Why Aren’t Anti-Money-Laundering Regulations Adjusted for Inflation?

Banks and other financial institutions are required by law to implement measures for catching money launderers. Over the decades, these obligations have been getting more onerous due to new rules and the tightening of existing rules. They have also become more onerous because of inflation.

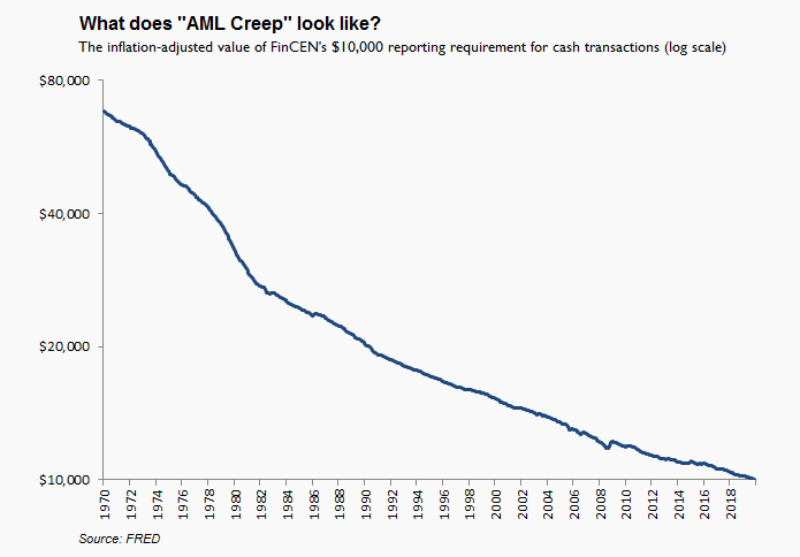

Anti-money-laundering (AML) rules set a number of fixed-dollar trigger points. The most well-known of these is the $10,000 threshold for filing a currency transaction report. In 2020, the $10,000 requirement will be celebrating its 50th anniversary. Since the purchasing power of the dollar has steadily fallen over the last 50 years, more and more transactions are hitting the $10,000 reporting requirement than were initially intended.

We can think about AML regulations as a pact that law-abiding citizens have struck (for better or for worse) with our financial regulators. “We’ll all sacrifice a bit of our privacy and accept a few extra bureaucratic hassles, and you will stop money launderers.”

Currency transaction reports (CTRs) are a manifestation of this pact. Ever since the Bank Secrecy Act of 1970, financial institutions have been required to report names and Social Security numbers whenever a customer deposits cash. The Financial Crimes Enforcement Network (FinCEN), the bureau that administers the Bank Secrecy Act, collects and analyzes this information.

Not just any amount of cash, though. A CTR need only be filed with FinCEN when more than $10,000 in cash is deposited. We can think of this $10,000 threshold as a compromise between citizens and financial authorities. The level was set high enough that the financial privacy of most citizens would not be invaded. Nor would bank tellers have to be constantly filing reports. It is expensive for banks to set up and operate a mechanism for monitoring transactions. Ultimately, this cost is borne by customers in the form of higher fees and a stifling of bank competition. Upstarts, after all, have trouble absorbing the fixed costs of setting up AML programs.

The $10,000 threshold was also set low enough that criminals anxious to get a million dollars’ worth of cash into the banking system might think twice. After all, they might have to give up potentially incriminating information.

Back in 1970, $10,000 would have purchased around what $68,000 would today (see chart below). Today, it doesn’t even purchase a new car. So transactions that didn’t come close to triggering CTRs in 1970 now set them off. This means ever more invasions of privacy and higher costs of compliance.

CTRs aren’t the only AML threshold to be undermined by inflation. For decades now, FinCEN has required financial institutions to keep a log of all cash purchases of “monetary instruments” between $3,000 and $10,000. These instruments include cashier’s checks, official bank checks, money orders, and traveler’s checks.

AML thresholds don’t only apply to cash transactions. Since 1996, FinCEN has tasked financial institutions with filing suspicious activity reports (SARs) on all “suspicious” financial transactions in excess of $5,000. Money-service businesses face a $2,000 threshold. Eerily, clients are not notified when a transaction they have made is deemed suspicious. So, thanks to inflation, the odds of your electronic funds transfer being flagged and passed on to the authorities are way higher than ever before.

Prepaid and gift cards also face a number of fixed-dollar caps. By limiting cards to a face value of $1,000, prepaid non-reloadable debit card issuers can avoid FinCEN rules. Which means they needn’t set up a costly customer-identification program — a useful feature for attracting unbanked Americans without identification cards. Issuers of gift cards (like Starbucks, Amazon, or Subway) can avoid being subject to FinCEN regulation as long as they don’t issue cards with face values in excess of $2,000.

But as inflation steadily eats away at these two thresholds, the gift- and prepaid-card exemptions become less meaningful. Issuers lose their ability to reach the unbanked or offer regular folks a low-hassle Christmas or birthday-present option.

FinCEN thresholds are established through a democratic process. Implicit in this is some sort of consent by citizens to give up fixed amounts of convenience and privacy in return for security. These thresholds are debated in Congress and the Senate, and lawmakers are held accountable for their decisions.

Not so with inflation-induced AML creep. The authorities have reduced the real value of the CTR trigger from $68,000 to $10,000 in 50 years — without having to pass anything into law! The resulting growth in invasiveness and burgeoning costs of compliance are arbitrary and undemocratic. If we are to be subject to a perpetual 1–3 percent ratcheting back of the line we’ve drawn between security and freedom, presumably we need to consent to it.

The idea that monetary thresholds should be adjusted for inflation is already well-recognized in many parts of government. Governments all over the world index tax brackets in order to prevent citizens from falling into higher tax brackets solely because the purchasing power of money has fallen.

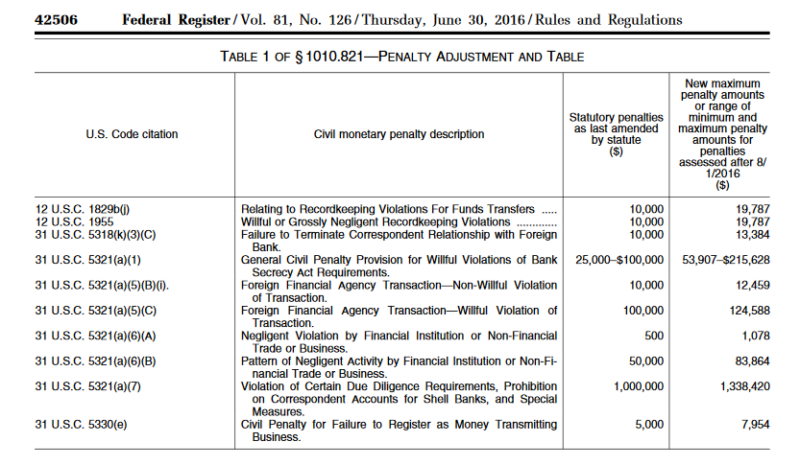

Ironically, FinCEN itself recognizes the effect that inflation has on monetary thresholds. After decades of being fixed at the same level, the agency’s financial penalties for rule breakers underwent a one-time “catch-up” in 2016. For instance, going back to 1988, FinCEN has set a $10,000 fine on any financial institutions that violate recordkeeping requirements for funds transfers. However, between 1988 and 2016, consumer prices increased by 98 percent, rendering the penalty half as effective as originally intended. To catch up, FinCEN increased the recordkeeping violation in one fell swoop to $19,787.

Below is a list of all of the monetary penalties that were adjusted to account for inflation in 2016.

Source: Federal Register/ Vol. 81, No. 126 [link]

Going forward, FinCEN now increases its monetary penalties in line with inflation every year. For instance, the 2019 adjustment brings the penalty for recordkeeping violations up to $21,039 from $20,521.

FinCEN is required to make these inflation adjustments thanks to the Federal Civil Penalties Inflation Adjustment Act of 2015. This bit of legislation tasked all federal agencies with implementing a one-time catch-up to inflation in 2016, to be followed by yearly inflation adjustments to their monetary penalties.

It makes sense to adjust FinCEN penalties for inflation. Given the pact that we citizens initially signed with the authorities, presumably we want them to provide us with a consistent amount of security over time. Arbitrary forces like inflation interfere with this mandate by reducing the real value of the penalties that FinCEN is allowed to levy.

But the original compromise we accepted was also designed to protect our privacy and limit nuisances. Inflation’s arbitrary interference with FinCEN’s ability to assess penalties has been permanently fixed. We should be no less eager to fix the tendency for inflation to arbitrarily reduce our financial privacy and burden our financial system with ever more bureaucratic hassle.