The Keynesian Trap: Lessons From the Japanese Slump

The macroeconomic demand theory formulated by John Maynard Keynes is no longer the leading paradigm in economics departments. But it lives on as vulgar Keynesianism at the policy level.

There the belief is still widespread that the economy needs an active stabilization policy and that monetary and fiscal stimuli are necessary to achieve high economic growth, full employment, and a stable price level.

Not welcome at all are the voices that claim that such economic policy itself is often the reason for inflation, unemployment, and recession. Yet examples abound. An instructive illustration of a government-induced long stagnation is how Japan got into and become stuck in the economic doldrums in recent decades.

Stimulus Policy in Japan

Since the economic downturn began in the early 1990s, Japan has been trying to escape its economic predicament with the quackery of a policy aimed at stimulating aggregate demand. From the start of the recession onward, the Japanese government has tried to boost the economy with a series of hefty expenditure programs. The Japanese central bank pushed interest rates into negative territory.

Yet despite this perfect Keynesian-textbook policy making, the economy has not revived. As a legacy of the policies, the Japanese government debt has grown to a dimension rarely reached outside of times of war.

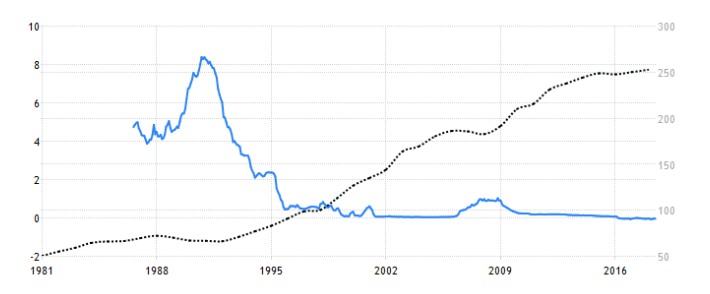

Since the 1990s, Japanese government debt as a percentage of gross domestic product has risen by 200 points to over 250 percent at the end of 2017. The Japanese central bank has put its key rate close to zero and, since 2016, at −0.1 percent, even into negative territory (see figure 1).

Figure 1

Source: Central Bank of Japan, Ministry of Finance. TradingEconomics.com

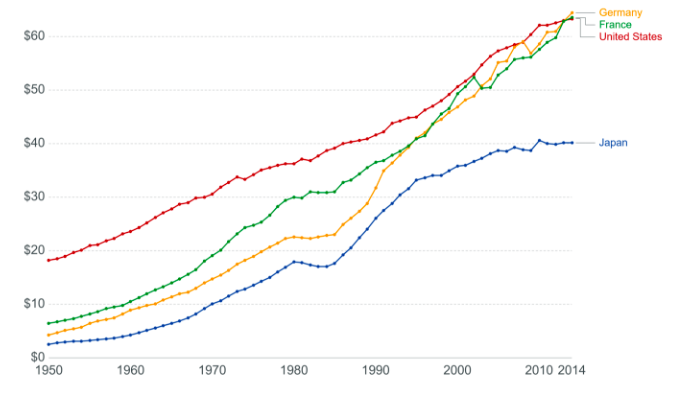

Despite these heavy dosages of stimuli, economic growth has remained weak. The fiscal packages and the monetary impulses have not gotten Japan out of the slump. Even worse, the economy suffers from stagnating productivity. The data show that Japan has been falling behind the United States, Germany, and France in productivity since the middle of the 1990s and suffers from a big gap today (figure 2).

Figure 2

What remains of the fiscal policy is a vast debt overhang, which has paralyzed private economic activity. Savings are in decline, fears of tax increases are on the rise, and the zeal for innovation has weakened.

Instead of fostering a swift recovery through liquidation, the Japanese economic policy has furthered the structural distortions of the economy. Macroeconomic policy since the 1990s has wasted much of the wealth Japan had accumulated in the decades after World War II.

Not Learning from Japan

Since 2008, the United States and Europe have been committing similar errors to Japan’s. The Federal Reserve and the European Central Bank have cut interest rates, and the governments have expanded spending. Yet these measures have not brought a solid economic upturn. Despite the recent official figures of strong economic growth, the United States is still below the trajectory between the 1990s and the crisis of 2008.

How will the United States and the countries of Europe react when they are faced with a new recession? Will they follow the Japanese model and drive up public spending to the Japanese level? Will they expand the monetary base still more and bring down the policy interest rate to zero or below? Will the United States and the European countries join Japan in producing a decades-long slump?

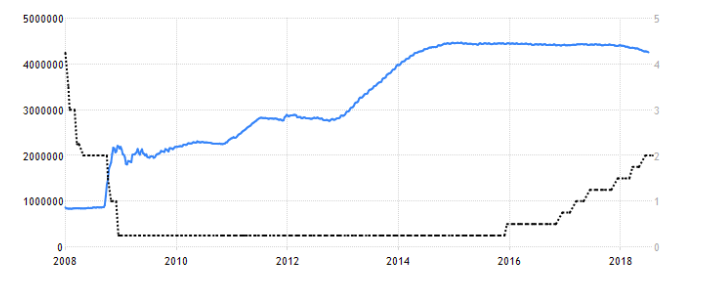

The Fed has boosted its balance sheet from $0.67 trillion in 2003 to $4.3 trillion in August 2018 and brought down its policy lending rate (federal funds rate) from 4 percent in 2008 to the zero bound in 2010. In 2016, it began raising the rate toward its current level of 2 percent (figure 3).

Figure 3

This amount of money creation and the low-interest-rate policy did not boost the economy commensurately because the velocity of circulation of money (the ratio of gross domestic product to the money supply) has fallen drastically since the onset of the financial crisis of 2008 (figure 4).

Figure 4

If the dam that has held back the money from pouring into the economy should break, containing the money would probably require a stratospheric rise of the interest rate. Likewise, it is only a matter of time until the federal debt goes fully out of control. The federal debt of the United States stands at 105 percent of GDP, up from a low of 31.7 percent in 1981 and getting closer to the record of 118.9 percent reached in 1946 after World War II.

The Keynesian Trap

Although Keynesianism is no longer a leading paradigm in academic economics, it lives on in its vulgar form in government circles because politicians like the concept of demand management. It suits them well to justify spending, and thus any sign of a recession helps them to legitimize more government debt. The Keynesian excuse serves to rationalize more debt in good and in bad times. Thus, the national debt rises during a recession but does not fall when the economy expands.

The costs of such economic policies are enormous, albeit largely hidden. The public debt becomes a mounting drag on the economy. Over time, the rate of productivity advancement falters, as has already been the case with the United States and the European countries since 2008. Pushing the interest rate to zero and beyond creates economic misallocation and distorts the distribution of income and wealth.

Modern democracy as a system run by political parties works as a spending-and-debt machine. Democracy and deficit go hand in hand. Fundamental changes are needed to get out of this trap. One step would be to liberate money from the shackles of the state, another to transform the present system to a capitalism free of the state.