Financial First Steps: You and Your Credit Score

You’ve probably heard about it a hundred times, and you know it’s important, but what exactly is a FICO score? Understanding what factors go into to calculating your credit score is extremely important to your financial success. Imagine going to school and not knowing what factors contribute to your grade. It would probably be hard to get an A.

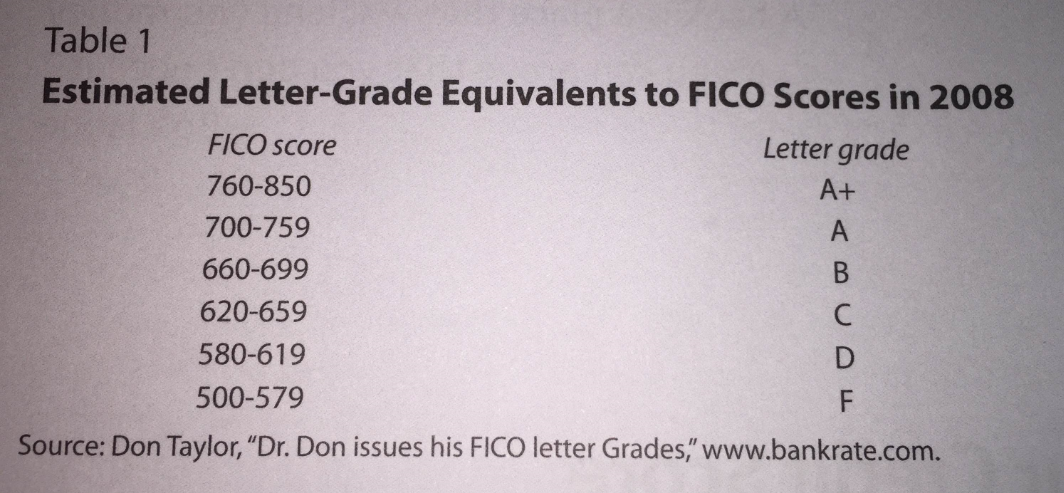

Your FICO, or credit score, is your financial identity. FICO stands for Fair Isaac Corporation, the company that collects and processes all the information on your credit history. FICO scores range from 300-900. You can think of your FICO score as a grade, and the higher your grade the more you will be able to borrow and at better rates.

So what goes into determining your FICO score? Well, there are five factors, each weighted according to their impact on your score:

Credit payment history (35 percent of FICO score), the most important factor in determining your credit score, includes all of your late payments on credit cards and loans. Different types of late payments affect your credit score differently. For instance, a 30-day delinquency is not as bad as a 90-day delinquency. But several 30-day delinquencies are worse than one 90-day delinquency. Bottom line? PAY YOUR BILLS ON TIME! For tips on how to do so, check out my first blog post.

Level of debt utilization (30 percent) refers to how much of your credit card limit you use. If you are consistently at or near the limit, statistically you pose more of a risk to lenders. This should be motivation enough to not max out your cards and to stay on top of paying off your debt.

Length of credit history (15 percent) is simple: The more years of credit experience you have the better you will score in this category. Unfortunately for young adults, this category hurts a little, but is reason enough to start building a credit history now.

The category for number of new credit applications (10 percent) is based on how many times you apply for credit. Each time you apply, it gets posted to a credit report as an “inquiry.” More than four credit inquiries in a six-month period will negatively affect your credit score.

Finally, a mix of credit experience (10 percent), refers to your number of credit cards and loans, including student and car loans. Having a little of everything is favorable to your credit, as the fact that numerous different sources are willing to provide you credit show you are a reliable borrower. However, this doesn’t mean you should try to get a million different cards, as many creditors now give fewer points for having five or more credit cards.

Now that you know what goes into your credit score, you can start to think about how you can build, raise, and access your credit score. I will be discussing these topics in my next blog post.

For more information on setting financial goals, as well as a variety of other topics, check out AIER’s Start Here digest. Dedicated to helping young people set their “life strategy,” the Start Here digest is a great resource for high school and college students interested in getting their financial lives on track. Best of all, it’s free!