University of Michigan Consumer Sentiment Fell Slightly in Early January

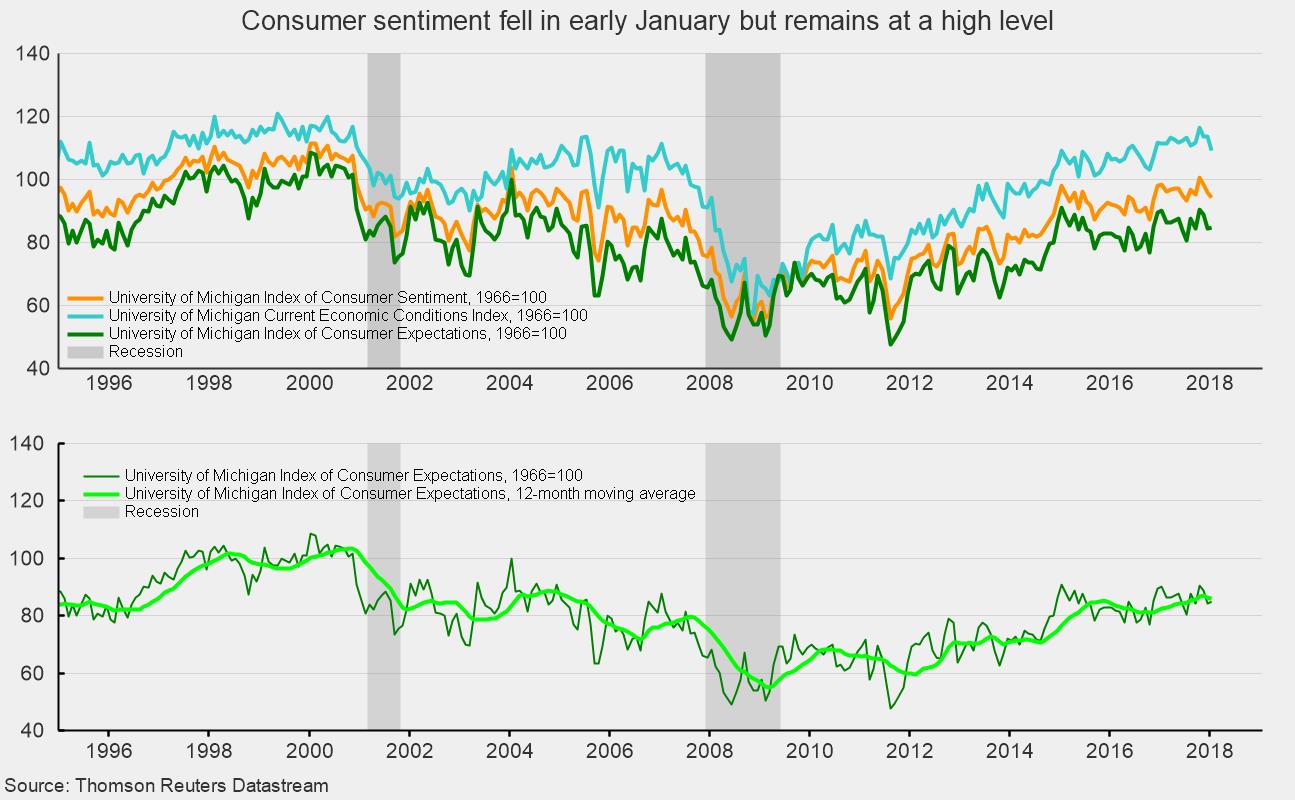

The preliminary January results from the University of Michigan Surveys of Consumer Sentiment show overall consumer sentiment fell slightly from the final December result. Consumer sentiment decreased to 94.4 in early January, down from 95.9 in December, a 1.6 percent decline. From a year ago, the index is off 4.2 percent.

The two sub-indexes had opposing performances in early January. First, the current-economic-conditions index dropped to 109.2 from 113.8 in December. That is a 4.0 percent drop for the first part of the month and a 1.9 percent decrease from January 2017.

According to the press release, “This small decrease in current conditions produced a small overall decline. Importantly, the survey recorded persistent strength in personal finances and buying plans, while favorable levels of buying conditions for household durables have receded to preholiday levels in early January, largely due to less attractive pricing.”

The second sub-index — that of consumer expectations, one of the AIER leading indicators — rose 0.6 percent for the month but still showed a 6.1 percent decline from the prior year (see top chart). Smoothing out the monthly volatility, the 12-month moving average came in at 86.1 in January, down 0.5 percent from December but still 4.4 percent above January 2017. The broad trend continues to be higher for the expectations index, which has plenty of room to move higher, given the highs achieved in the late 1990s and early 2000s (see bottom chart).

In regard to the forward-looking expectations index, the reported noted, “The Expectations Index remained virtually unchanged at 84.8. Tax reform was spontaneously mentioned by 34% of all respondents; 70% of those who mentioned tax reform thought the impact would be positive, and 18% said it would be negative. The disconnect between the future outlook assessment and the largely positive view of the tax reform is due to uncertainties about the delayed impact of the tax reforms on the consumers.” The report went on to note, ”Some of the uncertainty is related to how much a cut or an increase people, especially high income households who live in high-tax states, face.”

In addition to the tax-law changes, the reported indicated that “near and long term gas price expectations inched upward in early January but remained significantly below their peak. While long term inflation expectation remained at its 2017 average level and short term inflation expectation inched upward, consumers continued to remain very optimistic about the low national unemployment rate.”

Consumer sentiment remains at broadly favorable levels, supported by a robust labor market and a low pace of consumer price increases. Positive consumer sentiment should help support future gains in consumer spending.