U.S. Economy Posts Record Gain, But Areas of Weakness Persist

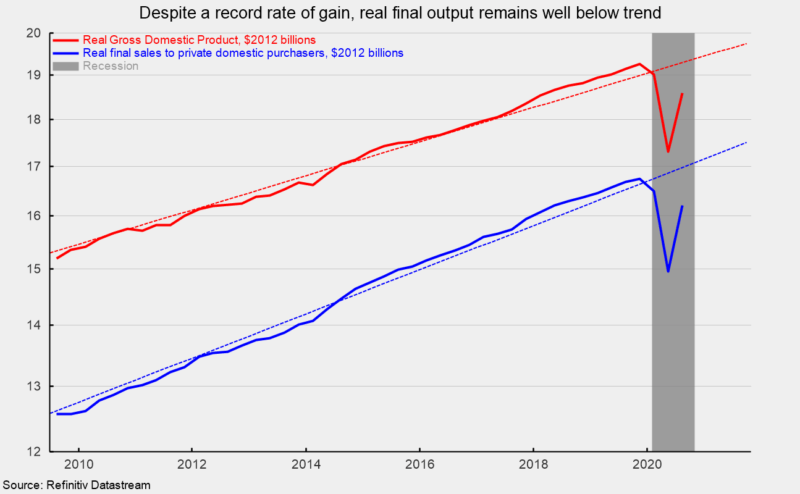

Real gross domestic product surged at a historic 33.1 percent annualized rate in the third quarter, up sharply from a historic 31.4 percent pace of decline in the second quarter. Over the past four quarters, real gross domestic product is still down 2.9 percent, and 3.4 percent, or $659 billion, below the previous expansion trend (see first chart). On a nominal basis, gross domestic product rose 38.0 percent in the third quarter, putting the change from a year ago at -1.8 percent.

Real final sales to private domestic purchasers, a key measure of private domestic demand, jumped at a 38.1 percent annualized rate in the third quarter, versus a 32.4 percent pace of decline in the second quarter. The rebound still leaves this important measure 4.2 percent below trend (see first chart).

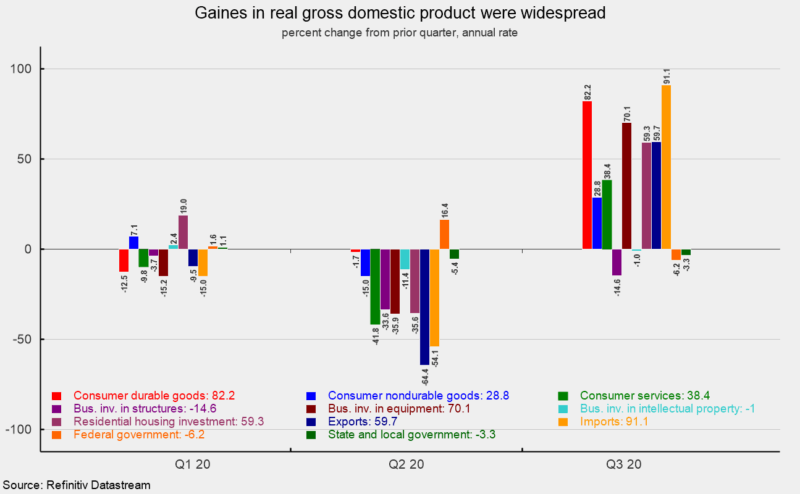

Gains were widespread across the different areas of the economy. Real consumer spending rose sharply in the third quarter, increasing at a 40.7 percent pace compared to a -33.2 percent rate in the second quarter. The gain was the result of rises in spending on durable-goods (up 82.2 percent) nondurable-goods (28.8 percent), and services (38.4 percent, see second chart). Business fixed investment increased at a 28.5 percent annualized rate in the third quarter of 2020. That gain was led by a 70.1 percent surge in spending on equipment while spending on structures fell 14.6 percent, the fourth consecutive decline, and Intellectual-property investment fell at a 1.0 percent pace (see second chart).

Residential investment, or housing, jumped at a 59.7 percent annual rate in the third quarter compared to a 64.4 percent drop in the prior quarter. Housing has shown resilience in the current environment as extremely low interest rates combined with the desire by some people to move away from virus epicenters has created demand.

Businesses liquidated inventory at a $1.0 billion annual rate (in real terms) in the third quarter versus liquidation at a $287.0 billion rate in the second quarter, adding 6.62 percentage points to third-quarter growth after subtracting 3.5 percentage points in the prior quarter.

Exports rose at a 59.7 percent pace while imports rocketed at a higher at a 91.1 percent rate. Since imports count as a negative in the calculation of gross domestic product, a gain in imports is a negative for GDP growth, subtracting 7.99 percentage points. Net trade, as used in the calculation of gross domestic product, subtracted 3.09 percentage points from overall growth.

Government spending fell at a 4.5 percent annualized rate in the third quarter compared to a 2.5 percent gain in the second quarter, subtracting 0.68 percentage points from growth versus a 0.77-point contribution in the second quarter of the year.

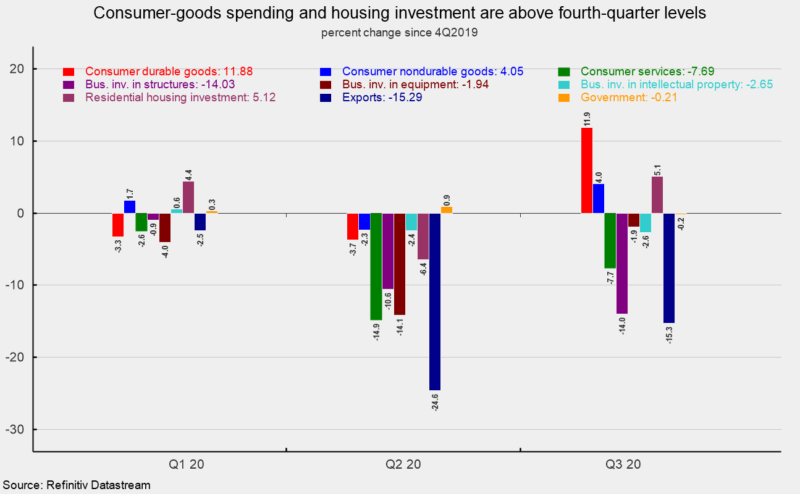

Despite the rebounds in the third quarter, several key components of domestic demand remain well below their fourth-quarter 2019 level (see third chart). Consumer spending on durable goods and on nondurable goods as well as new home construction are the three areas that are above prior peaks while consumer services, all three major components of business fixed investment, and exports are all well below the fourth quarter. High levels of uncertainty, especially regarding policy, are likely to sustain an elevated level of caution among businesses, resulting in weak investment and slow recovery for the labor market.

Consumer price measures also showed a rise in the third quarter. The personal-consumption price index rose at a 3.7 percent annualized rate, up from a -1.6 percent pace in the second quarter. From a year ago, the index is up 1.2 percent, well below the Federal Reserve’s 2 percent target. Excluding the volatile food and energy categories, the core PCE (personal consumption expenditures) index rose at a 3.5 percent pace versus a drop of 0.8 percent in the second quarter. From a year ago, the core PCE index is up 1.4 percent and has been at or below 2 percent since 2012. The U.S. economy suffered a historic contraction in the second quarter as government shutdowns intended to fight the COVID-19 outbreak sent economic activity plunging and unemployment soaring. Reopening has spurred a historic rebound in the third quarter, but some areas of the economy remain below pre-pandemic levels. A resurgence of new cases and deaths attributed to Covid-19 as well as the extreme partisanship related to the upcoming elections is sustaining a very high level of uncertainty, confusion, and risk aversion among consumers and businesses, putting the recovery at great risk.