A Mild Forecast For Inflation

The American Institute for Economic Research is forecasting mild inflation for the balance of 2016, according to a new brief released today. This is in line with the sluggish price growth we have seen in recent years, said the author, AIER research fellow Jia Liu.

“For consumers, there is no reason to rush in making purchases. For savers, this is obviously good news, since low inflation means less of a reduction in the purchasing power of their savings,” Liu wrote in the brief.

Investors are likely to find that their projects are more profitable with a low inflation rate, if all else holds equal, Liu wrote. And policymakers are likely to worry less about high future inflation, which would lead to slower interest rate increases at the Fed for the rest of the year, she wrote.

Liu forecasted this slow inflation growth using a new model. She created the model by using advanced time-series techniques. Various economic variables over the last five decades are applied to this model, including labor market conditions, demand and supply, the housing market, and interest rates.

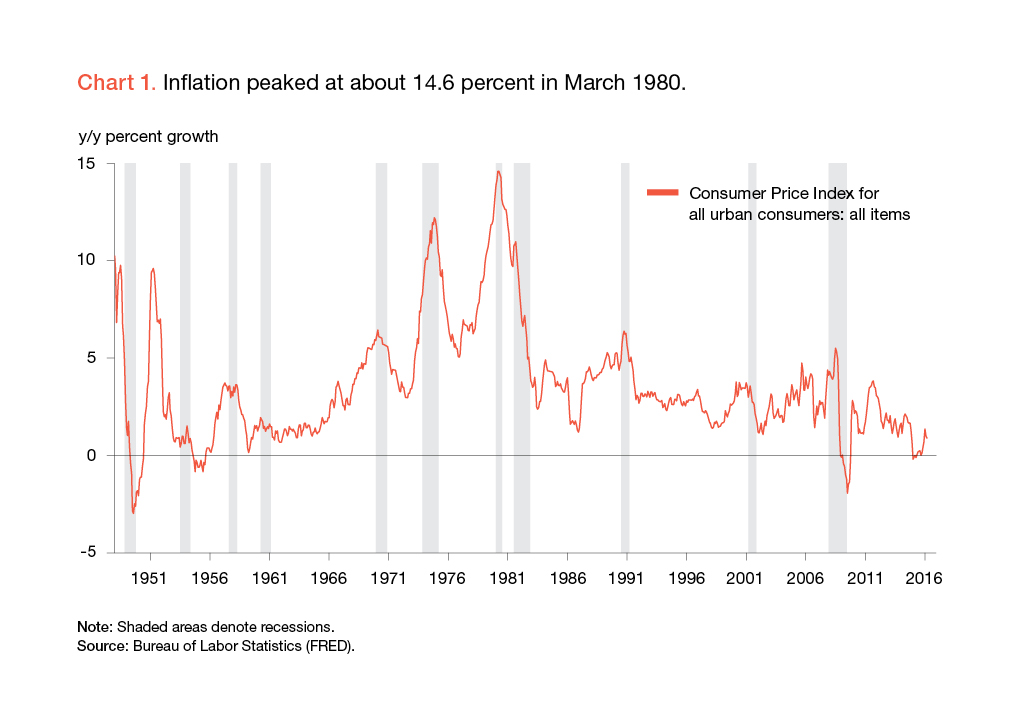

The resulting inflation rate in the model closely matched the actual inflation rate in the past three decades.

For the next six months, the model predicts that the average monthly core-CPI inflation will be in the range of 0.14 to 0.17 percent, or an annualized 1.7 to 2.1 percent, which is close to the Federal Reserve’s target of 2 percent.

We look forward to continuing to use this model to track inflation in the future, and sharing the results with you.

Click here to sign up for the Daily Economy weekly digest!