Total Unemployment Benefits Recipients Hovering Near 30 Million

Government-imposed restrictions intended to slow the spread of Covid-19 continue to wreak havoc on the economy and the labor market. The longer businesses remain closed or limited, the more uncertain a labor market recovery becomes and the higher the probability of a slow and drawn-out economic recovery.

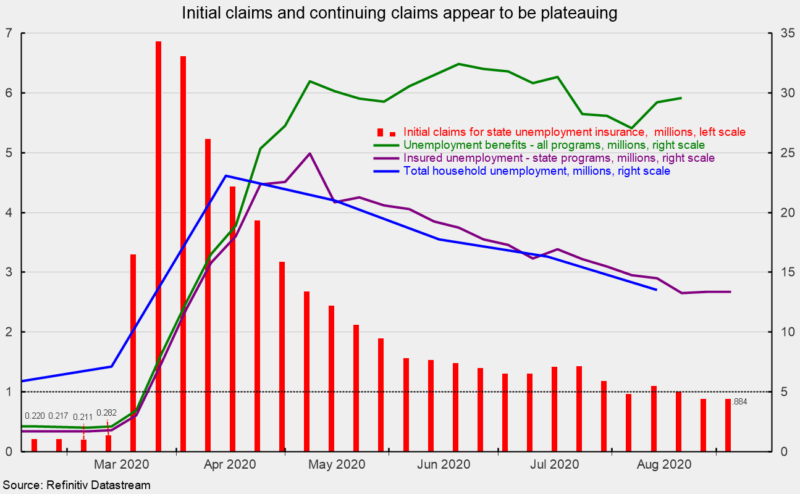

Initial claims for regular state unemployment insurance totaled 884,000 for the week ending September 5, unchanged from the previous week’s revised tally (see first chart). The latest two weeks are at the lowest level since the implementation of lockdowns in March. However, they also mark the 25th week of historically massive claims. Prior to the lockdowns, initial claims were running around 230,000 (see first chart). The number of initial claims surged in the initial phase of government lockdowns, hitting almost 7 million for the week ending March 28. The number of initial claims declined fairly rapidly over the next 10 weeks but since early June, the declines have slowed significantly with some weeks showing slight increases. Persistent initial claims at such a historically high level are a very troubling sign for the economy.

The number of ongoing claims for state unemployment programs totaled 13.385 million for the week ending August 29, up 93,000 from the prior week. For the same week in 2019, ongoing claims were 1.683 million. The insured unemployment rate for these programs was 9.2 percent, up from 9.1 percent in the prior week.

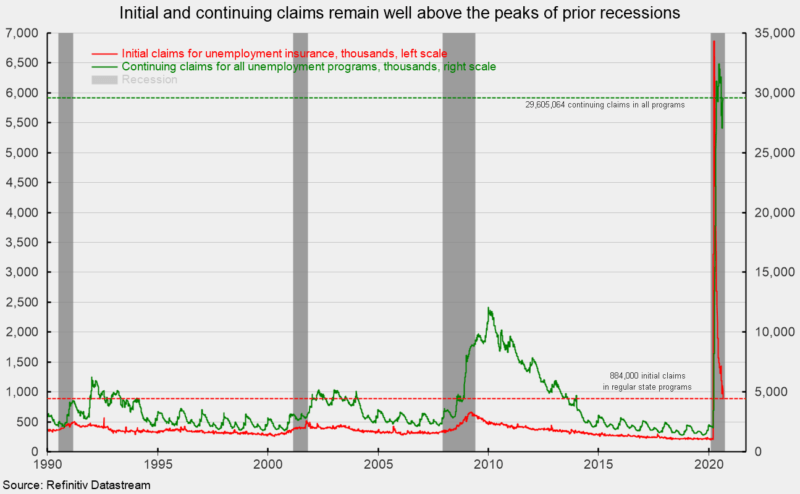

The total number of people claiming benefits in all unemployment programs including all emergency programs was 29.605 million for the week ended August 22, up 380,379 from the prior week and the second weekly increase in a row. While there has been improvement from the catastrophic results in March and April, the current level of weekly initial claims is still very high and continuing claims are still massive by historical comparison (see second chart).