The Latest Labor Market Indicators Ticked Down but Still Suggest Future Gains

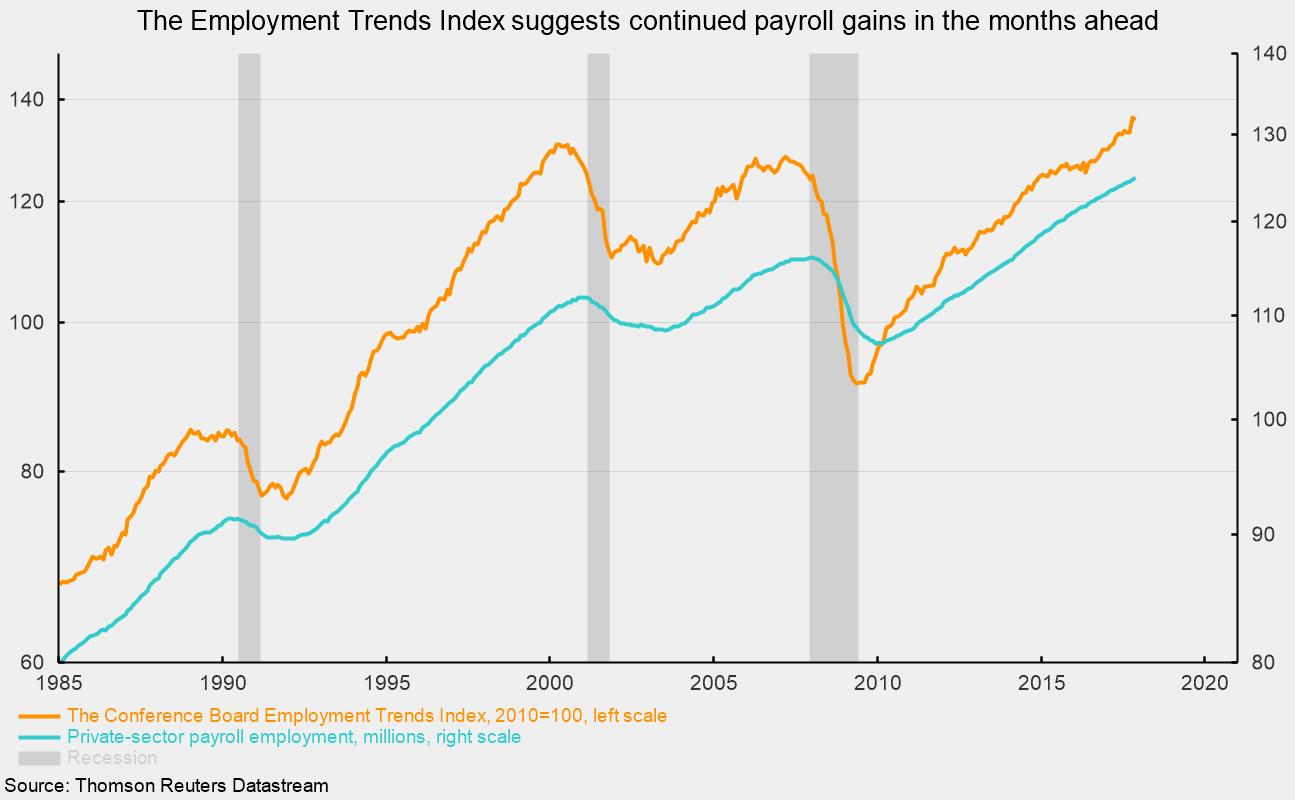

The Conference Board Employment Trends Index ticked down slightly in November after surging to a record high in October. The ETI tends to lead private payroll employment by about four to five months, and, despite the slight decline in the latest month, still suggests further gains in payrolls in coming months (see chart). In November, the index declined to 135.9 from 136.2 in the prior month. Even with the slight decline, the ETI is up 4.7 percent from a year ago.

The ETI is a composite index consisting of eight indicators: the percentage of respondents who say they find “jobs hard to get,” from The Conference Board consumer-confidence survey; initial claims for unemployment insurance, from the Department of Labor; the percentage of firms with positions not able to be filled right now, from the National Federation of Independent Business Research Foundation; the number of employees hired by the temporary-help industry, from the Bureau of Labor Statistics; the ratio of involuntarily part-time to all part-time workers, from the BLS; job openings, from the BLS; industrial production, from the Federal Reserve Board; and real manufacturing and trade sales, from the Bureau of Economic Analysis.

A separate report from the BLS shows a similar pullback in the latest month but also suggests continued strength in the labor market. Total job openings in the United States fell to 5.996 million in October from 6.177 million in September. Private-sector jobs openings totaled 5.462 million in the latest month. The jobs openings rate, openings divided by the sum of jobs plus openings, ticked down to 3.9 percent from a record-high 4.0 percent for the total labor market, and dropped to 4.2 percent from a record-high 4.3 percent for the private sector. The highest openings rates were in accommodation and food services (5.4 percent), health care (5.0 percent), and professional and business services (4.9 percent) while the lowest openings rates were in wholesale trade industries (2.1 percent), education (2.6 percent), and mining and logging (2.8 percent).

Further signs of labor market strength may be seen in the layoffs rate, which dropped to 1.2 percent for private employers, well below the 2.2 percent peak rate in 2009, and the quits rate, which remained at 2.4 percent in November, well above the 1.4 percent low in 2009.

Combining the data on people looking for work or who want a job but haven’t looked in the past month with the jobs openings data, the number of available people per opening fell to 1.869, the lowest on record and just a fraction of the 9.923 people per opening available in 2009, just after the end of the Great Recession.

Overall, the data relating to the labor market continue to show strength. Payrolls are rising, layoffs remain low, and quits have risen. The substantial number of open positions in the economy while the unemployment rate remains near cycle lows suggests wage gains may accelerate, but, as of now, increases have remained quite moderate.

Accelerating wages gains are a double-edged sword: faster gains boost income and potential spending; however, they could also boost price pressures if employers try to pass higher labor costs on to consumers. The two wild cards are the low productivity rate and low participation rate. An acceleration in productivity could offset higher labor costs, while a rising participation rate could ease some of the tightness in the labor market and keep a lid on wage pressures.