Wide-spread Increases Boost Everyday Price Index in October

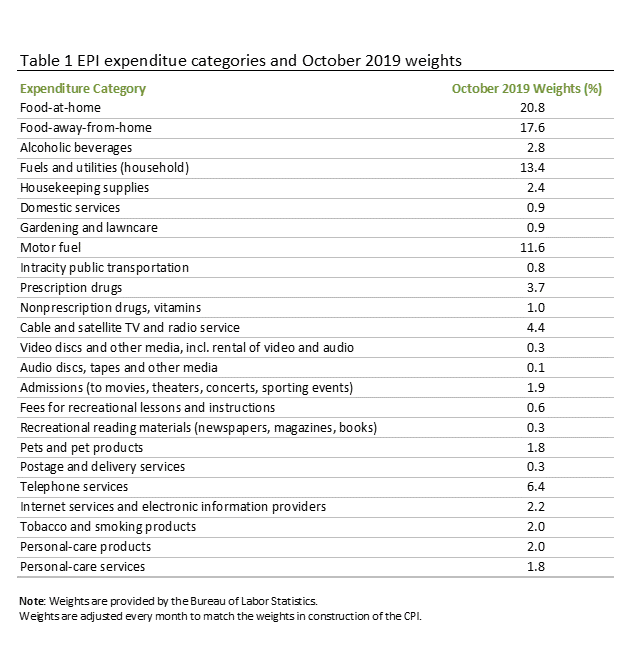

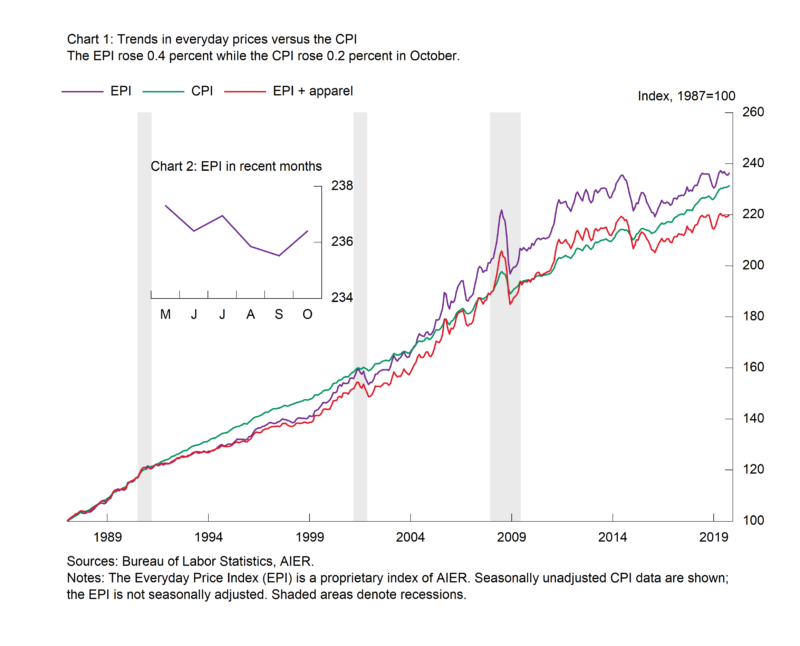

AIER’s Everyday Price Index rose 0.4 percent in October, reversing back-to-back declines. Increases were widespread for the month. However, over the past 12 months, the index is up just 0.2 percent and over the past five years, the annualized gain is just 0.5 percent. The Everyday Price Index measures price changes people see in everyday purchases such as groceries, restaurant meals, gasoline, and utilities. It excludes prices of infrequently purchased, big-ticket items (such as cars, appliances, and furniture) and prices contractually fixed for prolonged periods (such as housing).

The Everyday Price Index including apparel, a broader measure that includes clothing and shoes, increased 0.3 percent in October after a 0.1 percent rise in September. Apparel prices fell 0.7 percent on a not-seasonally-adjusted basis in October and are down 2.3 percent over the past year. Apparel prices tend to be volatile, registering sporadic large gains or declines in between stretches of relatively steady prices. Over the past year, the Everyday Price Index including apparel is unchanged while the five-year annualized gain is just 0.7 percent.

The Consumer Price Index, which includes everyday purchases as well as infrequently purchased, big-ticket items and contractually fixed items, rose 0.2 percent in October. The Everyday Price Index is not seasonally adjusted, so we compare it with the unadjusted Consumer Price Index. Over the past year, the Consumer Price Index is up 1.8 percent.

Increases in the Everyday Price index were broad-based. Among the key contributors to the increase were gains for food at home or grocery prices (up 0.3 percent for the month and 1.0 percent for the year), food away from home or restaurant prices (up 0.2 percent and 3.3 percent for the year), motor fuel (up 1.6 percent in October but down 7.4 percent over 12 months), and prescription drugs (up 1.4 percent and 1.0 percent for the year). Partially offsetting those gains were household fuels and utilities which was down 0.6 percent for the month (but up 0.7 percent from a year ago).

Price pressures were more widespread in October than in recent months with 19 of 24 categories posting gains for the month. Twenty categories show gains over the past year while just four show declines. Among the 20 with increases, half have increases above 2 percent. It’s unclear whether the broadening increases are likely to be persistent or temporary. Wage gains, a source of potentially more persistent price pressure, continue under tight labor market conditions, but the pace has decelerated modestly in recent months. Tariffs, which are more likely to be temporary, may also be contributing to upward price pressure, but anecdotal evidence suggests businesses are not passing tariff increases through to final buyers easily. Furthermore, private final demand growth has also decelerated in recent months, helping restrain pricing power. These strong cross currents suggest an uncertain outlook for prices in coming months.