The Overheating Canard

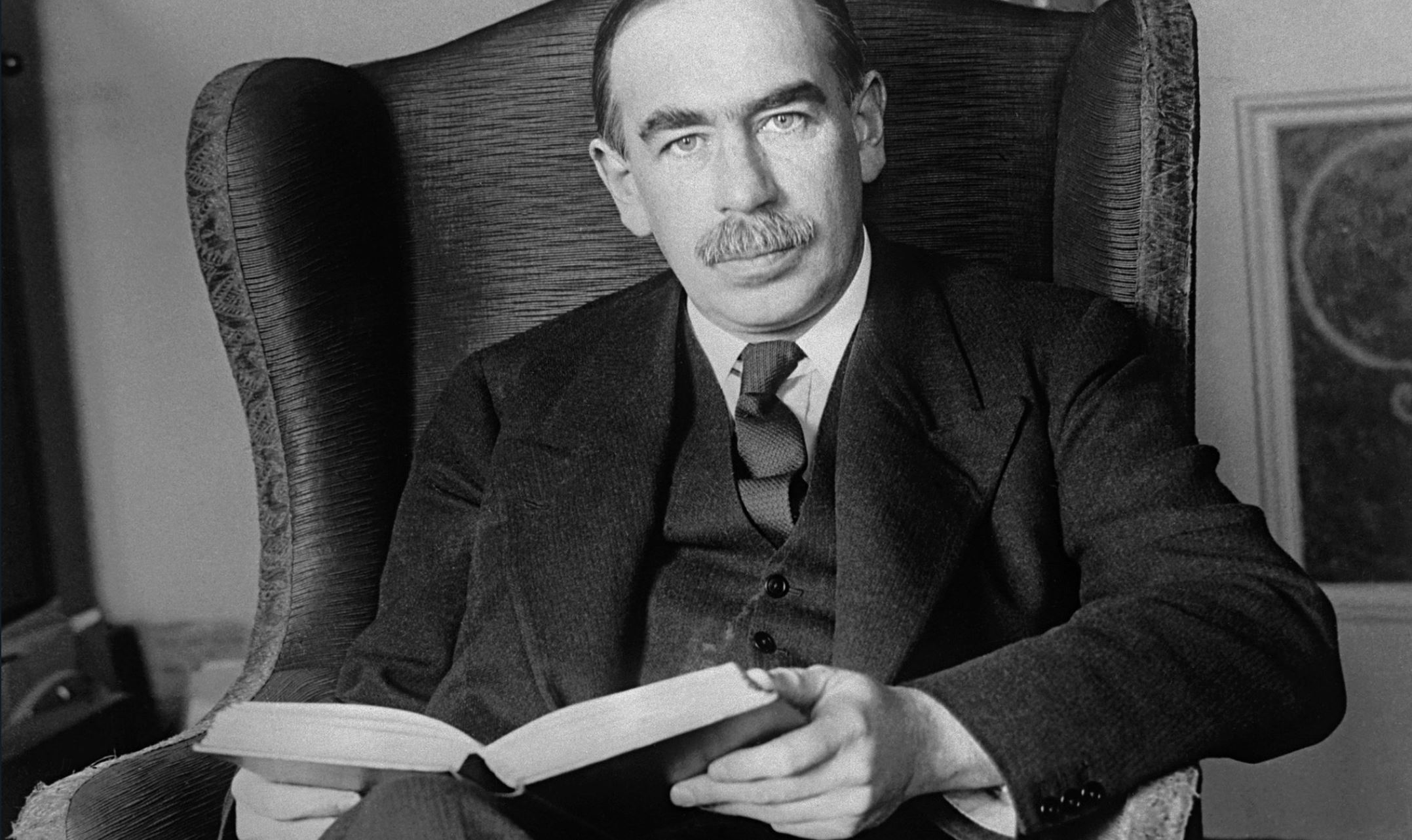

“Practical men who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back.” This is how John Maynard Keynes described the relationship between original thinkers, on the one hand, and second-hand dealers in ideas—journalists, activists, and politicians—on the other.

People usually believe that they are just espousing common sense, when what they are actually doing is unwittingly parroting the peculiar ideological orthodoxies of some professor in the past.

It is a rich irony of history that the said “madmen of authority” and “practical men” of today’s world, when it comes to economics at least, for the most part are the slaves of the late Keynes himself. One of his main assertions, which is more difficult to kill than a zombie in sci-fi movies, is that there must be a trade-off between inflation and unemployment.

If inflation goes up, then unemployment must go down, so the thinking goes. If there is full employment and wages start going up, that’s a sure sign of impending inflation, that the economy is “overheating” and consequently it has to be cooled down by the central authorities through increased taxes and tighter monetary policy. However, if unemployment is low, then the government has to shift the printing press into sixth gear and finance a budget stimulus to “warm up” the economy.

This Keynesian thermodynamics is thoroughly absorbed, almost by osmosis, by journalists, intellectuals, and even economic analysts. It’s everywhere. Over the last couple of weeks, a breathless chorus of Keynes’s adherents in the media have been sounding the alarm from the rooftops about economic “overheating.”

The economy is doing too well, it’s almost at full employment, and wages are growing. Rising wages will lead to inflationary expectations, these expectations to Fed rising interest rates, and all of this to recessionary pressures.

At the center of this phenomenon is the pernicious idea that economic growth is impossible without governmental macroeconomic alchemy. The sheer panic with which the economic Intelligentsia sees the minimal tax cuts by the Trump administration is deeply reflective of this: why stimulate an economy which is already at full employment? Didn’t Keynes himself explain that taxes should be cut only during recessions to stimulate aggregate demand, not during a full-employment boom?

What this means is that people who are essentially already doing fine, both investors and workers, will now have more money for themselves and pay a little less to the government! We cannot have that, it will lead to inflation!

Let this sink in. We have full employment and healthy economic growth. Then the federal government lowers corporate and income taxes. How do economic actors react? Do they seek to invest more in future production and in current real wage growth?

No, in this strange Keynesian world, real wages are not determined by marginal productivity of labor; marginal productivity of labor is not affected by capital investment per worker; and capital investment per worker is not affected by marginal propensity to save, which in turn is not affected by lower cost in form of lower taxes. There are no microeconomic, supply-side ways of increasing wages and “productive capacity;” there is no non-inflationary growth.

The basic fallacy of all these “supply-side” and cost theories of inflation is, however, deeper: it follows from the view that prices are determined by costs. Costs are mythical pre-existing objective characteristics of factors of production. If costs increase, prices will increase and we’ll have inflation. Essentially, Alfred Marshall’s misconstrued notion of “real costs” is the true source of the misconceived Keynesian cost-push inflation: both substitute cause for effect, believing that costs precede prices both temporally and logically.

In reality, costs are epiphenomena of the process of imputation of consumer demand to the factors of production. They are not pre-existing objective determinants of prices.

Real wages grow not because they simply do, but because entrepreneurs anticipate increased demand for final goods and services, or for some goods and services that participate in their production. Real wages of steel factory workers increase because the price of steel relative to other prices increases. The price of steel does not increase because wages of steel worker increase first for some mysterious reason, forcing buyers to pay more for steel since steel producers now have “higher costs.”

And even if all wages increase simultaneously, that is an increase in the relative price of labor vis a vis other factors of production. It’s a change of value of one group of assets relative to other assets and factors of production. Are we going to say that whenever any change in relative prices occurs in the economy that will lead to “cost-push inflation”?

All this does not mean that the fears of inflation are unjustified. It only means that citing real wage growth as a cause for this fear does not make much sense. If inflation increases, wages will too, but that will not be the cause of inflation, rather one of its many consequences.