Understanding the Greek crisis

As I write these lines, it is almost certain that Greece will default on its debt today, June 30. What led to such a disastrous situation? To understand, we must look back in time to the events leading up to and surrounding today’s expected default.

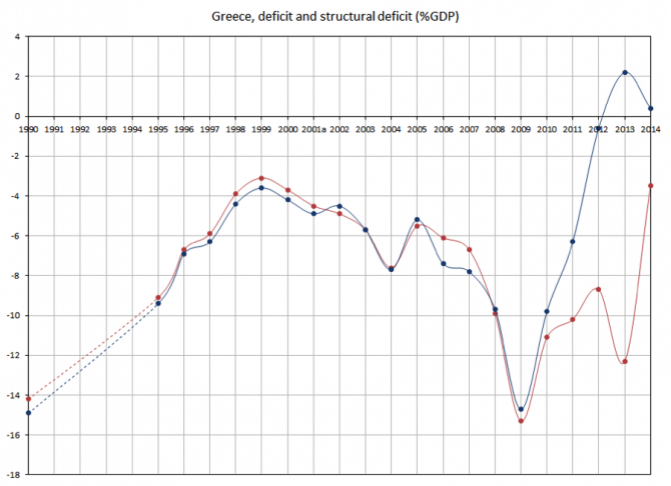

A brief clarification must be made in order to understand the events leading up to the current crisis. In economics, it is common to divide the deficit analysis in two, into the “deficit” and the “structural deficit.” The structural deficit is the equilibrium result of the budget, unaffected by business cycles. The deficit is the structural deficit plus short-run oscillation around its structural level.

The international financial crisis of 2008 significantly affected the outlook of the Greek economy. The structural deficit of Greece, plus its debt, resulted in a downgrade of Greek sovereign debt below investment grade. Because of this, Greece lost access to financial markets. Greece is part of the eurozone, which means that it cannot issue money to finance its deficits; it has to borrow.

With an inability to print new Euros, and without access to financial markets, Greece should have had to make similar decisions years ago to the ones it is facing today, particularly reducing the deficit or leaving the Eurozone. Together, however, the European Commission, the European Central Bank (ECB), and the International Monetary Fund (IMF) — commonly referred to as the “Troika” — decided to give Greece a bailout loan of 110 billion euros. This loan would have covered Greece’s financial needs between May 2010 and June 2013, but was conditional on Greece undertaking “austerity” measures. Greece, therefore, only received the loan under the condition that the structural deficit would be fixed.

The argument is straightforward: If the rest of the European countries are going to give taxpayer money to Greece, then Greece must stop spending beyond its means. Would you lend money to an individual who consistently maxes out his credit cards, allowing his credit score to be affected, but showing no sign of wanting to put his finances in order? Worse still, should your government force you to lend to such an irresponsible borrower?

Within a year, it became clear that the bailout loan fell short by more than half of what Greece needed, partly because Greece was slow in cutting down its structural deficit and because its spending continued to climb. In February 2012, a second bailout for 130 billion euros was approved and all private banks holding Greek sovereign debt had to accept a 53.5 percent loss. This second bailout loan would expire on December 2014.

These two bailout loans were not enough. In December 2012, the Troika agreed to extend Greece a third loan for the period of January through March 2015. However, by the end of 2013, Greece’s budget showed a structural surplus, output started to grow and unemployment was falling. This allowed Greece to regain its access to financial markets, and sell bonds in the private market to cover its financial needs for 2014.

The following chart shows the deficit and structural deficit (in percentage of GDP) for Greece and shows the structural surplus for 2013 and 2014. However, because of cyclical events, Greece still had financial needs for those two years. Greece has not had a budget surplus since before 1990 — and note that the worsening of the deficit started before the 2008 financial crisis.

Soon after, political events changed the situation for worse. In December 2014, the Greek Parliament called for premature elections. The left-wing Syriza party won on the promise that it would reject the austerity plan that had been negotiated with the Troika, and Alexis Tsipras became the Prime Minister of Greece. Unsurprisingly, the Troika reacted by suspending the remaining financial aid to Greece until the new government accepted compliance with the old agreement, or until a new agreement was accepted by both Greece and the Troika. The result of this was widespread market uncertainty, and investors pulled out — leaving the financial markets, once again, closed off to Greece.

The Troika extended the expiration date of the third bailout loan for four months to allow time for negotiations of the new loan conditions, but on June 26 Greece left the negotiating table and called for a nationwide referendum to decide whether or not the conditions of the loans should be accepted. The referendum is to be held on July 5, five days after Greece is supposed to make its June 30 debt payment — one that it does not presently have the funds to make. The loan expiration date was known well in advance, so it is fair to say that Greece waited too long to call for a referendum. The nation’s lack of financial resources to pay off its loan spurred a bank run, and the government imposed limits on cash withdrawals.

Unless the Troika once again decides to extend financial aid to Greece, the Greek people are facing two courses: accept the loan conditions and balance the budget; or default on the debt, leave the Euro, and introduce a new domestic currency (i.e., the drachma), possibly at a devalued rate with respect to the euro. Because Greece waited so long, its options are limited.

As a native Argentine, it is easy for me to draw a parallel between the current Greek crisis and the Argentine crisis of 2001. Both countries arrived a financial crisis after an unsustainable accumulation of deficits. Deficits do not fall from the sky; they are voted for and approved by political representatives. Both countries also limited bank withdrawals. The parallel extends even further, however, to what the Greek government and citizens should do.

Some economists and analysts suggest that Greece should follow Argentina’s steps, but this may not seem so advisable after taking a closer look at the current state of the Argentine economy. The loss of wealth after the crisis spurred Argentina’s government to impose price controls on utilities, so that utility prices did not rise with inflation. Those price controls were never lifted, though, and the ongoing lack of investment in utility sectors now shows clear bottlenecks in energy, communications, and transportation, which hampers Argintina’s international competitiveness. The structural deficit remains, and financing has shifted from foreign debt to the issuing of money.

The result is that Argentina has one of the highest inflation rates in the world. Price controls returned, this time applied to foreign currency markets, especially U.S. dollars — the Argentine people’s currency of choice, because the relative stability of dollars would allow them to protect themselves from inflation. Debt restructuring was handled in such a poor way that Argentina is, once again, in default.

There is still another lesson to learn from Argentina. Minister of Economics Lopez Murphy offered an austerity program that was rejected by the ruling politicians, forcing Lopez Murphy to resign. This did not allow them to avoid austerity, however. On the contrary, the government of Argentina ended up having to implement larger and more unorganized austerity measures.

It is likely that the default and crisis of 2001 was much deeper, and longer, than it would have been under a plan similar to that of Lopez Murphy. When a crisis looms like the one Greece faces today, or Argentina faced in 2001, austerity is no longer an option. What is left to be decided is not whether the budget will be balanced, but how.