The Market for Cryptocurrencies in 2017

With 2017 coming to a close, I thought it would be useful to take stock of the market for cryptocurrencies; to reflect on what has gone well over the past year and what improvements might be made in the year to come.

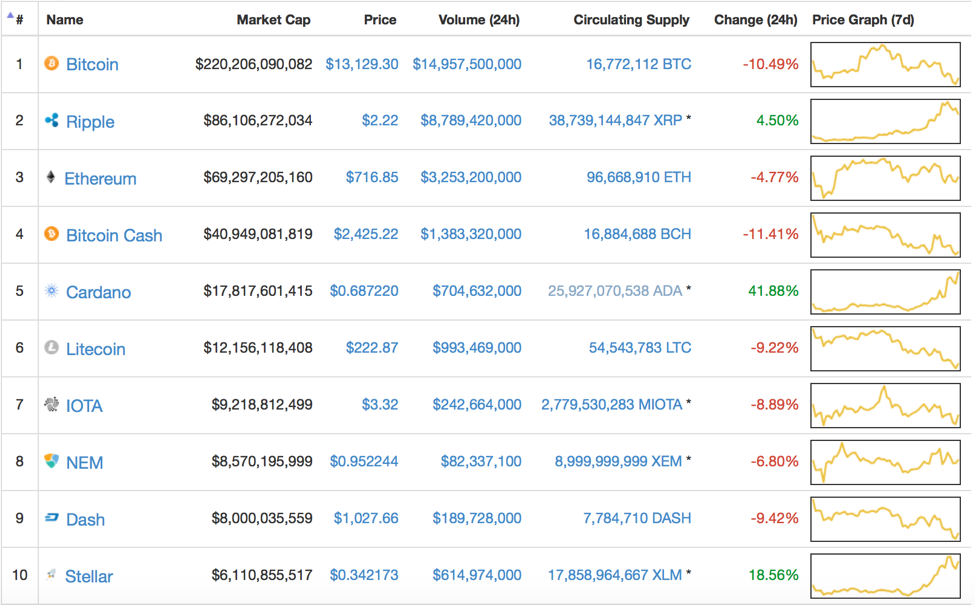

It has been a big year for cryptocurrencies, to be sure. The market capitalization of bitcoin is around $220 billion at present. It began the year at a mere $16 billion, but the network has grown and matured a bit in the time since. Futures markets, for example, launched earlier this month. Although they are still very new, they offer much promise.

Competition is strong. Ripple and Ethereum continue to serve as unique alternatives—one a centralized ledger, the other a platform for a host of decentralized applications. Bitcoin Cash has charted a path to overcome scalability issues, keeping transaction fees low in the process. And upstarts like IOTA, which promises to facilitate communications and payments on the internet of things, have come to prominence.

Much progress has been made in the market for cryptocurrencies. And, yet, there is still much room for improvement.

One of the biggest problems in the market for cryptocurrencies is regulatory ambiguity. According to Coin Center, only nine states have adopted clear and narrowly tailored regulations for cryptocurrencies. Regulatory ambiguity discourages entrepreneurs from supporting existing cryptocurrencies and offering potentially-superior alternatives. It puts an unnecessary and unproductive cap on network size.

Another problem, especially for bitcoin, is scalability. It is hard to imagine how Bitcoin could live up to its promise as global payments system with a mere four transactions per second and transaction fees exceeding $20. SegWit activation was a good first step. But widespread adoption of SegWit in the near term and increasing the block size limit in the medium term are essential.

Finally, we must improve the level of discourse surrounding cryptocurrencies. As the price of bitcoin picked up in the last half of the year, high-profile naysayers—from Jaime Diamond to Joseph Stiglitz—came out of the woodwork. The response from the cryptocurrency community was subpar at best. Many advocates failed to identify the specific applications where bitcoin might function as a superior alternative. Instead, they reasoned from cost-to-value and, when the price slumped, clung to HODL memes.

You can be sure that, in 2018, those of us at the Sound Money Project will continue our efforts to improve the level of discourse surrounding cryptocurrencies; stress the need to scale; and promote clear, narrowly tailored regulations that will not hamper innovation. We hope you will join us.