U.S. Consumers Taking Their Confidence on Vacation

The Wall Street Journal recently ran an interesting article on “The Smartest Way to Take a Vacation,” which is especially relevant this summer, as we see Americans increasingly opening their wallets for a warm-weather getaway.

The story highlights three conclusions: Longer vacations aren’t necessarily better than shorter ones. Engage in activities you haven’t done before, even if you’re at home on a staycation. And end a trip on a high note. The article goes on to offer other recommendations on the degree of separation from work-related activities, including how often to check email while on vacation, as well as the vacation planning process, and how to reengage with work.

This seems like a worthy effort as American consumers, who are in better shape overall, prepare for and engage in summer vacations. Confidence is up near expansion highs, net worth is at a record high and the unemployment rate is down substantially, though underemployment and slow wage growth persist (See the July Business Conditions Monthly.)

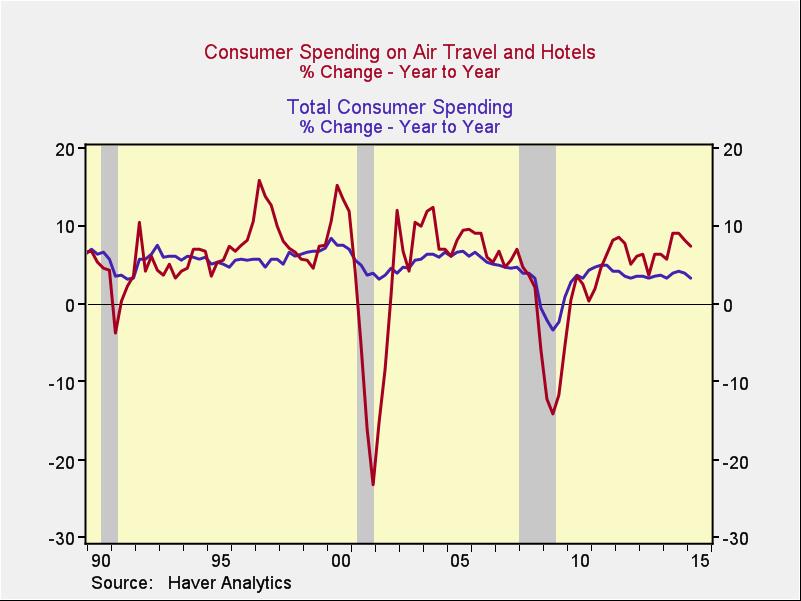

Those fundamentals helped retail sales rise at a 6 percent annualized rate in the second quarter, after a 4 percent decline in the first. Interestingly, consumer spending on air travel and hotels has been growing at a much faster pace than overall consumer spending (Chart 1), though a good portion of the faster rate of growth is due to faster growth in prices in those areas.

Nevertheless, Americans seem to be out there vacationing, in spite of the higher costs. The total number of miles being driven is at a record high, as is the number of visitors to national parks, as well as consumer spending at theme parks.

While economists and policymakers are hard at work worrying about consumers, Americans are out on vacation. Good for them!