These are Not Just Opinions

The theme of Financial Exclusion is that market competition can help those who suffer from financial exclusion, discrimination, and predation. The theme of this post is that market competition can also ameliorate the suffering of authors tired of dealing with university presses and commercial publishers!

University presses were once synonymous with quality scholarship but increasingly many of them have been publishing some real stinkers. Recently, one of the elite university presses asked that I recommend for publication, in one of my editorial capacities, an excerpt from a book it had recently published. Although its topic was extremely interesting, the book was chock full of factual inaccuracies, like a reference to the “Hoover Institute at Stamford University” when the author clearly meant the Hoover Institution at Stanford. These were not opinions, but outright errors, yet they now bear the imprimatur of a hoary institution (but thankfully not my name).

For authors, university presses were never easy to deal with but at least scholars could expect decent feedback from anonymous reviewers. No more. Before the AIER’s recent efflorescence, I shopped my manuscript around and met rejection at two university presses when apparently the same referee claimed that the notion that competition can ameliorate financial exclusion was just my “opinion.”

Now, I have been teaching university for two decades and am, lamentably, accustomed to encountering students who cannot discern the difference between mere opinions, which are based wholly on subjective evaluations, and learned judgments, which are based on the rational evaluation of empirical evidence. But the fact that storied university presses are now confused about the distinction does not bode well for their reputation or continued existence.

After all, the claim that easier entry can help to reduce financial exclusion, discrimination, and predation is not my opinion, it is my learned judgment, based on 928 references to 44 pages worth of key primary and secondary sources, and literally decades of writing and teaching about U.S. financial history. That does not mean that my interpretation is correct in some cosmic sense, but it most assuredly is not my opinion.

If you can’t understand that, I opine (am under the opinion that) you’re an ugly ideological zealot. I’m in jest about that, of course, as such a claim would be ad hominem. Claiming that somebody’s learned judgement is “just an opinion,” however, is also ad hominem because it attacks the author’s credentials rather than the merits of his or her argument and evidence.

So, please, read Financial Exclusion and find fault with it if you can, but don’t call it my opinion. And if you possess a worthy manuscript of your own, consider publishing it with AIER. In my learned judgement, the probability that you will be happy you did exceeds the probability that you will be happy with a university or commercial press.

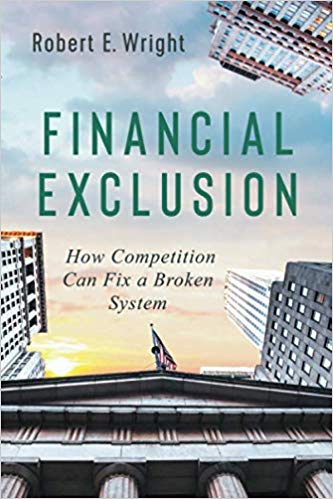

As evidence of that claim, compare the covers of my Corporation Nation (University of Pennsylvania Press, 2014) and Financial Exclusion. Although both are based on images of corporate edifices, the cover of the latter soars far above that of the former, which bears no clear relation to the devolution of corporate governance, the topic of Corporation Nation.

Those who view the cover of the AIER book, by contrast, immediately feel excluded from the financial institutions soaring above them. The partly cloudy sky symbolizes that competition cannot eliminate bigotry, but can brighten horizons. The sun, a la Benjamin Franklin, may be setting or rising, depending on whether policymakers return to the self-help policies that mitigated the effects of financial exclusion in America for several centuries, or if they continue to rely on heavy-handed interventions like those that led to the financial crisis in 2008. Ultimately, the eye is drawn to the limp American flag in the center of the picture. It suggests, as the book itself does, that while the U.S. financial system is not what it once was, the stiff breeze of competition could enliven its star-spangled banner once more.

Mind you, I played no part in the design of the cover other than to approve its brilliant conception and execution. AIER staff wisely jettisoned my cover art ideas, which, unlike the book’s content, were merely opinions, and lame ones at that.