Despite Weaker Data, Stock Market Optimism

We’ve seen some less-than-stellar data about the economy in recent days, which could point to a softer GDP number on Thursday.

Nevertheless, our senior research fellow Bob Hughes says equity markets may already be looking past the weakness.

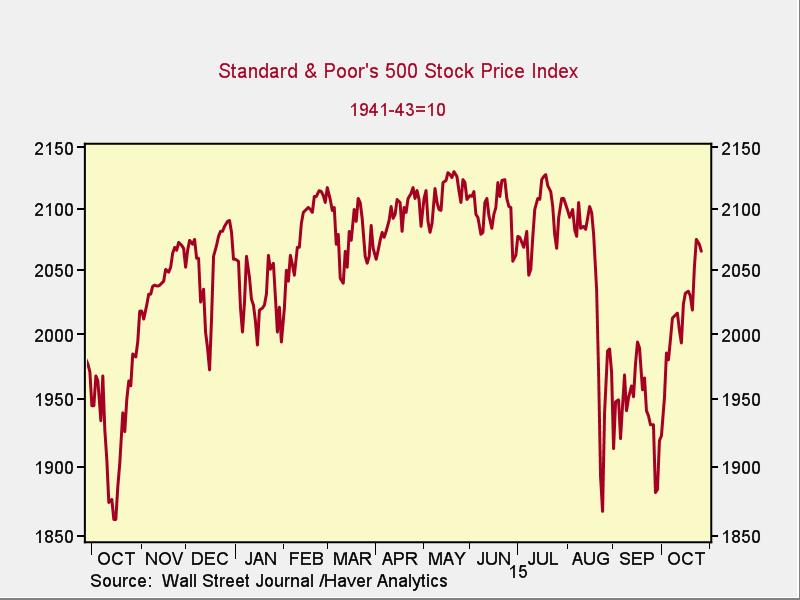

The S&P 500 bounced back from its August low of 1867.61 to yesterday’s close of 2065.89, an increase of 10.6 percent, he noted.

Thomson Reuters notes expected 3rd quarter corporate earnings are down 2.2 percent from the same quarter one year ago, led by a 65.5 decline in the energy sector. The materials sector fell by 16.1 percent.

Nevertheless, there were notable gains in such sectors as consumer discretionary, telecommunications, technology, financial services, and health care.

Those gains are helping drive some of the renewed optimism we’re seeing in the stock market, Hughes said. That’s despite mixed results in recent economic reports on capital spending, housing starts, trade and durable goods, he said. Investors, he said, may be regaining some confidence about the trajectory of the economy.

“Even if we see a somewhat weaker GDP number on Thursday, if the stock market proves to be right, we might expect to see a stronger fourth quarter GDP,” Hughes said.