The Nonmanufacturing Sector Gained Momentum in February on Strength in Activity and New Orders

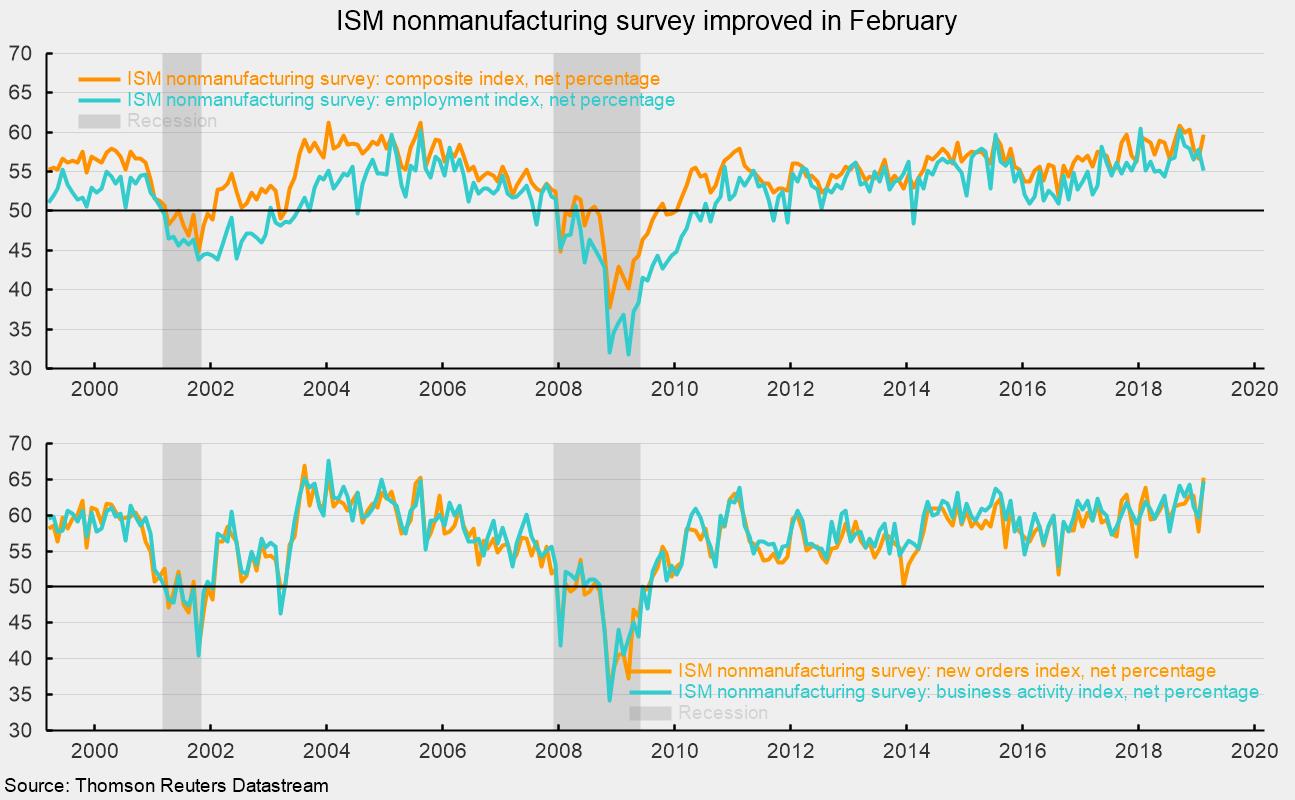

The Institute for Supply Management’s nonmanufacturing composite index rose to a reading of 59.7 from 56.7 in January (see top chart). For this index, 50 is neutral, with readings above 50 suggesting expansion and readings below 50 suggesting contraction. Typically, the nonmanufacturing index ranges between 50 and 60, with dips below 50 during recessions. Historically, readings above 48.6 have suggested expansion of the overall economy. The February result is the 115th consecutive month of expansion.

Among the key components of the nonmanufacturing index, the business-activity index (equivalent to the production index in the ISM manufacturing report) was 64.7 in February, up from 59.7 in January (see bottom chart). For February, 16 industries in the nonmanufacturing survey reported growth while 1 reported contraction.

The nonmanufacturing new-orders index came in at 65.2, up from 57.7 in January (see bottom chart). February was the 115th month with readings above 50. The new-export-orders index, a separate index that measures only orders for export, was 55.0 in February and has been above 50 for 25 consecutive months.

The nonmanufacturing employment index decreased to 55.2 in February, versus 57.8 in January. The favorable readings from this and the manufacturing survey released on Monday suggest employment likely increased in February. The Bureau of Labor Statistics will be releasing its own employment report for February on Friday, March 8.

Supplier deliveries, a measure of delivery times for suppliers to non-manufacturers, came in at 53.5, up from 51.5 in January. It suggests suppliers are falling farther behind in delivering supplies to non-manufacturers, and the slippage has accelerated a bit from the prior month.

The one component that had been raising concerns in the nonmanufacturing report is the prices index. It had been bouncing around in the 60–65 range from September 2017 through November 2018, but it has fallen in two of the last three months, dropping to a reading of 54.4 in February. February was the 21st month in a row that the prices index has been above 50. This result suggests non-manufacturers are experiencing materials-costs increases but that the pressure may be easing a bit.

Today’s report from the Institute of Supply Management suggests the nonmanufacturing sector continued to grow in February, and is part of a growing list of data that suggests the period of weakness over the last few months may be coming to an end.