Vaccinations and Stimulus Boost Consumer Sentiment As Impatience Also Rises

The final March results from the University of Michigan Surveys of Consumers show overall consumer sentiment rose in March, hitting the highest level in a year. Ongoing distribution of vaccines as well as expectations for stimulus were the primary drivers.

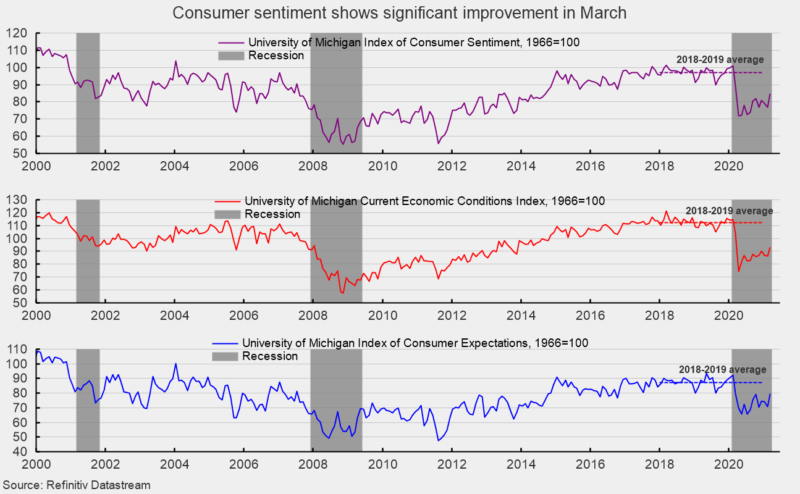

Overall consumer sentiment increased to 84.9 in March, up from 76.8 in February, a 10.5 percent rise and the highest since a reading of 89.1 in March 2020 (see top chart). From a year ago, the index is still down 4.7 percent. The sub-indexes both gained in March with the expectations component leading the move higher.

The current-economic-conditions index rose to 93.0 from 86.2 in February (see second chart). That is a 7.9 percent gain and leaves the index with a 10.3 percent decrease from March 2020. The second sub-index — that of consumer expectations, one of the AIER leading indicators — jumped 9.0 points or 12.7 percent for the month to 79.7 (see third chart) and is now equal to the March 2020 result.

However, all three indexes are still below the pre-pandemic levels, with the Current Economic Conditions index 17.3 percent below its 2018-2019 average and the Index of Consumer Expectations 8.7 percent below the recent average. Combined, the overall index sits 12.7 percent below the pre-pandemic average.

According to the report, “Consumer sentiment continued to rise in late March, reaching its highest level in a year due to the third disbursement of relief checks and better than anticipated vaccination progress.”

However, the report goes on to add, “As prospects for obtaining vaccination have grown, so too has people’s impatience with isolation, as those concerns were voiced by nearly one-third of consumers in March, the highest level in the past year.”

With regard to the economic outlook, the report adds, “The majority of consumers reported hearing of recent gains in the national economy, mainly net job gains. The data clearly point toward robust increases in consumer spending. The ultimate strength and duration of the spending surge will depend on the rate of draw-downs in savings since consumers anticipate a slower pace of income growth. Despite the vast decline in precautionary motives sparked by the easing of pandemic fears, those precautionary motives will not completely disappear.”

The report adds to the recent run of positive data that show widening vaccine distribution, and the easing of government lockdown restrictions are having a positive impact. Continued easing of restrictions is boosting the economic outlook, though the cumulative damage done to the economy by the lockdowns is likely to be a headwind and suggests that it may be several more quarters until complete recovery to pre-lockdown conditions. Nevertheless, the economic outlook is growing more positive.