Weak Results for Retail Sales in February

Retail sales and food-services spending fell 0.5 percent in February following a 0.6 percent gain in January. Excluding the volatile auto and energy categories, core retail sales and food services were down 0.2 percent in February after a gain of 0.7 percent in January. Over the past year, total retail sales and food services were up 4.3 percent through February, while core retail sales and food services have increased 4.4 percent.

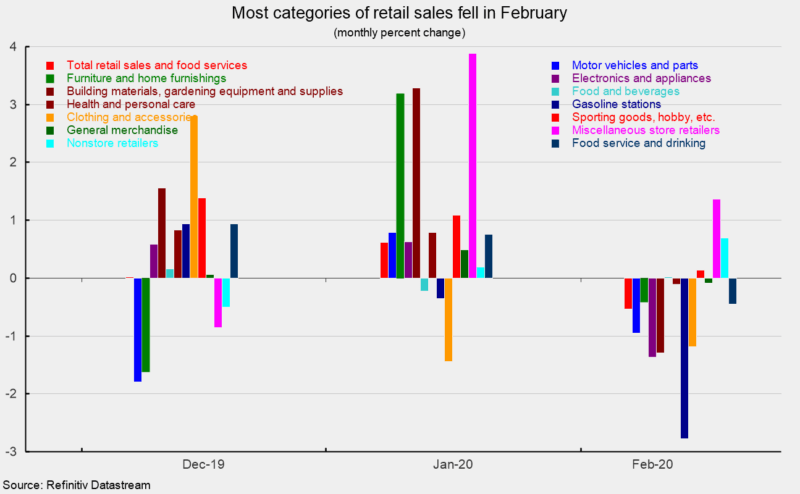

Weakness in February was widespread, with declines in nine retail-spending categories, while three categories posted gains and one was essentially unchanged (see chart). Declines were led by a 2.8 percent drop for gas station sales though volatility in gasoline spending tends to reflect changes in prices rather than changes in volume. There was a 1.4 percent decline for electronics and appliance stores, a 1.3 percent fall for building-material, garden-equipment, and garden-supplies dealers, a 1.2 percent decline for clothing and accessory stores, and a 0.9 percent retreat for motor vehicle and motor vehicle–parts dealers. The drop in motor vehicles was not surprising given the slower pace of unit sales, coming in at a 16.8 million-unit annual pace versus a 16.9 million rate in January.

On the positive side, miscellaneous store sales were up 1.4 percent, nonstore retail sales rose 0.7 percent, and sporting-goods, hobby, musical-instrument, and bookstores posted a 0.1 percent increase.

Retail sales were broadly weak in February. It’s unclear if the outbreak of COVID-19 had any significant impact. Weekly retail sales estimates from Johnson Redbook suggest sales spiked in mid-March as panic buying set in. Retail sales are likely to show significant weakness in late March and April as the effects of widespread quarantines and lockdowns materialize. That weakness sharply increases the risk of recession later this year.