Why Your 401(k) Differs from Fund Performance

I recently wrote a post about how investors regularly underperform investments (called the “Behavior Gap” by Carl Richards). The notion is that people have a tendency to sell after markets have dropped, and buy after they’ve risen. There is a second component to why investors underperform their investments, however. The way that a fund calculates performance is probably quite different from the way that you perceive performance.

Funds calculate performance on a time-weighted basis. When you go to a mutual fund website, it will often show the hypothetical growth of $10,000 over the last 5, 10, or 20 years. This is an honest result. If you put $10,000 in at the beginning of the period and made no deposits or withdrawals, you would get exactly that result. That is the return that a fund will report, and it is entirely accurate.

The problem is that people don’t invest in this manner. In 401(k) plans, for instance, people deposit additional savings every month. Even if we assume that people aren’t trading in and out of different funds or withdrawing money, we should expect a different return pattern when the amount invested gradually increases with deposits over time. The investor experiences what is called a dollar-weighted return.

Imagine a worker who started putting $100 into his 401(k) every month 20 years ago. Let’s assume he simply places the money in a passive S&P 500 Index fund with no fees, and he never withdraws money or trades to another fund.

The first $100 he puts into the fund will receive exactly the rate of return that the fund reports. Over the last 20 years, this $100 would have grown to about $510, for an average annual return of 8.48 percent (total return gross of dividends). This exactly matches what the fund would report returning over the last 20 years.

But since he’s contributing each month, the total investment will not receive that long-term rate of return. For instance, the money he contributed 10 years ago has received an annual return of only 7.15 percent. Market returns were lower over the last 10 years than they were over the period from 1995 through 2004. That means that his overall performance may be less than the reported performance of the fund.

The sequence of returns matters for investor performance, but it doesn’t matter for fund performance. If there are higher-than-average returns early in the investment period—when he has relatively less invested in the market—his overall performance will be lower than the fund. Likewise, if the fund has weak returns early and great returns late, his performance may be better than the fund’s.

You can’t control it, but timing and the sequence of returns matters. For investors that have been in the markets for the last 20 years, they experienced excellent growth during the late 1990’s, but more timid growth since. The result may be that they have underperformed the funds in which they’re invested.

$100 invested in the S&P 500 over the last 20 years (through August 2015) returned 8.48 percent per year. An investor who contributed an inflation-adjusted $100 per month to this investment returned 7.20 percent per year. In other words, he underperformed the fund that he invested in (note that this discrepancy is much smaller than what Dalbar reports for investor underperformance, meaning that there is still a behavior gap that has led to significant underperformance that could be easily rectified with a buy-and-hold strategy).

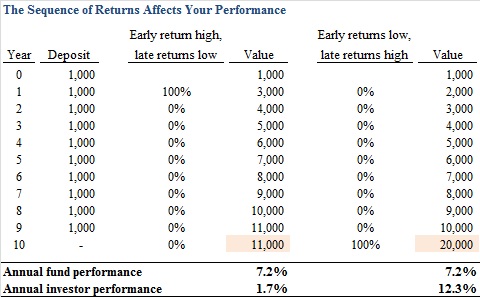

Finally, a basic (and extreme) example of how the sequence of returns can affect your performance is provided in the table below. In this example, a hypothetical investor invests $1,000 per year. In the left panel, the fund returns 100 percent the first year, and nothing thereafter, for a 7.2 annual fund return. In the right panel, the fund returns nothing for nine years and 100 percent in the 10th year, when the investor now has $10,000 exposed to this large return. The fund performance is still 7.2 percent per year, but the resulting value is quite different. The investor performance swings from 1.7 percent to 12.3 percent in this example, quite varied from the fund’s 7.2 percent performance.

All this is a lot to say that the sequence of returns matters. There is little you can do about it, but it can be helpful in understanding why your returns may differ from the reported returns of the funds in which you invest.