Weekly Data Portend Weak Retail Sales

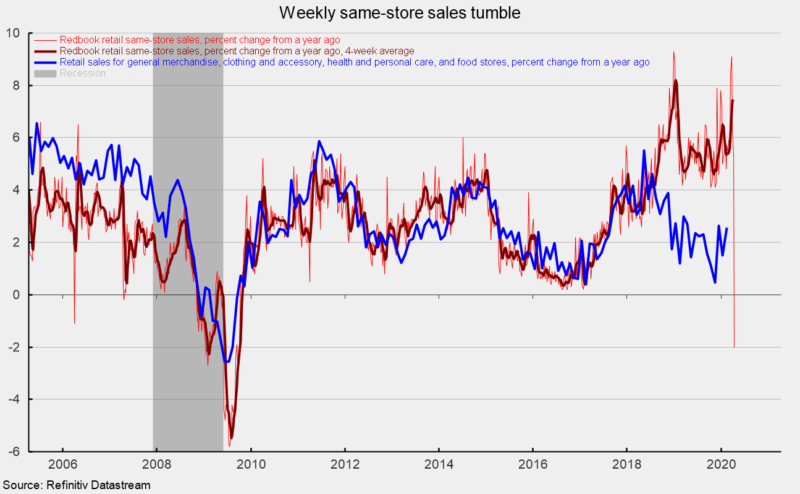

Weekly retail same-store sales data from Johnson Redbook reflect the collapse in retail spending as a result of the COVID-19 outbreak. For the week ending April 11, the Redbook same-store sales index tumbled 8.3 percent from the previous month. The prior week saw a 0.9 percent rise versus the prior month. From a year ago, same-store sales are off 2.0 percent versus a 5.3 percent rise in the prior week versus a year ago (see chart). The widespread efforts to contain the COVID-19 outbreak have shut down large portions of the economy and sent economic activity plunging. Data on the economy are going to be shockingly weak over the coming weeks and months.

The most recent broader retail sales report from the Commerce Department shows retail sales and food-services spending fell 0.5 percent in February following a 0.6 percent gain in January. The report for March retail sales is due out tomorrow, April 15. The current consensus is for an 8.0 percent decline versus the prior month with the lowest estimate coming in at a 24.0 percent decline and the high estimates showing a 0.9 percent decline.

Excluding the volatile auto and energy categories, core retail sales and food services in February were down 0.2 percent after a gain of 0.7 percent in January. Over the past year, total retail sales and food services were up 4.3 percent through February, while core retail sales and food services have increased 4.4 percent.

Weakness in February was widespread, with declines in nine retail-spending categories, while three categories posted gains and one was essentially unchanged. Declines were led by a 2.8 percent drop for gas station sales though volatility in gasoline spending tends to reflect changes in prices rather than changes in volume. There was a 1.4 percent decline for electronics and appliance stores, a 1.3 percent fall for building-material, garden-equipment, and garden-supplies dealers, a 1.2 percent decline for clothing and accessory stores, and a 0.9 percent retreat for motor vehicle and motor vehicle–parts dealers. The drop in motor vehicles was not surprising given the slower pace of unit sales, coming in at a 16.8 million-unit annual pace versus a 16.9 million rate in January.

On the positive side, miscellaneous store sales were up 1.4 percent, nonstore retail sales rose 0.7 percent, and sporting-goods, hobby, musical-instrument, and bookstores posted a 0.1 percent increase.