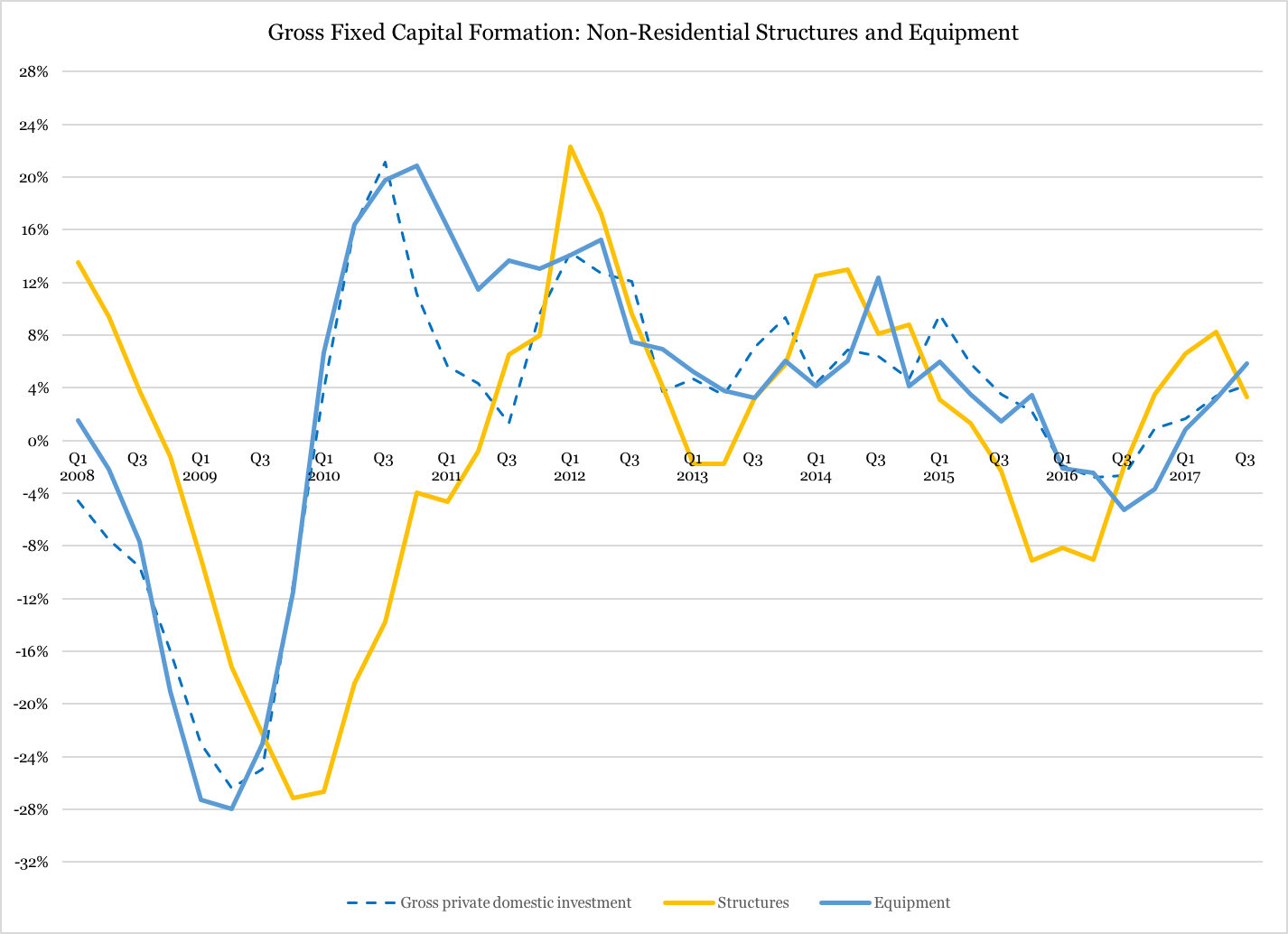

There is a similarly ho-hum sentiment in business investments. Since early 2016 there has been a minor growth period with construction of new structures, and, with a six-month lag, a rise in equipment purchases. However, as demonstrated in Figure 2, this growth period is not very strong:

Figure 2

Source: Bureau of Economic Analysis

Our economy could definitely do better. We are nowhere near maxing out our capacity utilization: according to the Bureau of Labor Statistics, our workforce participation rate is a full four percentage points below where it was in the late 1990s. Plainly, there are millions upon millions of workers left to join the workforce, if only the incentives were on their side.

Unfortunately, the GOP tax plan is not very interested in tapping into this growth potential. The plan is full of incentives for people to work for a living, but it does not offer much to encourage people to work for prosperity. Likewise, it offers nothing to encourage small business owners to expand, invest, and create new jobs.

Here is how this incentives structure plays out. On the upside, a near-doubling of the standard deduction, together with the EITC and the new Family Credit, liberate low-income families from federal income taxes. Tax rates for higher incomes are reduced, though according to some estimates that only means an extra $1,182 per year for the average family. Again, incentives to work but no incentives to grow and thrive.

On the downside, higher incomes are left with the same 39.6 percent tax bracket. But that is not all: in addition to the reduction by half of the mortgage deduction, Politico reports on a hidden, extra 45.6 percent tax bracket, apparently tucked away inside the GOP plan:

House Republicans claim the tax plan they introduced Thursday keeps the top individual rate unchanged at 39.6 percent — the level at which it’s been capped for much of the past quarter-century. But a little-noticed provision effectively creates a new band in which income is taxed at over 45 percent. Thanks to a quirky proposed surcharge, Americans who earn more than $1 million in taxable income would trigger an extra 6 percent tax on the next $200,000 they earn — a complicated change that effectively creates a new, unannounced tax bracket of 45.6 percent.

This 6 percent feature is a claw-back mechanism, aimed at recovering tax revenue that Congress “gives away” in other parts of the plan. To compensate for tax cuts for low-income families, the GOP tax plan adds a 6 percent surcharge on incomes above $1 million. The idea is that every taxpayer in that income bracket will pay an extra $12,420 on his earnings in the $1-1.2 million bracket. After that, the six-percent surcharge goes away.

By making “revenue neutrality” the argument behind this tax reform, Congressional Republicans have flagged up: their thinking behind this plan is far more short-term than long term. They are more concerned with recovering “lost” revenue than with stimulating economic growth; we can now, sadly, conclude that the great Art Laffer’s influence over Republican tax policy has definitively come to an end.

By thinking short term, and by focusing on revenue rather than growth, the GOP makes another mistake that can cost our economy quite a bit over time. They liberate low to moderate incomes of federal taxes and make the federal government depend even more on higher incomes for its revenue. Already today, 80 cents of every dollar in federal tax revenue comes from personal income, and already today, the top 5 percent of income earners pay almost 60 percent of all personal federal income taxes. By alleviating low and middle incomes of federal taxes — by itself a good idea — the Republican plan concentrates even more of the federal tax base onto the shoulders of the few.

There are two structural problems with this. The first is increased volatility in tax revenue. Higher work-based incomes are more volatile than lower incomes. High earners are more often consultants, business owners, and other professionals who work on projects and against profit-sharing and bonuses. This makes their tax payments more volatile.

But the volatility problem does not stop here: by maintaining, and even ratcheting up, the taxation of higher incomes, the Republican plan reinforces the incentives for people to shift their earnings from work-based income onto an equity base (the taxes on which apparently will stay unchanged). The problem is that equity-based income fluctuates with the performance of the underlying equity; with more income coming from assets, the volatility in taxes is reinforced.

When tax revenue is volatile, it will rise more quickly in good economic times, but it will also plunge faster and deeper in recessions. With weaker growth incentives in the tax plan, the net result will be deeper revenue losses in recessions and smaller revenue gains in growth periods. As a result, we will see more government borrowing, and possibly talk about tax hikes in a not-too-distant future.

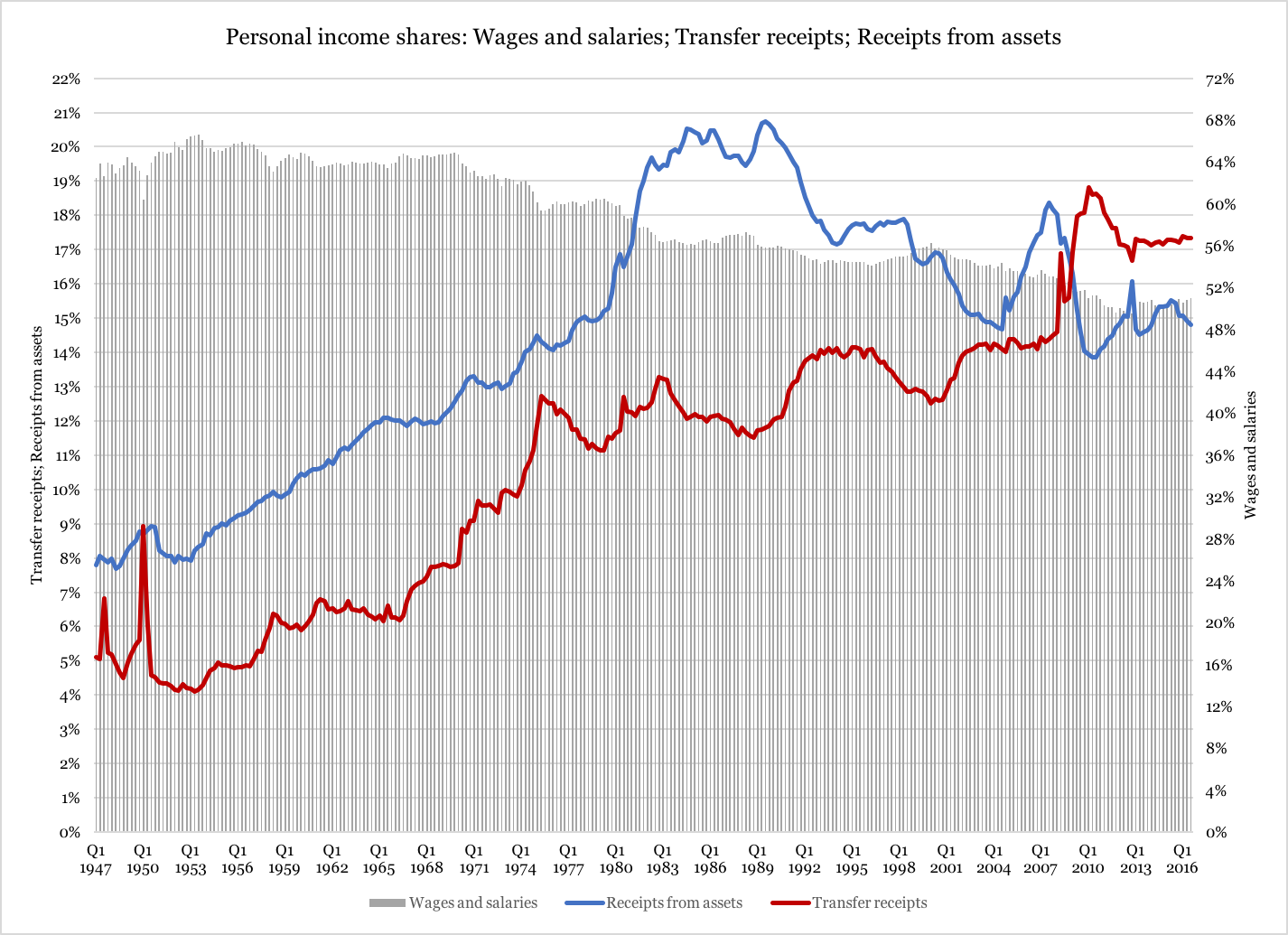

The second structural problem has to do with the composition of personal income. As seen in Figure 3 below, over the past few decades, wages and salaries have declined as a share of personal income (grey columns), while at the same time income from equity increased through the 1980s (blue function). Since then it has declined, while the third income category, entitlements (or transfer receipts, red function), has increased to become the second-most important source of personal income:

Figure 3

Source: Bureau of Economic Analysis

The tough lesson from Figure 3 is that work-based income is decreasingly relevant as a tax base. Higher-income families rely to an even lesser extent on work for their earnings, while at the same time lower-income families increasingly depend on entitlements. The Republican tax plan encourages more of the former and does not discourage the latter.

It is disappointing to see that the GOP has abandoned economic growth as a primary goal in its tax policy. The US economy is in a long-term decline, with increasingly rare episodes of 3 percent growth. This is not just a problem for economists; it is a major problem for our country. Slow growth means a life less prosperous for coming generations. Unless we want to go down in history as the first generation on the prosperity downslope, we better make sure our elected officials get their macroeconomic priorities right.

Image: Level Financial Advisor.