The Reason Congress Won’t Control Spending

Earlier this month, Congress passed an omnibus spending bill to keep the government running that authorized $1.3 trillion in spending detailed in a 2,232-page document that absolutely no one read. It was classic logrolling.

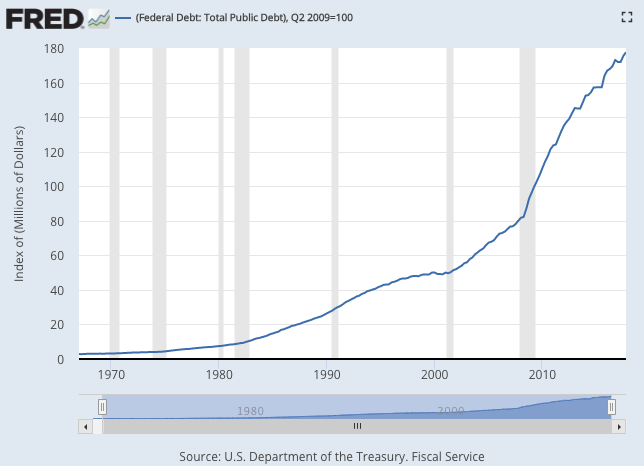

Both parties got what they wanted even as politicians on both sides of the aisle attacked the bill, the process, and the effect on the deficit (soon to be $1 trillion), and the federal debt (which has now surpassed an unthinkable $21 trillion).

Observers on all sides decried it as a monstrosity. The president signed it even as he too denounced its existence.

NPR sums up the strange spectacle:

This bill basically flashes the green light for spending on all the discretionary functions of the federal government, which means everything except entitlements (Social Security, military and other pensions, and the interest payments on the national debt). That covers a lot of government for a whole fiscal year.

The bottom line in dollars was a mind-boggling record, in part because President Trump demanded and got the biggest increase in defense spending in 15 years. Also escalating the price tag was the Democrats’ insistence on rough parity for spending increases for domestic programs as well.

All this new spending is, of course, entirely debt-financed. That is because previous spending levels were already higher than revenues and because the recent tax cut bill further widened that gap by reducing those revenues. The next budget’s deficit will be in the neighborhood of $1 trillion for a single year.

You can decry it all as irresponsible, reckless, even immoral. This is right. Maybe many people Washington will agree with you. And yet there doesn’t seem to be anything anyone can do about it. Nothing stops the insanity, not the constitution, not political pledges, not concerned taxpayers, not earnest political commentators.

The situation gets worse by the decade. It’s remarkable to recall that the size of the deficit and debt was a huge source of controversy in the 1980s.

Now contrast the situation at the level of the states. Half today have budgets in deficit, but the deficits are in the $100s of millions. Ever wonder why state and local government can’t run billions and trillions in deficits and the federal government can? True, lower levels of government typically have rules in place that prevent it, but there’s more going on. What restrains them are the same forces that restrain corporations, small businesses, and even you from running up an endless amount of debt.

Your Bank Would Decline

Think about it from your own point of view. You have a house debt, a car debt, and your credit card debt is growing. Inspired by a scene in Real Housewives, you try to borrow another $16K on a big Bloomingdale’s trip. The card is declined. You hit the roof and call the bank.

“Hey, why did you reject my purchase?”

“Well, we are so sorry but you have too much debt and not enough income.”

“Why does that matter?”

“We have doubts about your ability to pay this off. You have quite enough debt given your income stream and your credit history. It’s too big a risk.”

This is the market applying discipline to your spending habits. You might want more, more, more, but the market itself is imposing limits on you. It doesn’t matter how much you beg, if your creditor thinks you are a default risk, you are toast. You need to cool it and bring your spending in line with reality.

The same happens with businesses. Banks say no if the revenue stream does not support more borrowing. And if the corporation issues bonds for investors to buy, the bonds are rated according to default risk. This default risk operates as a premium on the price of the bond. This allows for a market for quality among all types of debt.

Debt Ratings

Bonds are rated most commonly like grades: AAA for the best and D for the worst. The lower the quality of debt, the smaller the market. At some point, there are no buyers remaining. That’s when the spending must stop and the financial discipline must begin.

What keeps the market for debt operating in a realistic and responsible way is an accurate, non-distorted default premium on every debt instrument. The people who are extending the credit need make their best guess on the likelihood that it will be paid back, based on any factors that affect the financial soundness.

When rating agencies and lenders underestimate the default risk, default premiums are too low for the actual risk. When defaults occur above the expected rate, default premiums rise, the market shrinks, and investors can take heavy losses. This happened, for example, in the mortgage markets in 2008. The higher default premiums reduced supply of credit and restored discipline to mortgage lending. Far from being a disaster, this is exactly what needed to happen.

Now consider the federal government. Its debt is rated by all agencies at AAA, except for Standard & Poor’s where it is a single notch lower at AA+ (a downgrade that was considered as an act of treason when it happened in 2011).

These high ratings are ridiculous by normal market standards. The US government has issued about $20 trillion in debt of which the public holds $13.6 trillion, and governments hold the rest. But the government is not paying this debt off. The deficit, which is the amount of new debt the government will issue to cover annual expenses, will soon approach $1 trillion.

On top of that, the government has incurred additional long-term liabilities of $130 trillion and more, for Social Security, Medicare and other promises, and continues to add more at an alarming rate.

If we used real-world standards on the ability of the debt insurer to pay, would this debt be a good risk? That’s a tough question because markets correctly assume that there are no circumstances under which it will not be paid. The market is behaving entirely rationally here; what’s irrational are the conditions that permit the government to evade all normal standards of fiscal discipline.

We’ve already seen how market-based risk assessment is the real limit on the ability of individuals and institutions to run up endless amounts of debt. The problem is that this market seems to allow the federal government a limitless capacity to continue to add to its debt and unfunded liabilities.

The crucial question: why?

The Fed

The crucial answer: the federal government has access to a printing press that can run without limit. The Federal Reserve is the reason. This is why their default risk premium on US debt is completely unlike that of Illinois, Microsoft, or you and me.

Notice that this problem didn’t actually become one until the limits on the ability of the Fed to create an infinite inflation were completely removed until after 1971. Once the last remnants of the gold standard were wiped out, the limits on the ability of the government to expand were effectively removed.

Think of your own case. If you could explain to the bank that you have a printing press in your basement that allows you to supplement your income whenever necessary, the bank might send you on your way and approve that $16K transaction.

But you do not. Neither do state governments. Neither do corporations.

If you want Congress to restrain spending, lectures and laws are not going to do it. What you need is a realistic default premium on US debt so that spending is disciplined by market standards. It is the market that restrains spending. Congress needs the same restraint.

But this requires, above all else, getting rid of the promise to bail out the government no matter what.

Yep, that would mean ending the whole underlying purpose of the central bank. It would mean, in effect, abolishing the Fed itself. Only that will bring market discipline to government. Just like it brings discipline to state government, corporations, and you and me. So long as the central bank stands ready to pay for whatever Congress does, there is no practical reason for Congress to restrain spending, much less pay off the debt.

This is why all the homilies you hear every day now on the danger of the debt and deficit – and why the US must never cut taxes for fear of increasing them – are mostly political rhetoric designed to perpetuate the ongoing pillaging of the American taxpayer. The way to restrain debt accumulation is through spending control, and the way to impose that is through market discipline under real-world conditions.

The real world, in this case, means ending the power of the federal government to pay for its profligacy with money printing. Until that happens, all promises to restrain government spending are worth as much as the Continental.